Big tech earnings underwhelmed this past week. The spotlight was on mega-cap technology companies, which exert an out-sized influence on the markets. Alphabet, Microsoft, Meta, Apple and Amazon together account for 20% of the index, and, on average, their stocks declined 9% on the day of their earnings release. Third quarter GDP rebounded, on an annual basis it rose 2.6%, mostly

due to energy trade. Growing hopes for a Fed slowdown pulled yields lower (bonds higher) as leading indicators of inflation have turned lower and wage growth looks like it has peaked. Looking to

data next week, traders will be focused on Dallas Fed Manufacturing, Chicago PMI, EIA oil inventories, labor productivity, jobless claims, unemployment rate, and of course the biggie, the FED rate hike decision,which 75bps is pretty much a lock.

ENERGY AND MATERIALS

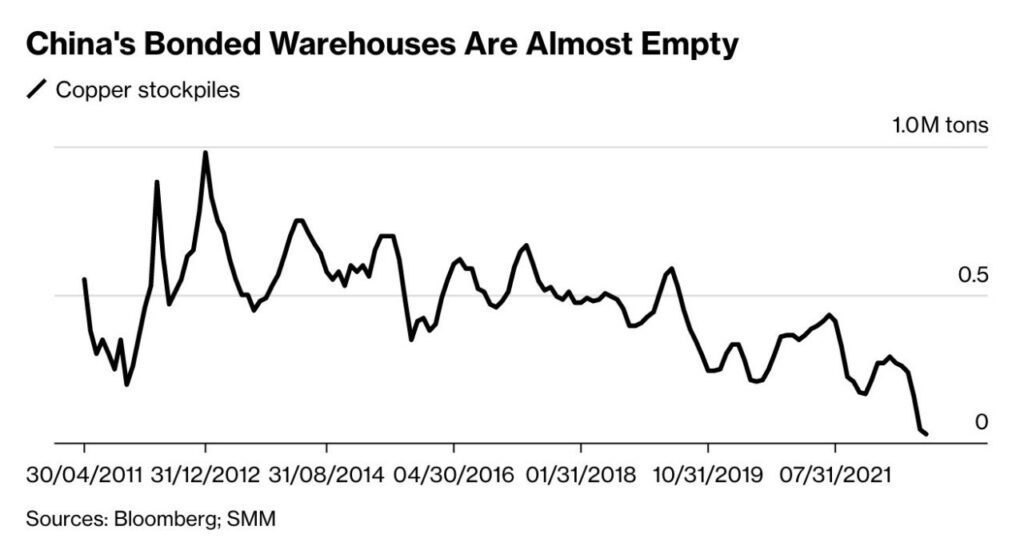

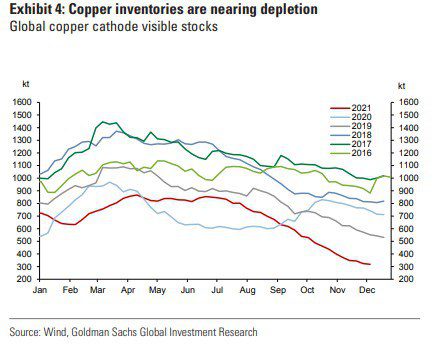

COPPER: Copper started the week strong, but ended the week just slightly higher than the prior week. New China lockdown announcements plus the rising dollar at the end of the week fueled

and exit from base metals across the board. This market is still in severe deficit and for the next decade.

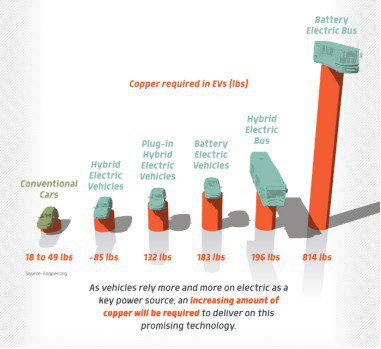

Longer term, we need a lot more copper that we just do not have. Shorter term, pay close attention to China zero-covid lock-downs and government response to the slumping property market for

clues on directional intraday trades.

