Powell speaks 9:15AM ET

No EIA crude inventories today, scheduled maintenance

- Hong Kong: Hang Seng closed down -0.58%

- China CSI 300 -0.24%

- Taiwan KOSPI -0.91%

- India Nifty 50 +0.16%

- Australia ASX -0.22%

- Japan Nikkei -0.59%

- European bourses in MIXED territory so far this morning

- USD +0.18%

TOP STORIES OVERNIGHT

Stocks Slip Before Powell Speech-BBG

Stocks edged lower as investors awaited clues on the path of interest rates from a raft of central bank officials including Federal Reserve Chair Jerome Powell.

Europe’s Stoxx 600 fell 0.1% and US equity futures traded little changed. The 10-year Treasury yields climbed by three basis points to 4.6%. West Texas Intermediate held at $77, near a three-year low. Marks & Spencer Group Plc soared 10% after profit surged and it reinstated a dividend.

Traders are trying to gauge how hard global central bankers will push back against the drop in government bond yields, which potentially hinders efforts to keep a handle on inflation. Up today are US policymakers including Powell and New York Fed President John Williams, as well as Bank of England Governor Andrew Bailey and officials from the European Central Bank.

“Fed speakers will attempt to jawbone and cool market expectations for rate cuts,” said Todd Schubert, Dubai-based senior fixed-income strategist at Bank of Singapore. “The market is underestimating the Fed’s resolve in bringing down inflation to 2% and we would not expect a sustained rally in risk assets until there is clearer evidence of a pronounced downward trajectory in inflation.”

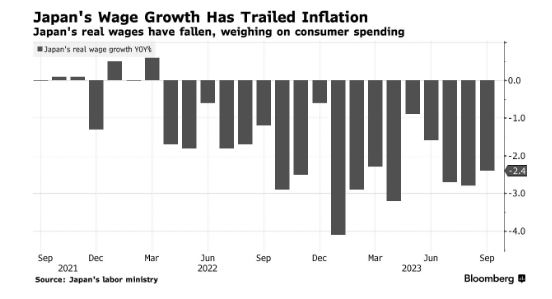

BOJ: Ueda Hints at Chance of Policy Shift Before Real Wages Increase-BBG

Governor Kazuo Ueda signaled that a prolonged decline in real wages won’t necessarily keep the Bank of Japan from shifting toward normalization as long as its inflation target comes into sight.

“If I’m asked whether real wages must be positive when we decide how long we continue with yield curve control and negative interest rates, it’s not necessarily so,” Ueda said in response to questions in parliament Wednesday. “It’s about whether we can forecast with certainty that real wages will be up amid a positive economic cycle.”

Ueda is keeping his options open as the central bank sees a gradual rise in the possibility of achieving its inflation target in a sustainable manner. While most economists expect a normalization step by April, Ueda said he is determined to continue with easing until his target is in sight in a virtuous wage-inflation cycle.

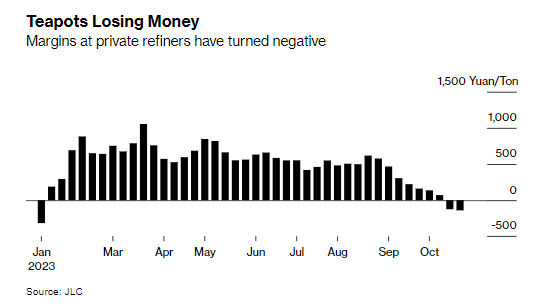

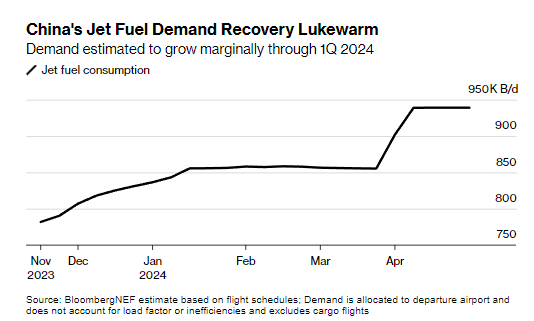

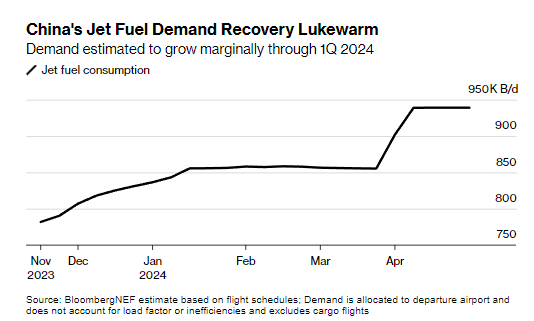

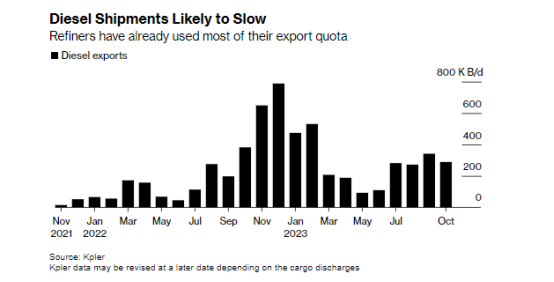

China’s Oil Demand Outlook Is Worsening as Winter Approaches-BBG

The oil demand outlook in China, the world’s biggest importer, isn’t offering much inspiration to bulls as the end of the year approaches.

