ALL EYES ON THE FED THIS COMING WEEK!

There was not a lot of data last week, so lets look at some key indicators in the market

EQUITY MARKETS

Via Edward Jones:

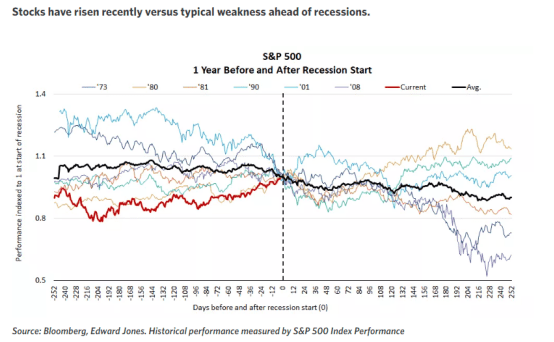

- Stocks have rallied sharply off of the October bear-market low, recouping the majority of the 26% decline between January and October of last year.* This rally has gained steam of late, supported by incoming data indicating the economy is holding up despite the Fed applying the brakes for the last year and a half.

- Equities have typically peaked about six months ahead of the start of recessions, as stocks start to sniff out headwinds to growth. By this measure, the S&P 500 is not reflecting an impending recession. We have long held the view that last year’s sell-off priced in an eventual modest economic downturn – an outcome we still believe will transpire. In this regard, equities were more advanced than typical in a recessionary pullback.

- If a recession were to be avoided, this would join the bear markets of 1987 and the mid-1960s as the 20%-plus stock-market declines that were not accompanied by recession.

INTEREST RATES

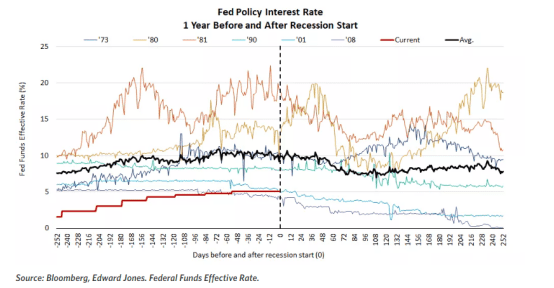

The Fed has been firmly behind the wheel of the financial markets, as it has embarked on its most aggressive tightening cycle in four decades. Restrictive monetary policy is a reliable catalyst for recessions, and we’re mindful not to dismiss the lagged impacts recent rate hikes could have on the economy.

ECONOMIC TRENDS

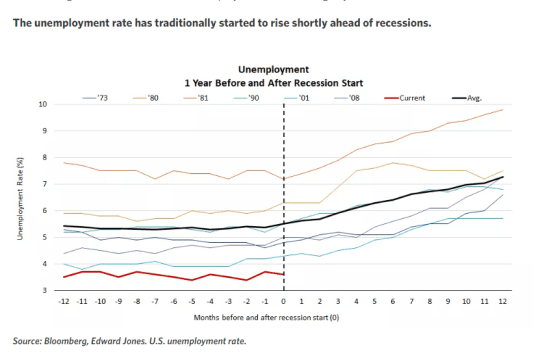

- The labor market is the glaring pillar of support that has set this phase of the economic cycle apart. Thanks to half-century lows in unemployment and elevated wage growth, consumer-spending growth clocked in above 4% in the first quarter of this year, more than double the overall GDP growth rate, indicating that household consumption is doing nearly all of the heavy lifting for the economy.

- Unemployment has historically risen moderately ahead of economic contractions, then accelerating, with the unemployment rate increasing by an average of nearly 2% in the 12 months from the start of recessions

COMMENTARY: Hard landing? Soft landing? This current environment is different from any other period in time. What has over a decade of loose, free monetary policy done? Likely we will not know until after it happens.

