2022

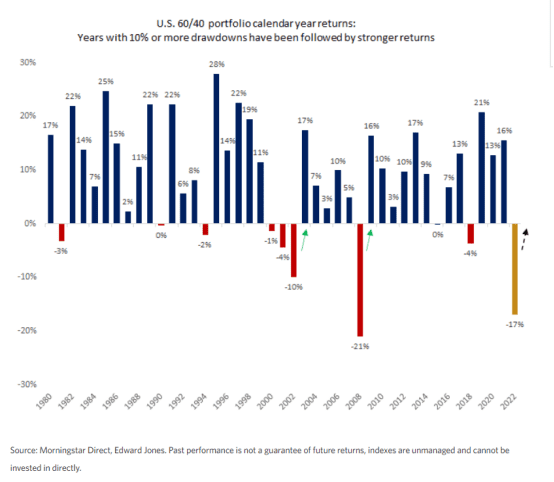

As the history books close on 2022, investors may recoil at some of the records that markets set this year. For equity and balanced investors, 2022 brought the steepest losses since the 2008 great financial crisis. For bond investors, this was the worst year on record for Barclay’s U.S. Aggregate Bond Index since it began over 45 years ago in 1976, down about 15%. This also held true for Barclay’s Global Aggregate Bond Index, which also had its worse year since its inception, down about 14% in 2022.

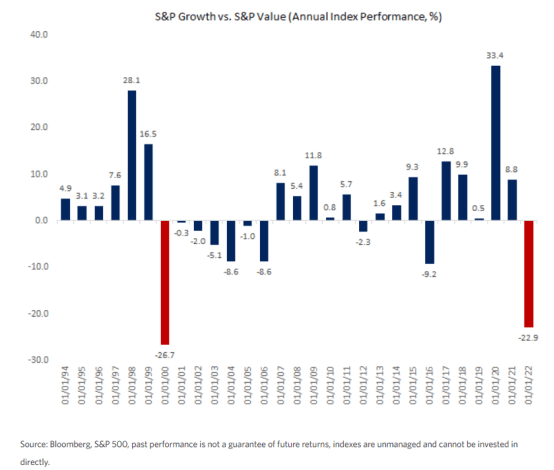

Value outperformed growth by the largest margin since 2001

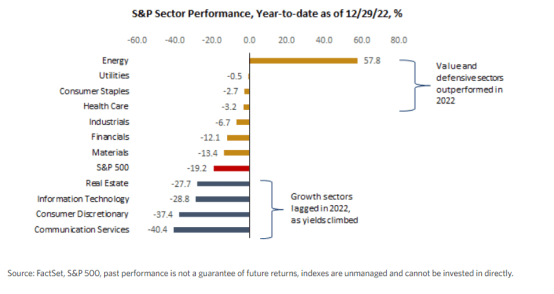

Sector performance: Defensive sectors were relative out-performers in 2022

Another persistent trend in 2022 was the relative out-performance of defensive sectors in the market. Aside from energy, the three top-performing S&P 500 sectors for the year were consumer staples, health care, and utilities. These are traditionally considered “recession-proof” sectors that can hold up better during periods of economic slowdown. They also can be considered inflation hedges, as most consumers will continue to purchase staples, health care, and utilities, even as prices increase.

Overall, while 2022 has been a challenging year for investors, and we still face headwinds in the form of central-bank tightening and an economic slowdown ahead, in our view the bear market that began this year should conclude in 2023. History has repeatedly shown us that time spent in the market is overall more favorable than trying to time in and out of markets. And perhaps the good news for investors is this: Throughout history, every bear market has 1) ended and 2) led to a bull market that is longer and stronger than the bear market that preceded it. So, as we bring this tough 2022 to a close, let’s toast to the potential start of the new bull market in 2023.

I expect value to continue to outperform in the near term as the Fed embarks on its final set of rate hikes. However, as the Fed pauses its rate-hiking campaign, and if treasury yields potentially stabilize and move lower, we could see growth stocks rebound, but not outperform.

MARKET MOVERS THIS WEEK

Slow week

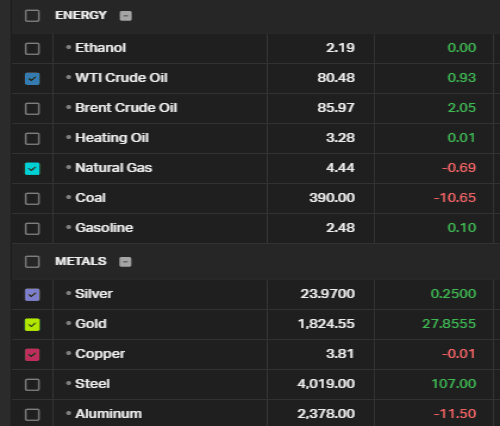

COMMODITIES PERFORMANCE

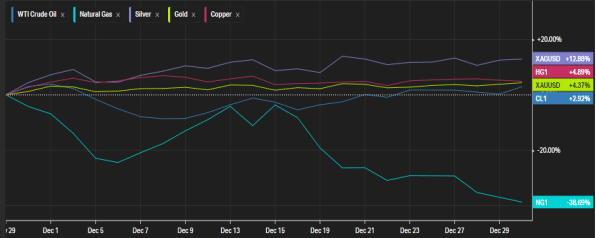

Month to Date Commodities Performance

Week to Date Commodities Performance

LOOKING AHEAD TO THIS WEEK

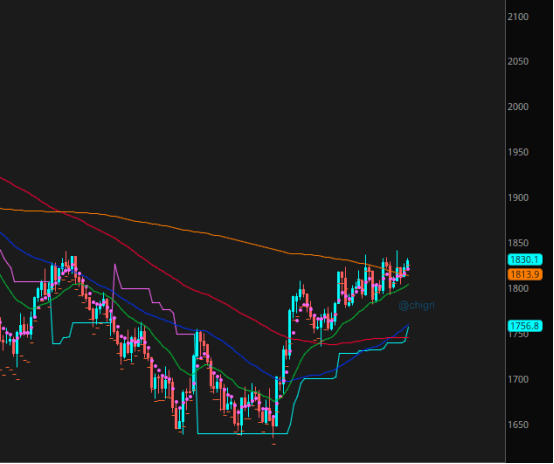

$DXY continues to show weakness (this is positive for precious metals)

