SEPTEMBER HAZE..FOURTH QUARTER RAISE?

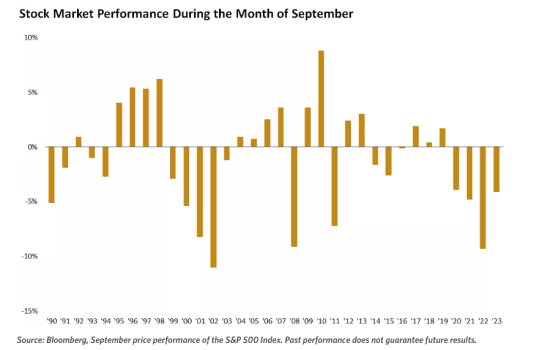

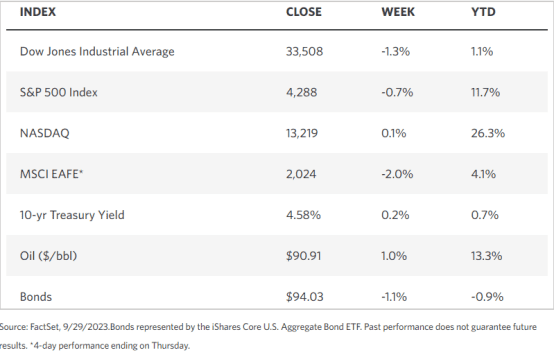

September is over, traditionally one of the worst months in terms of stock market performance.

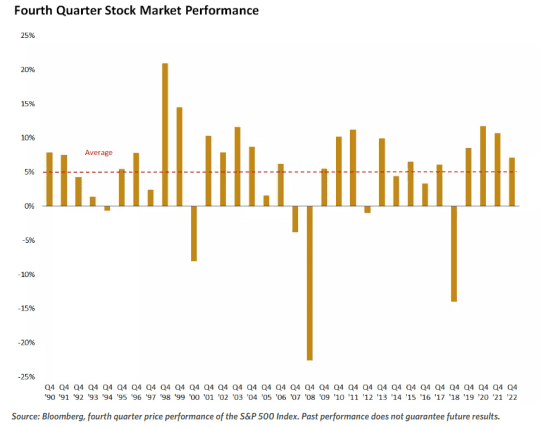

Fourth quarter historically has seen positive returns particularly after third quarter declines….will this year follow??

Via Edward Jones September swoon: stocks declined in September for the fourth straight year:

September was a lousy month, with the S&P 500 falling nearly 5%. Rising rates and concerns that tighter Fed policy will undercut the economy drove additional weakness in growth and small-cap investments, with the Nasdaq and Russell 2000 indexes both shedding close to 6% for the month**. This capped off an overall 3% drop for the S&P 500 for the third quarter, the first quarterly loss in a year.

If history is any guide, the market’s story gets better from here, as weak third quarters have often been followed by a strong encore. Since 1990, in the 11 years when stocks fell in the third quarter, the S&P 500 rebounded with a gain in the subsequent fourth quarter nine times, averaging an impressive return of 10.6% in the final three months of the year. Small-cap stocks did even better in those years, averaging an 11.4% gain for the final quarter. 2000 and 2008 were the two instances in which the market fell in both the third and fourth quarters.

While fourth-quarter returns have been higher following third-quarter declines, the fourth quarter is traditionally a solid period for stocks, with an overall average quarterly increase of 5% going back to 1990. 2018 was the last year stocks were down for the final quarter of the year, with an average fourth-quarter gain of 9.5% from 2019-2022.

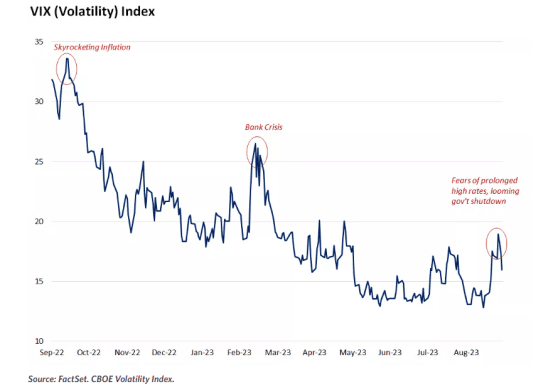

Also interesting to note: despite the market pullback, volatility has remained below previous sell-offs.