OTHER NOTABLE HAPPENINGS OF INTEREST

On Monday the Black Sea Grain Agreement was terminated by Russia

I had the pleasure of interviewing Andrey Sizov on the Wednesday Place Your Trades spaces…if you missed it, you can catch the entire episode HERE

That said he posted a tweet, that pretty much summarized what he said on my spaces about the subject:

So many wrong takes on the Black Sea grain deal. Here’s what you need to know if you trade wheat (and corn) as of today:

* Odesa shipments are over. The chance was high that the Kremlin would stop the grain deal and show everyone that they should stay away from Odesa. We gave a heads-up about such a scenario last week after the first light attack on Odesa and Putin’s angry interview (the market/media missed that – everyone was watching the NATO forum). * Despite what the media/politicians are telling you,

Odesa shipments are not a game-changer now. Ukraine can ship 40+ mmt of grain via other routes, and that more or less matches their 23/24 export potential.

* Other export routes are the Danube and via land to the EU. The almost-forgotten Danube has been expanding rapidly since the start of the war. In recent weeks for the first time, they loaded two handysize ships (17K)

* Is the Danube safe? We don’t know. Russia threatened all vessels in the Black Sea going to Ukrainian terminals, so that could potentially include ships going to the river. Some vessel owners are cautious and prefer not to send ships there currently, but overall the navigation is still active, and local traders are actively buying at CPT Reni/Izmail/Kilia.

* Potential attack on the Danube terminals could be a game-changer. Watch this carefully. Is it likely to happen? The chance is not negligible but low, the Kremlin clearly doesn’t want to mess with NATO, and Romania is very close. What is concerning is that Russian propagandists, who were happy about the Odesa attacks, are now starting to talk about the Danube…

* Potential escalation could come from the Ukrainian side. We do doubt that they would openly attack vessels going to Russian ports, but some attempts to disrupt the shipments are possible (ie more attacks on the Crimean bridge impacting Russian shipments from Azov…or Novorossiysk).

If something big happens here, we could see a rally similar to Feb-Mar 2022….Russia has almost 50mmt+ of wheat to ship.

* A potential path to de-escalation? It also exists….we will be watching Erdogan. We do believe that Moscow and Ankara discussed the end of the grain deal some time ago – Ankara clearly wasn’t surprised. We also know that Erdogan still likes the deal and has a lot of leverage over Moscow. *

CHINA STIMULOUS MEASURES LAST WEEK

Here’s How China Is Supporting Its Economy as Stimulus Awaited-BBG

July 18: Household Goods

Thirteen government departments outlined a plan to boost household spending on everything from electric appliances to furniture. Local authorities are encouraged to help residents refurbish their homes, and people should get better access to credit to buy household products, according to the measures announce

July 19: Private Businesses

The Communist Party and government issued a rare joint pledge to improve conditions for private businesses, outlining 31 measures that included vows to treat private companies the same as state-owned enterprises, consult more with entrepreneurs on drafting policies, and cut market entry barriers for firms.

July 20: Currency

The People’s Bank of China adjusted some rules to allow companies to borrow more from overseas, opening the door for more foreign capital inflows. It also set a stronger daily fixing for the currency.

July 21: Cars

The National Development and Reform Commission, the main economic planning body, released a 10-step plan to increase car purchases, particularly for new-energy vehicles, including lower costs for electric-vehicle charging and extending tax breaks. In June, the Ministry of Commerce launched a six-month campaign to boost car purchases and drive electric vehicle adoption in rural areas.

July 21: Construction

The State Council, chaired by Premier Li Qiang, ramped up support for property construction by saying the government will boost the renovation of so-called urban villages. It will also seek more private capital in the projects to expand domestic demand and push forward development of cities.

