Geopolitical Risk Governs the Markets

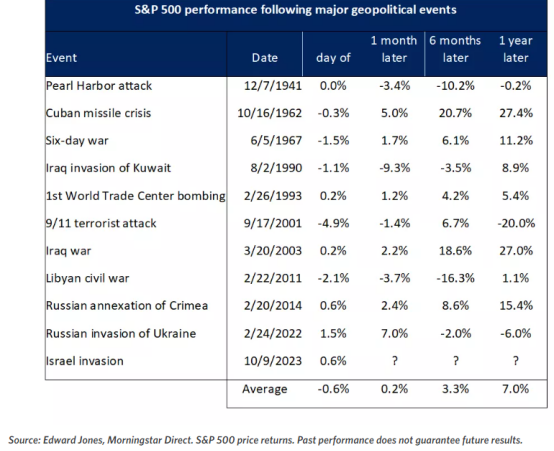

Like many of the past geopolitical crises, the attacks in Israel triggered an initial flight-to-safety move in the markets, with government bonds, the U.S. dollar, gold, oil rallying rallying last week

Via Edward Jones:

- The situation remains fluid, and the potential of a prolonged war could destabilize the Middle East, but so far there has been no impact to global oil supply. There are still questions about Iran’s involvement, but unless the conflict spreads, it appears that the supply-and-demand dynamics for oil won’t change materially. At the same time, the flight to safety in Treasury bonds has eased some of the valuation pressures on equities from rising rates, which helps explain why U.S. equity markets rose modestly last week.

- The evolution of the conflict and its implications is a known unknown for investors (a known event with unknowable risks). Yet, history suggests that geopolitical risks and the associated shock in confidence tend to be short-lived, as markets gravitate toward the more sustainable drivers for returns. Examining 10 prominent historical episodes of military conflicts/attacks shows that the knee-jerk reaction is for stocks to decline the day of the event and performance to be mixed over the following month, as investors have a natural aversion to uncertainty. But the impact on returns usually proves temporary, as equities were higher in most cases six months and one year later.

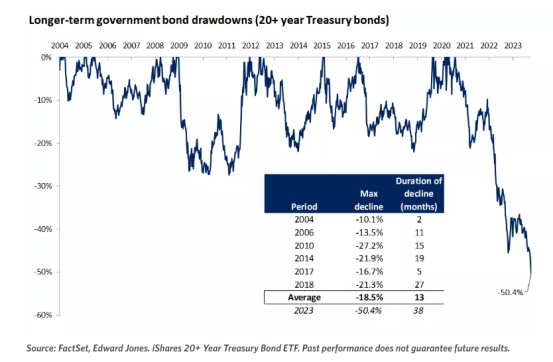

Rates remain in the driver’s seat

- Despite geopolitical uncertainty taking center stage, the market’s focus remains squarely on rates. Over the past two months, stocks have largely taken their cues from the bond market, as the rally in long-term yields to new cycle highs threatens valuations and the economy’s positive momentum. But partly helped by the flight to safety, and partly by a gradual shift in the Fed’s messaging, bonds rebounded some last week, and rates held below the recent peak.

- The silver lining behind the surge in Treasury yields, and the resulting tightening of financial conditions in August and September, is that they may reduce the need for more rate hikes. In our view, the Fed’s tone appears to be changing, with the focus turning from whether to keep hiking to how long to hold policy at restrictive rates. While the minutes from the Fed’s September meeting showed that policymakers agree that rates should stay high for some time, they are starting to get worried about tightening too much.

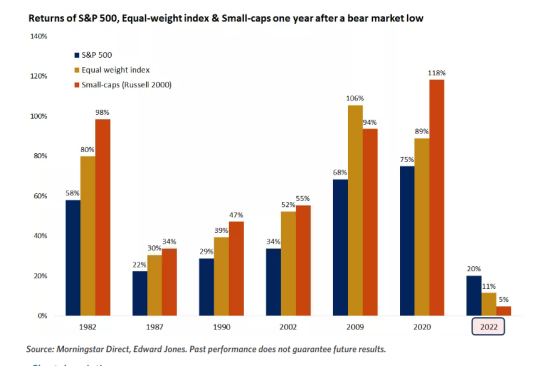

An unusual first year off of an equity bear-market low

Last week marked the one-year anniversary of the S&P 500 low, which serves as an important milestone to evaluate performance