SO WHAT DO WE NEED TO SEE A REBOUND IN FOURTH QUARTER?

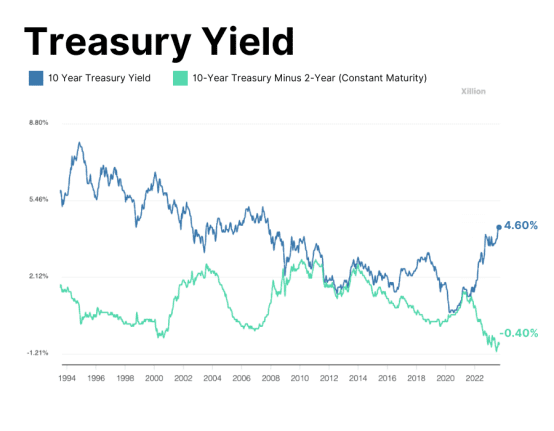

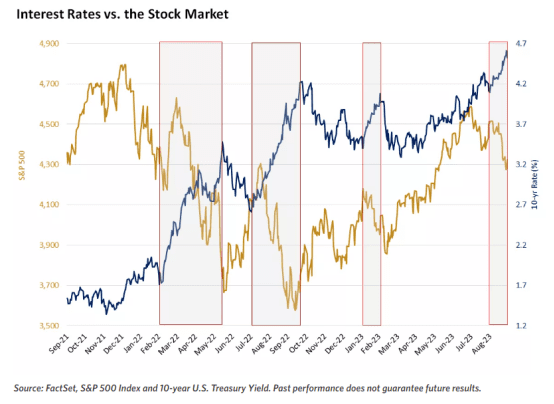

For starters we need to see a peak in rates.

Benchmark 10-year note yields hit 4.6% last week, the highest since November 2007. The inversion in the yield curve between two-year and 10-year notes narrowed to minus 40 basis points.

Are we hitting a peak is the question?

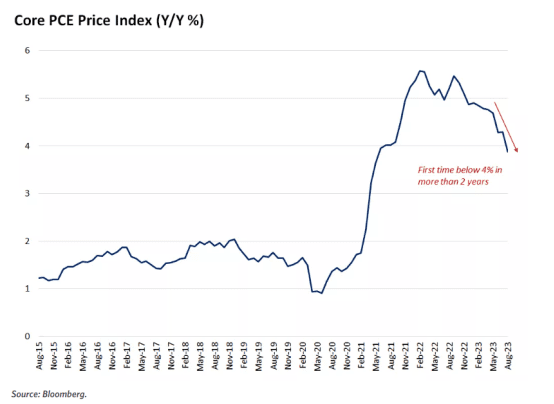

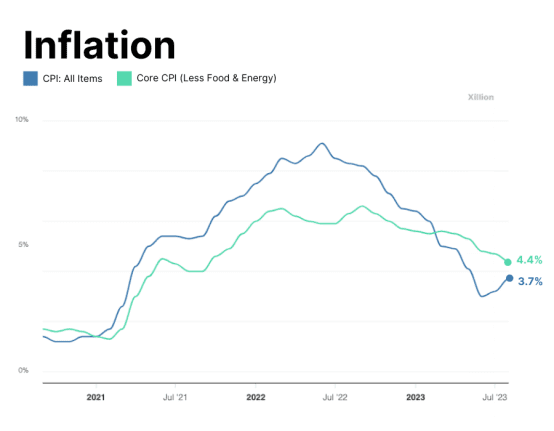

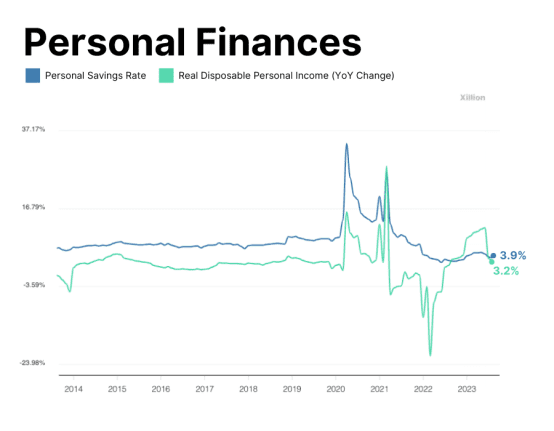

Also we need to be watching inflation. The good news is core inflation is coming down (the metric the Federal reserve is watching, even if we saw an uptick in actual inflation in September, mostly due to energy