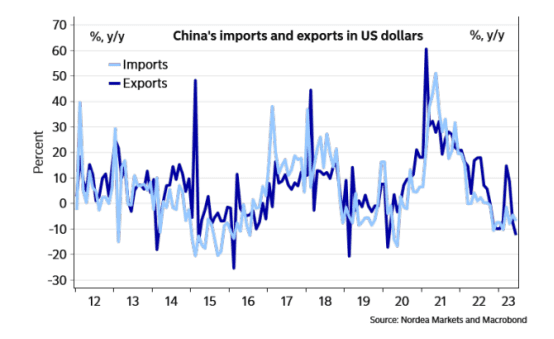

COMMENTARY: Will this be enough? So far that is up in the air and the market does not think so. Keep an eye on the Yuan. In the past there has been a line drawn a line in the sand around 7, they seem loathe to let it move beyond that price….which it has and they have been struggling to reign it in. The chart below speaks volumes.

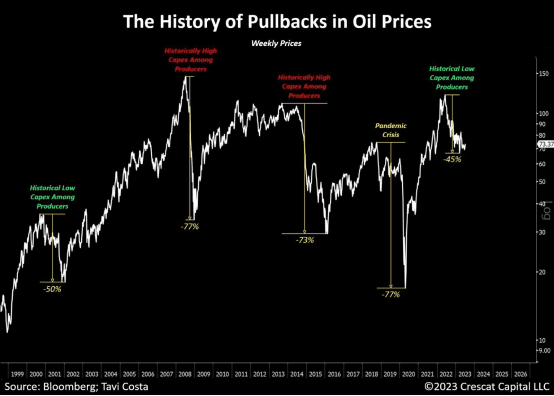

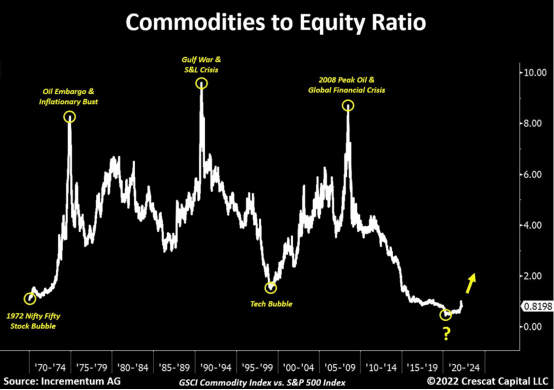

Crescat Capital Tavi Costa posted some compelling charts for commodities (which I completely agree with)

After being down 45% from its recent highs, the risk/reward to buy oil today appears heavily skewed towards the upside.

The current environment “emphasizes the importance of owning hard assets”

Since we are talking about commodities …

Just on a side note … it should be noted that wind power companies are abandoning offshore projects en masse.

World’s Biggest Wind Power Projects Are in Crisis Just When World Needs Them Most-BBG

Offshore wind projects are facing an economic crisis that erased billions of US dollars in planned spending this week — just as the world needs clean energy more than ever.

A unit of Spain’s Iberdrola SA agreed to cancel a contract to sell power from a planned wind farm off the coast of Massachusetts. Danish developer Orsted A/S lost a bid to provide offshore wind power to Rhode Island, whose main utility said rising costs made the proposal too expensive. Swedish state-owned utility Vattenfall AB scuttled plans for a wind farm off the coast of Britain, citing inflation.

Soaring costs are derailing offshore wind projects even as demand for renewable energy soars. Extreme heat driven by climate change is straining electric grids all over the world, underscoring the need for more power generation — and adding urgency to calls for a faster transition away from fossil fuels. In Europe, the move to reduce reliance on Russian oil and gas has also given clean-energy projects momentum.

Together, the three affected projects would have provided 3.5 gigawatts of power — more than 11% of the total offshore wind fleet currently deployed in the waters of the US and Europe. And the numbers could soon expand. At least 9.7 gigawatts of US projects are at risk because their developers want to renegotiate or exit contracts to sell power at prices that they say are now too low to make the investments worth it, according to BloombergNEF.

In addition…..

G20 bloc fails to reach agreement on cutting fossil fuels-Reuters

The Group of 20 (G20) major economies meeting in India failed on Saturday to reach consensus on phasing down fossil fuels following objections by some producer nations.

