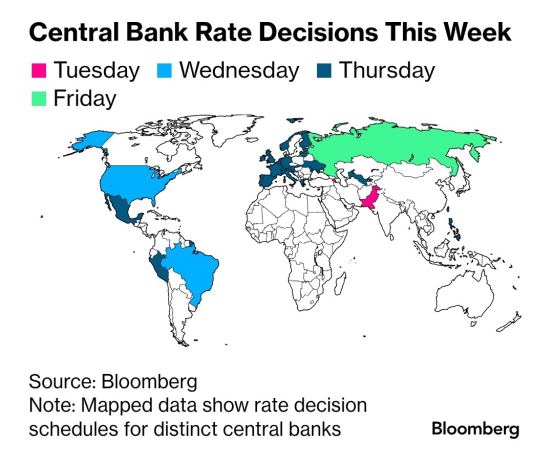

Central Bank decision frenzy starts on Tuesday of this coming week

The big decisions this week come from the Federal Reserve, ECB, BOE, SNB, Banxico, and PBOC. Prepare for possible volatile markets, particularly FX, bonds, and equities.

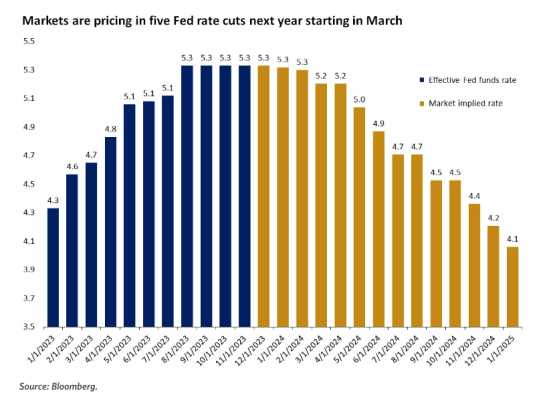

It seems most market analysts are calling for a pause this week, as well, that is what the market is pricing in, but still calling for rate cuts next year, even after NFP last week.

This is almost frightening and markets will be disappointed, for certain. The Fed has been consistent in their “higher for longer mantra” yet the market seems to continually second guess them. I would argue that this is not 2018 and it may be time to take the Fed seriously.

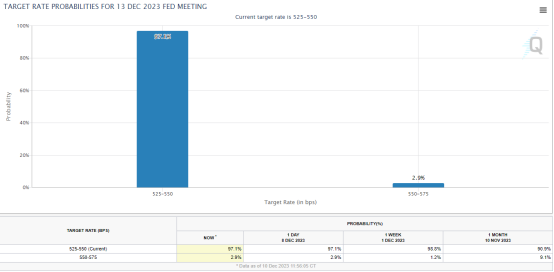

CME Fed Watch Tool is factoring a 97% chance of a hold this week. So again, all eyes on the presser after, there *should* be no surprises in the actual rate decision.

In sum, there will be no surprises there, I suspect the same for ECB given their current economic data which is deteriorating swiftly.

So what should traders really be focusing on this week?

THE ROLL

Most retail platform will open up tonight with futures indexes having rolled to H24 which is trading much higher.

ES close was 4660 for the March contract on Friday.

Be aware of this when you log on tonight!

Flows still seem rather positive

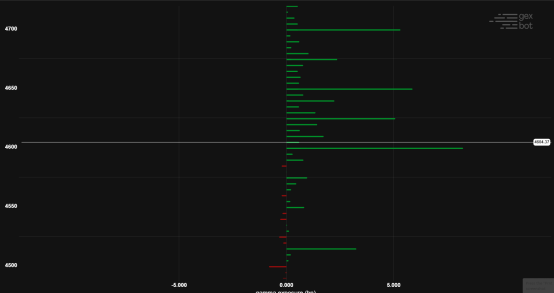

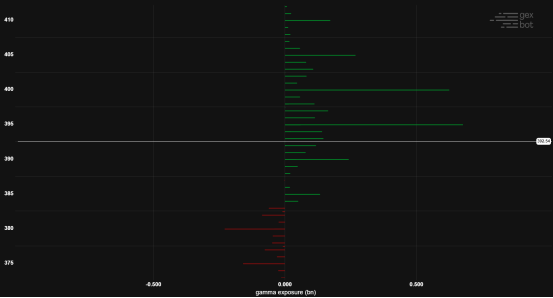

Here is gamma exposure for SPX (but it is based on the December contract, until the markets open tonight, that data is not available for the March contract)

That said, overall this suggests that flows still remain positive

$QQQ looks the same

For FX traders, keep an eye on any BOJ announcements and hint of change to current BOJ policy (like last week) will send the yen skyrocketing this week and could very well unwind some rather large carry trades (I have been talking about this for weeks now on my daily pre-market, so be sure to follow that).

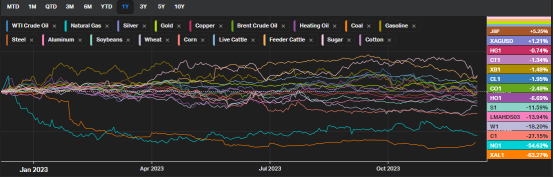

Also PBOC rate decision is on Friday, markets are counting on easing to boost the economy. This decision will have ripple effects throughout the commodities sector.

Stay nimble this week and watch for out-sized affects in the currency markets to govern the commodities and equities markets this week.