PCE

US CPI inflation came in slightly higher at 3.7%, compared to the expected 3.6%. The core CPI, which excludes volatile food and energy prices, stood at 4.4%. For the first time since July 2022, inflation has risen for two consecutive months

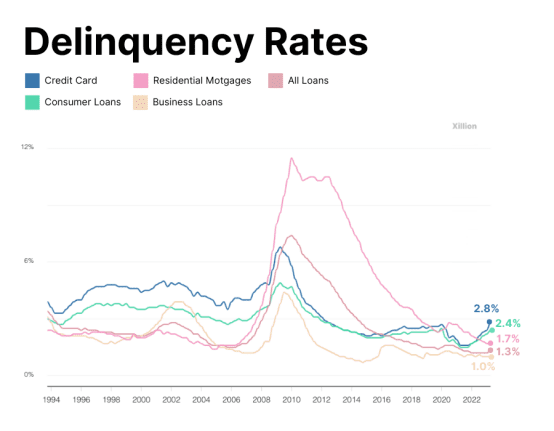

The economy is showing signs of fatigue (which is what the Fed wants)

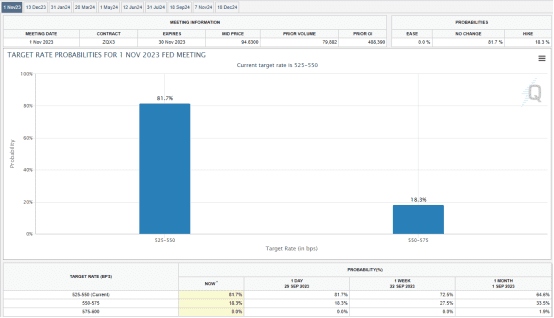

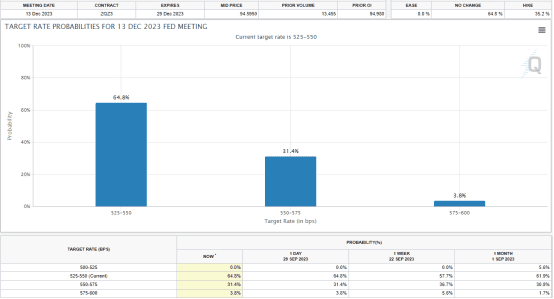

In sum, we need need to see rates peak, and the Fed to hold off on raising rates at the November and December meeting (which for right now the market seems to be favoring that scenario) in order to have a more robust Q4.

MARKET STATS THIS WEEK

TECHNICALS

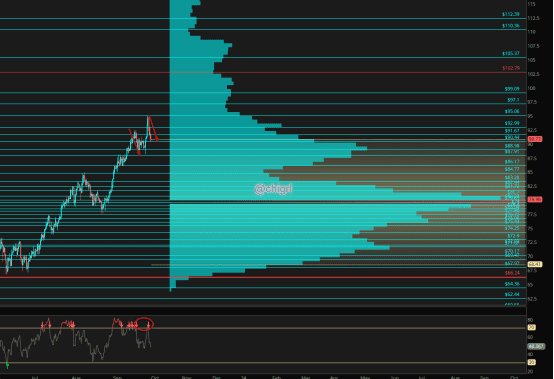

Crude Oil

We keep working off over bought conditions nicely for the last two weeks ….this is good news (healthy) for oil markets.

Again, imho, I would be looking to long this, not short this (unless for a day trade). This is the exact same environment we saw in 2016, but with stronger fundamentals.