INFLATION DATA

US inflation data was released last week

From the BLS:

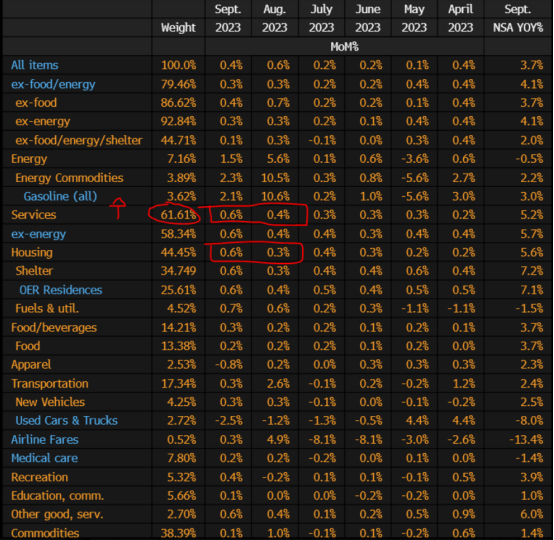

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally

adjusted basis, after increasing 0.6 percent in August, the U.S. Bureau of Labor Statistics reported

today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment.

The index for shelter was the largest contributor to the monthly all items increase, accounting for

over half of the increase. An increase in the gasoline index was also a major contributor to the all

items monthly rise. While the major energy component indexes were mixed in September, the energy

index rose 1.5 percent over the month. The food index increased 0.2 percent in September, as it did

in the previous two months. The index for food at home increased 0.1 percent over the month while the

index for food away from home rose 0.4 percent.

The index for all items less food and energy rose 0.3 percent in September, the same increase as in

August. Indexes which increased in September include rent, owners’ equivalent rent, lodging away from

home, motor vehicle insurance, recreation, personal care, and new vehicles. The indexes for used cars

and trucks and for apparel were among those that decreased over the month.

The all items index increased 3.7 percent for the 12 months ending September, the same increase as the

12 months ending in August. The all items less food and energy index rose 4.1 percent over the last

12 months. The energy index decreased 0.5 percent for the 12 months ending September, and the food

index increased 3.7 percent over the last year.

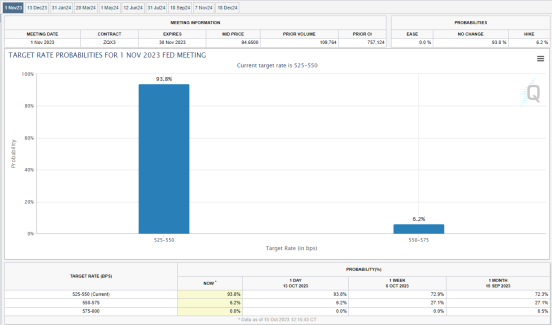

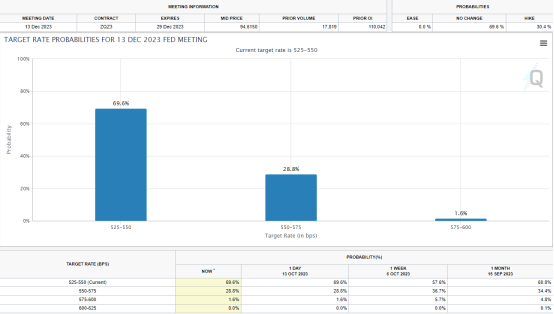

COMMENTS: Inflation came in slightly higher mostly due to housing, and a slight uptick in services, but core came in with expectations. This changed little in the way of rate hike expectations.

Chart credit: @Credit_Junk

November…still a hold

December-still a hold

According to the market. I think be may be in for one more hike in December, which the market is not factoring in really yet. Just keep that in mind. In other words, I do not think the low is in yet in bonds even though we have seen a flight to safety there over the last week on geopolitical risk.

IMF MEETING

Last week there was a notable IMF meeting in Morocco last week

Key points via Robin Brooks from IFF:

- Deep gloom beneath the surface. At best, the US is seen as divided and distracted. At worst, it’s seen as weak. Wars in Ukraine and Israel are symptoms of this. Many think the US will get tested more and more, so geopolitical risk will keep rising.

