This past week was all about CPI

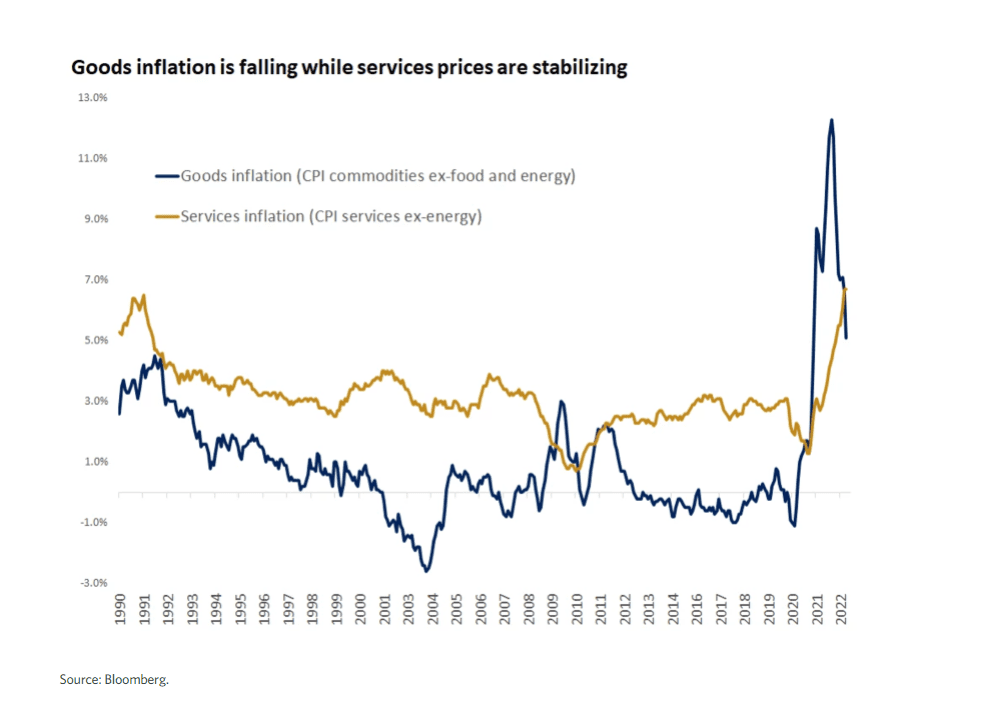

Goods inflation – Easing supply shortages, lowered consumer demand, and excess retailer inventories are all contributing to a sharp slowdown in goods inflation, with prices declining 0.4% month-over-month. The biggest drag came from a drop in used car prices, consistent with the decline in auction prices observed since February.

Services inflation – Price increases for services tend to be persistent and slow-moving on the way down but are also starting to shift in the right direction. Housing inflation (shelter) which is the biggest services component and accounts for about a third of the overall CPI index, accelerated from last month, but that was driven by the volatile lodging category (hotel rates). More encouraging, prices for rents slowed for the first time in four months

Food and energy inflation – Food inflation remains high, but the food-at-home index posted its smallest monthly increase since December 2021. On the energy front, after three straight monthly declines, gasoline prices exerted some upward pressure on headline inflation last month, though that was partially offset by a decrease in natural gas prices

Looking forward to next week:

Gold/silver: Looking forward to next week, I continually said this will depend on USD, keep your eye on the dollar

Copper: I would not be surprised if copper opens up in Asia overnight. Xi suddenly changed his focus from zero covid policy to focus on the economy. https://www.bloomberg.com/news/articles/2022-11-13/china-plans-property-rescue-as-xi-surprises-with-policy-shifts

Oil: Yellen admitted that oil caps won’t work. She eluded to the fact that the US could somehow mitigate

Russian oil risk with more SPR draws. The US does not even have enough heavy barrels to release anymore to mitigate this scenario

Some Russia Sanctions Could Extend Beyond Ukraine War’s End, Janet Yellen Says – WSJ