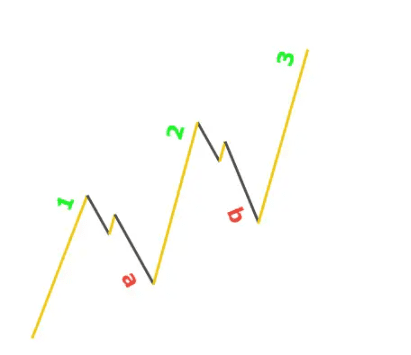

This pattern looks like a 3 drive right now (could end up being a 5 drive…lets see) …so we could see another push higher

3 drive

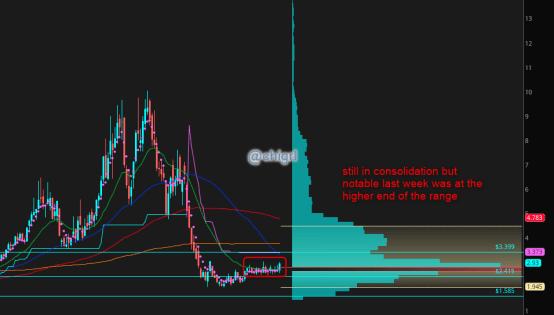

Nat Gas

No change to my thoughts.

This market is still in consolidation, August 20th I noted: If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino. (I still like this play)

I noted over the last month: This could break either way, but I lean toward the upside. This market may not move much until we get closer to winter, meaning, I am not expecting much during September.

Not much indeed!

We may see a push higher in October over the range, but I still am not expecting a lot from October…looking into the deep winter months for a real break to the upside.

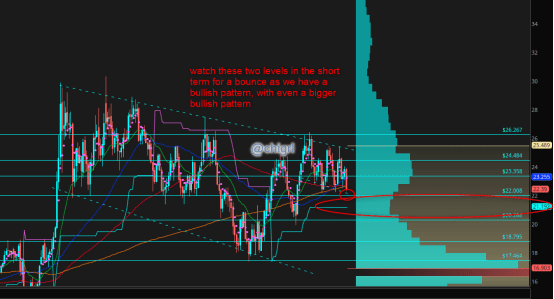

Copper

No change to my view as we are still consolidating in this weekly triangle

We could see more consolidation in this triangle until we have a clear understanding of China markets.

Technically to play this, one would wait for the break and retest to initiate a trade.

That said, I am partial to an upside break given the fundamentals of this market and the better than expected data out of China this last week.

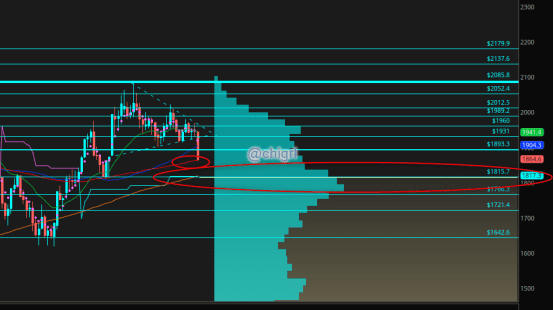

Gold

Gold broke down from that triangle, interesting point we ended up last week, that said I think a more interesting level is that 1800-1817 level for a decent swing trade higher

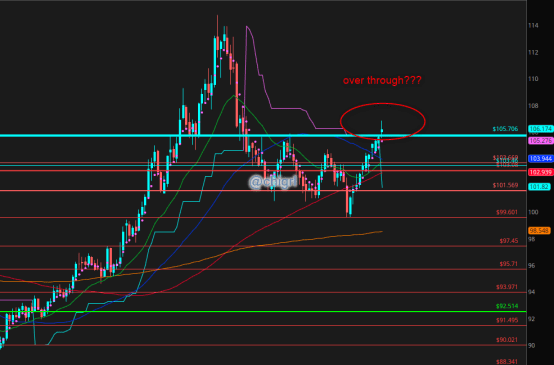

USD $DXY

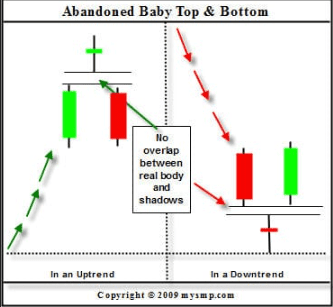

Interesting week as week broke through weekly resistance ..that said or a bearish evening star or this could be bearish abandoned baby candlestick pattern …next week will be the tell

Evening star

Abandoned baby

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.