Refining margins are falling, crude and fuel stockpiles are building and a hoped-for sharp jump in air travel still hasn’t eventuated. That’s mirroring the situation in the wider economy, where business and consumer confidence remain low despite government efforts to juice growth.

“Domestic demand has lost steam following the Golden Week holiday in October, and we don’t see any major supporting factors through winter,” said Mia Geng, an analyst at FGE. Gasoline and diesel consumption typically drop in the last couple of months of the year, and there could be additional downside risk as revenge travel seems to be wearing off in China, she said.

China’s crude imports did manage to increase by 7% in October from the previous month, customs data showed on Tuesday, but that came after a 13% drop in September.

COMMENTS: This is not nearly as bad as this article makes it sound, China has just stagnated. That said, running out of quotas for the rest of year, could exacerbate the rising global diesel shortage problems. Something to keep an eye on, that said it is adding downward pressure to the oil market.

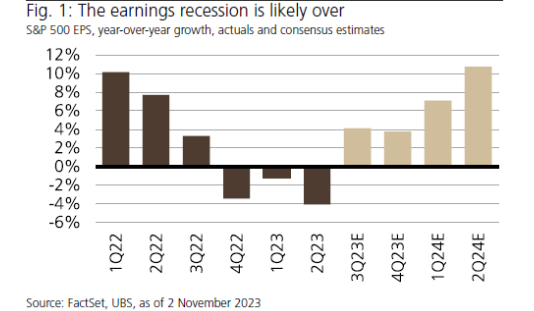

The Recession You May Have Missed Is Over-BBG

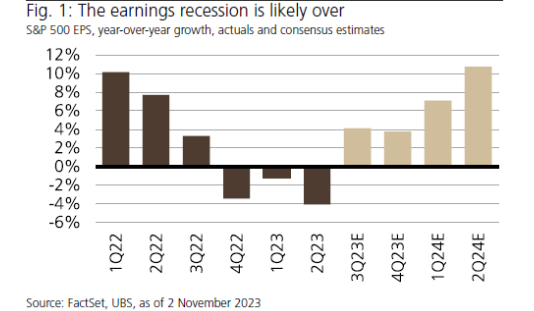

After that perhaps misleading headline, let me stress that the recession I’m talking about is in the profits made by companies in the S&P 500. After three quarters of year-on-year declines, they’ve plainly grown in the third quarter. Wall Street is confident that this will continue. This chart from UBS shows it clearly enough:

David Lefkowitz of UBS proclaimed: “It’s clear to us that the earnings recession is over.” That, however, raises a sticky issue. The corporate sector is not America’s economy. But the two are closely related. How can it be that gross domestic product is still showing year-on-year growth despite everything the Federal Reserve has thrown at it, while profits have had their recession and are recovering?

Lefkowitz points to one clear distinction. “Unlike GDP, S&P 500 profits skew more towards goods rather than services, so a rebound in goods activity should support earnings going forward,” he said. That plainly depends in part on the health of consumer spending, but of late their enthusiasm to keep buying big-ticket items like washing machines has been impressive.

“The economy is cooling, but companies have had their earnings recession, have cut costs, and are now enjoying margin expansion,” says Savita Subramanian of Bank of America. So corporate actions in doing what’s necessary to safeguard profits, which fascinatingly haven’t included significant job cuts, will contribute to the downward pressure on economic growth.

Beyond that, Subramanian points out that profits still look pretty bad given the apparent health of the economy, largely due to the pandemic’s continuing aftereffects on buying behavior:

Earnings lagged GDP growth for the fifth straight quarter (historically, quarterly earnings outpaced GDP by 1.5 percentage points on average since 1950). The lag was partly due to the shift from goods (50% of earnings vs. 30% of economy) to services, which appears to be long in the tooth.

GM’s Cruise to recall 950 driverless cars after accident involving pedestrian-Reuters

Cruise is recalling 950 driverless cars from the roads across the United States and may withdraw more following an accident involving one of its robotaxis, General Motors’ GM self-driving unit and the U.S. auto regulator said on Wednesday.

The recall is because the collision detection subsystem of the Cruise Automated Driving Systems (ADS) software may improperly respond after a crash, according to a notice on the National Highway Traffic Safety Administration (NHTSA) website on Wednesday.

Last month, a pedestrian in San Francisco was struck by a hit-and-run driver and thrown into an adjacent lane and was hit a second time by a Cruise robotaxi that was not able to stop in time.

Cruise has deployed an over-the-air software update on all of its supervised test fleet vehicles, the NHTSA website showed. All affected driverless vehicles will also be repaired before returning to service, it said.

US DATA TODAY