However, disagreements including the intended tripling of renewable energy capacities by 2030 resulted in officials issuing an outcome statement and a chair summary instead of a joint communique at the end of their four-day meeting in Bambolim, in the Indian coastal state of Goa.

A joint communique is issued when there is complete agreement between member nations on all issues.

“We had a complete agreement on 22 out of 29 paragraphs, and seven paragraphs constitute the Chair summary,” Indian Power Minister R.K. Singh said.

COMMENTARY: Energy security and cost is at the forefront of everyone’s concerns but the West’s leaders. Reality is slowly kicking in, even is Brussels refuses to see it.

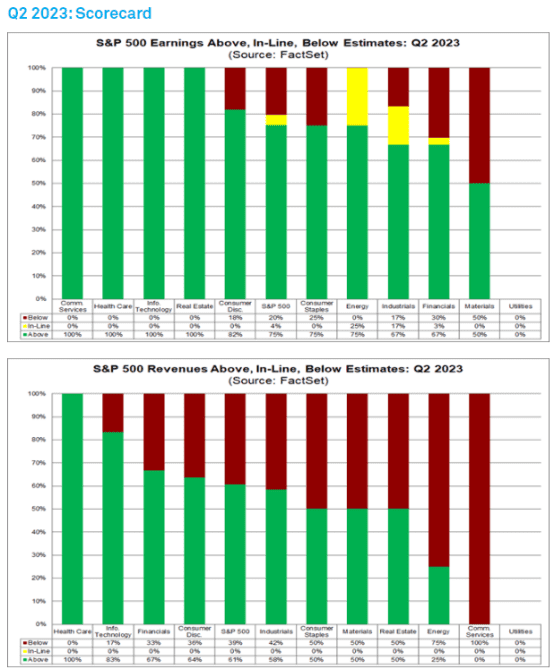

Q2 earnings scorecard so far

“Only 18% of the companies in the S&P 500 have reported actual results for Q2 2023 to date. Of these companies, 75% have reported actual EPS above estimates, which is below the 5-year average of 77% but above the 10-year average of 73%. In aggregate, companies are reporting earnings that are 6.4% above estimates, which is below the 5-year average of 8.4% but equal to the 10-year average of 6.4%” -FactSet

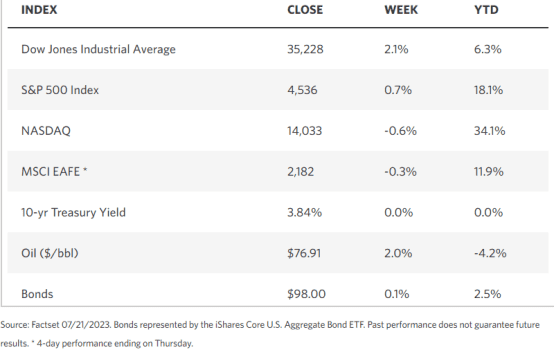

WEEKLY MARKETS STATS

TECHNICALS

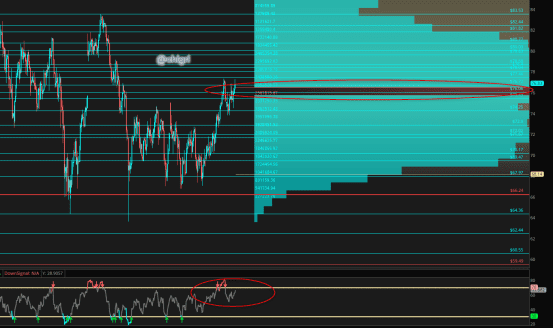

Crude Oil

Last week I noted that “ Libya has release a political prisoner that caused shut downs of 250K bpd last week

I would not be surprised if we opened down, that said, I think the downside its limited”

Indeed it did and was.

We are trading in fair value right now, failing to close above the HVN last week (just barely)but I an constructive to the upside (see last week’s post), that said, it could be a volatile market next week with the Fed rate hike decision.