2. A meta question that hangs over everything: “What if Trump gets re-elected next year?” Such an outcome is seen as being very negative for Ukraine and Europe. Even if it doesn’t happen, Putin and others have every incentive to sow confusion and instability ahead of Nov. 2024..

- Growing recognition that popular resistance is rising towards funding Ukraine and combatting climate change. Mounting resentment in EM at G10 double standards. For example, Germany fires up coal power plants, even as much of EM gets lectured on the need for a green transition.

4. Many noticed the immediate and emphatic denials out of the US that rising yields might reflect a growing fiscal risk premium amid political dysfunction. Most would probably agree, but aren’t reassured by the knee-jerk denials, which they see as an admission of vulnerability

- Lots of pessimism on Europe, in particular on constant foot-dragging over Ukraine and clear refusal by highly indebted countries on the Euro periphery to pursue debt reduction when times are good and growth is high. Growing frustration in northern Europe at Italy over this.

- There’s some near-term optimism on global growth given better cyclical data out of China, especially on exports and manufacturing. There’s also less anxiety on inflation than a year ago. But these positives are overshadowed by fears of a continued rise in geopolitical risk

7. In EM space, Turkey garnered positive attention thanks to strong performances by Minister Şimşek. But the investing community is cautious. Underlying reason is that many fear further Lira depreciation into March 2024 elections, which could wipe out any local currency returns.

- Dollar strength is a major challenge for EM. What’s the point of being able to issue local currency debt if foreign investors’ returns get wiped out by massive Dollar strength, as has been true over the past decade? This is seen as the single biggest EM challenge

COMMENTS: In my opinion, point #2 is most important. “Growing recognition that popular resistance is rising towards funding Ukraine and combatting climate change”

This is as close to admitting that current energy policy has failed.

Obviously dollar strength is always a problem for EM’s, especially those e that hold a lot of US debt amid a rising energy environment.

There may be more pain for EM funds.

CRUDE OIL

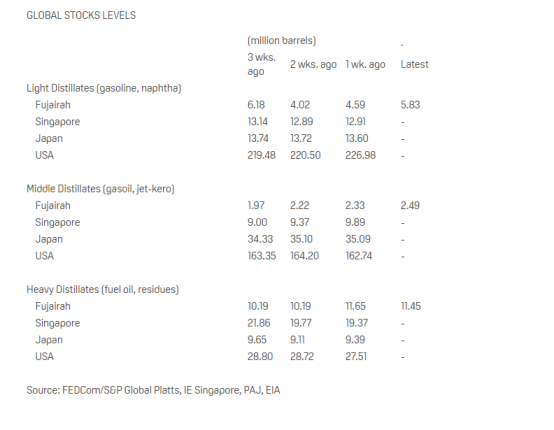

Along with geopolitical risks we are facing dwindling global oil stocks

Vortexa Floating Storage

Fujairah Product Stocks (via Platts)

As of Monday, October 9, total oil product stocks in Fujairah were reported at 19.766 million barrels with a rise of 1.193 million barrels or 6.4 % week-on-week staying just below the 20-million-barrel level. The stocks movement saw a rise for light distillates, middle distillates and a drop for heavy residues.

Stocks of light distillates, including gasoline and naphtha, increased by 1.236 barrels or 26.9% on the week to 5.825 million barrels. The East of Suez gasoline complex was rangebound Oct. 10 on the back of a narrowing US RBOB-Brent crack spread ahead of the US winter season and continued expectations of lower China gasoline exports towards the end of the year, market sources said. Market participants continued to expect China’s gasoline exports to fall in November and December as the remaining export quota volumes for this year was limited. Other participants said China’s incentive to export gasoline was reportedly moderate as gasoil export margins continued to outpace that of gasoline.