That said, USD has divorced itself (at least in the near term to the broader indexes)

Getting closer to my first downside target

Gold: Gold is correlated to real rates (not inflation) If real rates come down (interest rate minus inflation expectation} then likely we see a further rise in gold prices. If real rates continue higher then likely we see gold resume down. A proxy for real rates is to use the US 5 YR and subtract the 5 YR break evens (US05Y-FRED:T5YIE)

Gold is now above the 200day ..technically is bullish

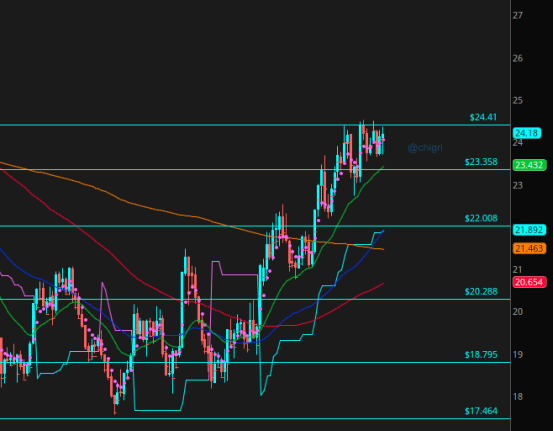

Silver: Also watch USD and rates. This chart has been much more bullish than gold. Last week I noted that although silver was overbought, this market tends to run, and indeed we did. We are well above the 200 day now. I noted last week this market was well overbought..we spent the week sideways, no surprise.

Next week we could continue sideways, but overall this market is bullish.

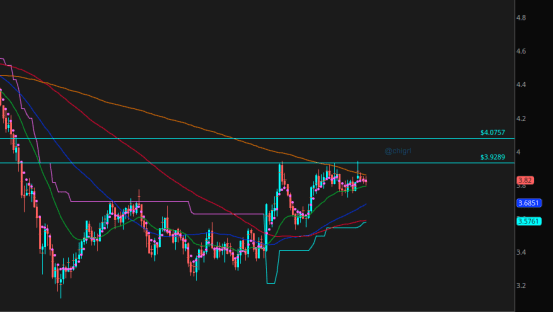

Copper: Watch the China reopening story. They have done a complete 180 as far as policy stance. That said, it will be a very choppy reopening.

Many attempts at the near-term resistance, and when it breaks we could see a huge short squeeze as obviously market participants have been trying to short this $3.9 level.

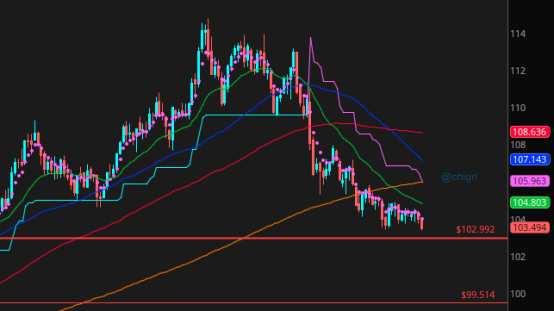

Natural Gas: Warmer weather than expected in Europe, the polar blast leaving the US, and a delay (again) of Freeport reopening sent markets south last week.

Technically this was no surprise as I noted last week this chart looked very bearish.

We are hitting long-term support and with news of Freeport finally re-opening ..we could see a bounce next week

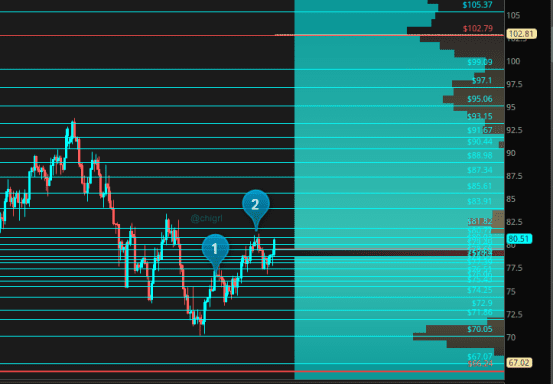

Crude Oil: Huge news for crude oil in the CFTC COT report, massive buying in the Brent contract after little to no interest for weeks. Crude surged in the final hour of trading last week, something we do not see often.

Tax loss selling and margin calls, forcing traders to exit a very profitable sector has ended. Let us see what happens at the beginning of Jan. Note..I still expect this contract to be very volatile..so stay nimble.

This could be the start of a 3-wave or 5-wave up.

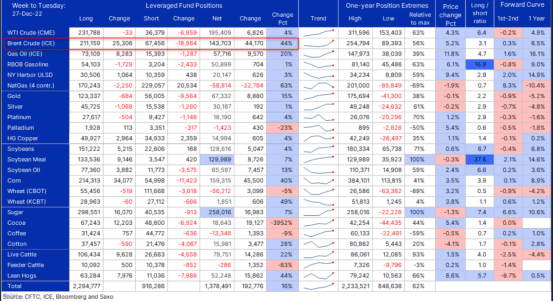

CFTC COT

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.

2 Responses

testtesttesttest

test