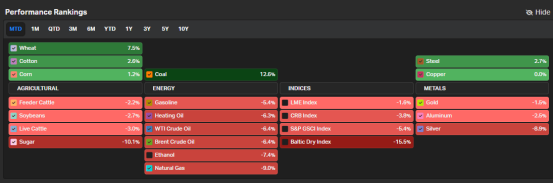

If you are a commodities trader, Brazil CB decision on Wednesday will also be of importance, particularly for the agricultural markets.

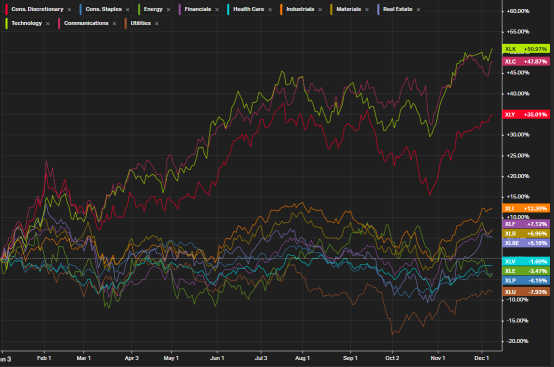

MARKET PERFORMANCE YTD

Equities by sector

Commodities

Month to date commodities performance

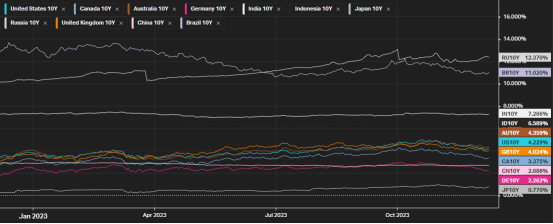

Global 10 year yield performance YTD

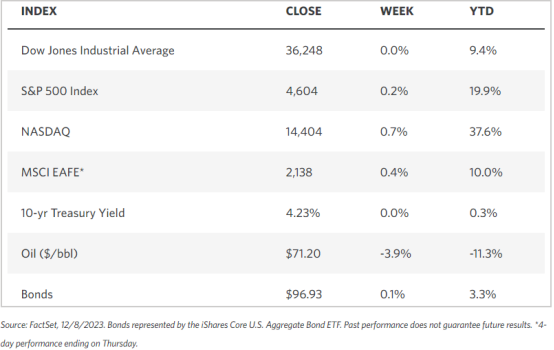

MARKET STATS LAST WEEK

TECHNICALS

Crude Oil

I finally got a long swing signal last week, but this price action is not very convincing yet. The weekly candle was bullish, and geopolitical risks rose a bit this weekend with the Houthis

Stay nimble this market

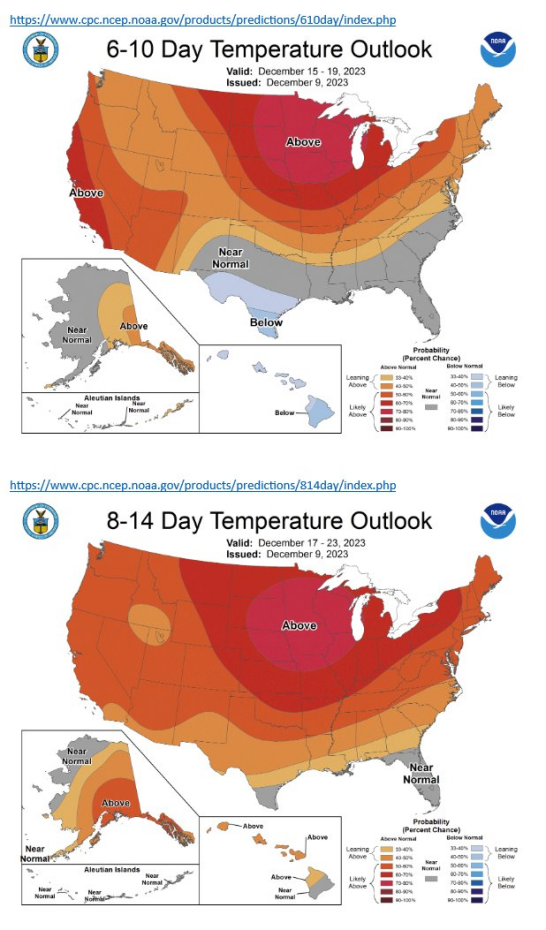

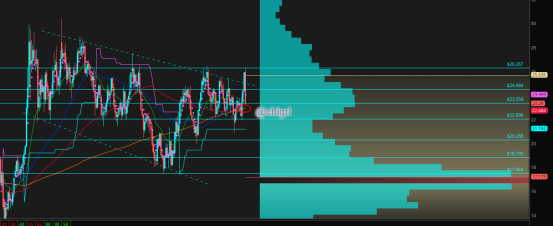

Nat Gas

Nat gas may gap down tonight based on US weather forecasts

Here are the levels below to watch for possible support

Gold

Bulls really want to see a hold here

Positive we broke a multi year high last Sunday. Was it a squeeze? Time will tell, but we are at a pivotal level where r/r for a long trade looks decent with a relatively tight stop.

Silver

Wild week for silver, it followed gold to overnight highs last Sunday, then collapsed. Silver is the wild child.

I still remain bullish (longer term). Weekly supports just below …possible nice set up for a short term trade

Copper

We had beak out of the triangle and retest of the breakout last week. Weekly candle is bullish.

That said watch this week carefully as either this was a fake break higher or we mover the next leg higher.

I actually love this market right now because it is trading technically beautifully.

USD $DXY

Last week did not give us many clues for direction, markets likely waiting for the CB decision frenzy this week

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.