Stocks of middle distillates, including diesel and jet fuel, rose by 163,000 barrels or 7% on the week to 2.494 million barrels. Sentiment in the East of Asia gasoil market was softer Oct. 10 as traders awaited fresh pricing direction amid uncertainty following Hamas’ surprise attack on Israel. The balance October-November Singapore gasoil swap time spread was pegged by brokers at plus $2.55/b intraday Oct. 10, narrowing 20 cents/b from the Platts-assessed plus $2.75/b at the Asian close Oct. 9. “For now, oil markets are pricing in a risk premium given the uncertainty in the Middle East,” a regional gasoil trader said, adding that there has not been any material impact on the middle distillates complex. “If tensions [in the Middle East] escalate and it turns out that Iran is involved, then China will struggle to buy Iranian crude, which might lead to tighter crude supply,” another regional gasoil trader said. “This will impact refinery run rates and margins.”

COMMENTS: Stocks of heavy residues decreased by 206,000 barrels, down 1.8% on the week as they stood at 11.447 million barrels ..WE HAVE A DIESEL PROBLEM

My overall comment on energy markets:

COMMENTS: I want to not as of the time of writing this there has been no disruption to oil flows. That said, geoplolitical risk PLUS the dive in global stocks is what is driving this market.

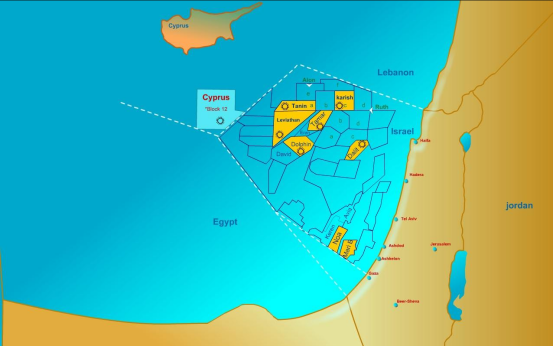

Under the radar is natural gas supplies, Tamar field (2nd largest field offshore Israel) has been shut in (CVX operated).

This will cause disruption of flows to Egypt and Jordan, imho this is an understated risk.

Map of offshore Israel gas fields

SILVER

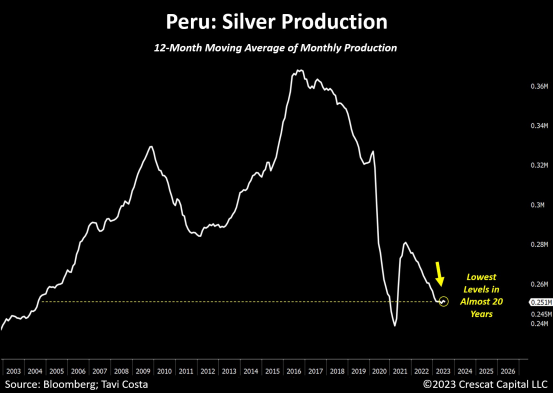

Interesting post from Tavi Cost of Crescat Capital:

Peru’s silver production is currently at the same levels as it was two decades ago, excluding the pandemic lockdowns period. That is the third largest producer of the metal in the world. Keep in mind: Mexico, by far the largest silver producer globally, is experiencing a nearly 20% year-over-year decline in its operations, marking the most significant drop in 4 years. The supply and demand case for silver remains incredibly compelling. If Gold ever decides to break out from its triple top formation, initiating another secular move, silver is a steal at these prices.

TECHNICALS

CRUDE OIL

Last week I noted: With this weekend’s event, likely we see a reactionary gap up in oil, and depending on how things unfold, this could create a strong move to the upside.

And that we did, we also saw a gap fill then higher…to me that says bullish.

That said we have hit an important level, and Israel has called off the land invasion of Gaza for a few more days due to rain, so we could see pullback. I would take this opportunity to get long if you missed Friday’s move. We are no even near overbought yet.

NAT GAS

This market is out of consolidation, on August 20th I noted: If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino. (I still like this play)

We saw a move up in prices last week due to the fact that Chevron strikes in Australia may be reignited along with current events in Israel

Last week that weekly resistance held, but watch 3.028 area for a bounce

GOLD

Last week I noted: Gold broke down from that triangle, interesting point we ended up last week, that said I think a more interesting level is that 1800-1817 level for a swing trade higher

We pretty much got there and with this current situation in Israel, we could see a significant bounce

Boom!

$DXY USD

With current geopolitical risk and China banking problems, it is going to be hard to try and short this right now ..even if it it crushing EMs

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.