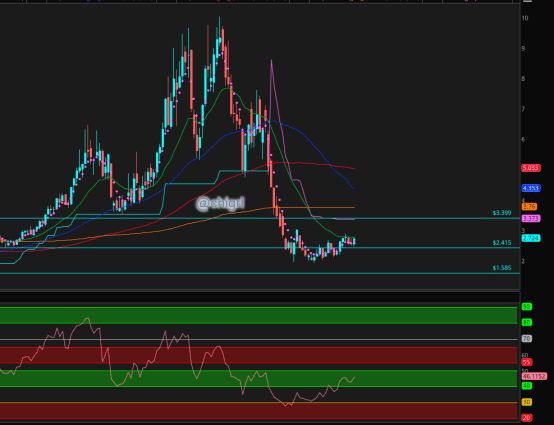

Nat Gas

Nat Gas is looking a little better if you squint.

That said, Nat gas is still waffling in a supply zone, but has regained a critical area.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

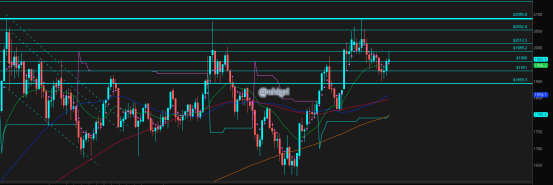

Gold

Gold is more a function of rate than anything.

Although that sold break above remain elusive, over the long term the chart is still bullish

Solid support is holding.

This has been a ridiculously technical trade for months.

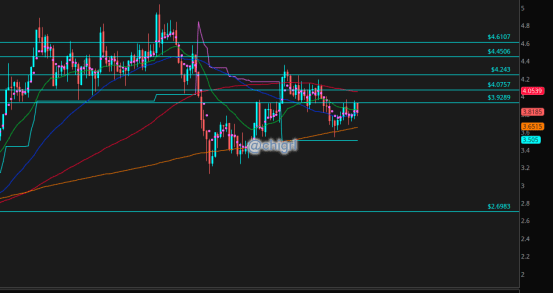

Silver

Three weeks ago I noted that we were in a major support area

Many do not think of the green economy when you mention silver, but in fact, silver has many uses in renewables- Industrial buyers were 51% of global demand in 2022

Led by end-uses in the green economy, industrial demand is forecast to rise yet again, by 4% to a new record high this year.

The drivers behind these gains include investment in PV, EV’s ,just as an example, In hybrid vehicles, silver use is around 18-34 grams per light vehicle, while battery electric vehicles (BEVs) consume in the range of 25-50 grams of silver per vehicle.

In addition silver is used in battery storage, power grids and 5G networks, and consumer electronics.

This chart remains bullish, although is remains in this giant bullish wedge still.

Again, this has been a trade governed by technicals.

Copper

No mans land …watch China for clues …so far last week, it remained unimpressed/unconvinced with China stimulus moves. That said, the downside is limited. Watch 3.65/3.50 as a floor (if it gets there)

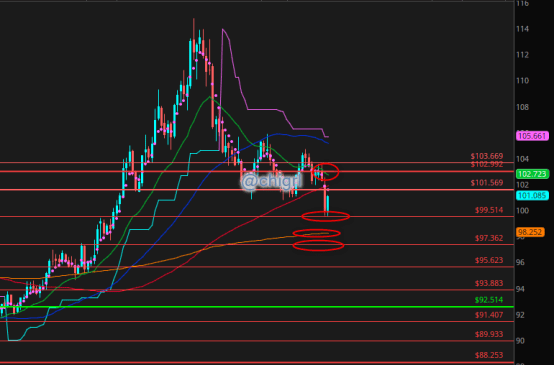

$DXY USD

Last week I noted that we were oversold and should be looking at 95.514 as support (bang on) …that turned out to be correct. We could see some further upside with the Fed raising rates (as the market thinks it will)

That said, I think it is limited, and we see further downside in the coming weeks, which iis a positive for commodities

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.