GOLD AND SILVER: Gold and silver continue to move sideways as this trade is largely a function of real rates and USD. If you are trading these intraday, pay close attention to $DXY or $DX_F.

CRUDE OIL: Crude oil stages a nice rebound this week, although closing below the highs on the week. Again, China lock-downs spooked the market in that latter part of the week. As SPR releases

wind down, this will drive the already tight market prices higher. Biden’s energy plan was weak, and he essentially put a floor under WTI at $70, immediately we saw markets moving higher.

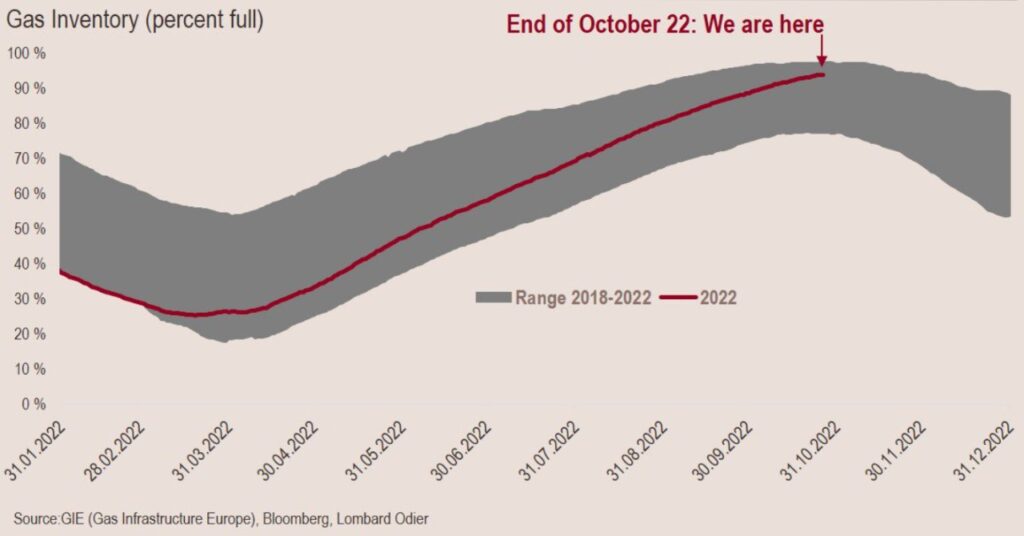

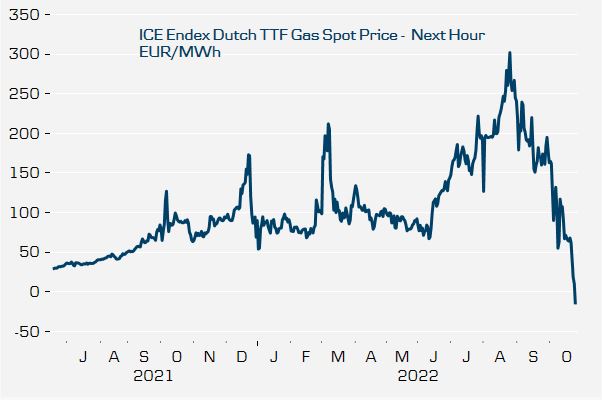

NAT GAS: Natural gas in Europe went negative (as well as in the Permian basin (Waha contract, not the one you are trading which is (Henry Hub) much of this because of slow downs in US exports due

to the lack of storage capacity in Europe. There was a story about ships waiting off the coast of Spain and Portugal this week, due to the fact, they have not been able to offload. Wait times are up to

30 days or more. In addition unseasonably warm weather in Europe has put downward pressure on prices. As we move into November, keep a close eye on weather. As soon as stocks start drawing meaningfully, we should see an increase in prices. We may have hit capitulation (see second chart).