I will go over two happenings in the crude oil market last week that I have been asked about a lot.

KEYSTONE PIPELINE SHUTDOWN

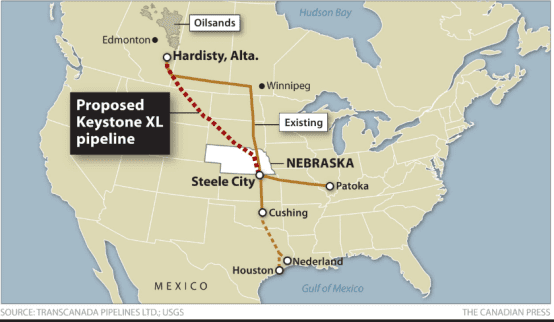

Wednesday, Dec. 7, there was a leak discovered from TC Energy’s Keystone pipeline in Kansas, forcing the operator to completely shut down this pipeline. This pipeline carries about 600K bpd from Canada to Cushing Oklahoma storage. (Cushing is the actually WTI futures contract that everyone is trading). As of yesterday, Sunday, TC energy has still now found the cause of the leak.

With Cushing inventories at already extreme historical lows of 23.9M barrels, the main question continues to be the duration of the potential outage. The longer the duration, ultimately, of course, means potentially tighter inventories in Cushing or heavy (crude) on the Gulf Coast. This will also affect refiners and output as there will be fewer much-needed heavy Canadian for blending purposes to produce heavier distillates.

“If the outage lasts for more than 10 days, it could push Cushing storage to near the operational minimum of 20 million barrels,” said AJ O’Donnell, a director at pipeline researcher East Daley Capital.

Map of Keystone Pipeline

About Cushing

Cushing’s state capacity is 90M barrels, but you have to leave room at the tops of the tanks for transfers, so realistically max storage is around 75M barrels. At 23.9M we are extremely low. In addition, below ~20M barrels you also have operational issues.

SAUDI/CHINA MEETING-OIL FOR YUAN?

The Saudis met with China this week and made a flurry of deals. China brought up the possibility of trading oil for yuan. Let me first state that this is not new. They have brought this over a dozen times in the past. Second, I will state that neither Saudis nor China has made any decisions on this.

Also note as Javier Blas from Bloomberg pointed out: “The “we can shift away from the dollar” has become a verbal diplomatic tool in the Saudi toolkit to put pressure on the White House. Every time Riyadh-Washington relations are strained chatter surfaces. But Saudi Arabia has shown very little interest in moving beyond talk.”

There is a very BIG difference between paying for a commodity in one currency and pricing it in another currency. You can pay for oil in whatever currency you like, but if it is still priced in USD… it’s just a currency exchange. In other words, invoicing or settling the oil purchases in yuan is significantly less disruptive than pricing the barrels in the Chinese currency.

Lastly, several OPEC countries have settled and continue to settle oil deals in non-dollar currencies (like Iran, Venezuela, and Libya) with little impact on the dollar.

There is a lot of speculation going on about this that has been very overblown, and we have been down this road many times.

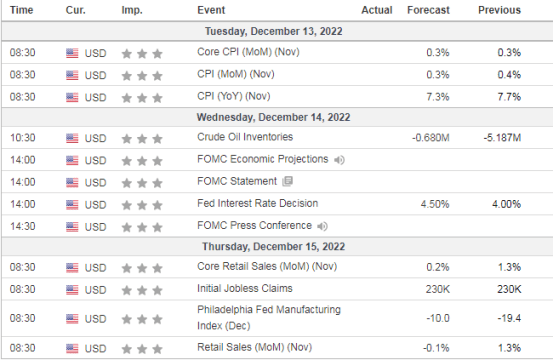

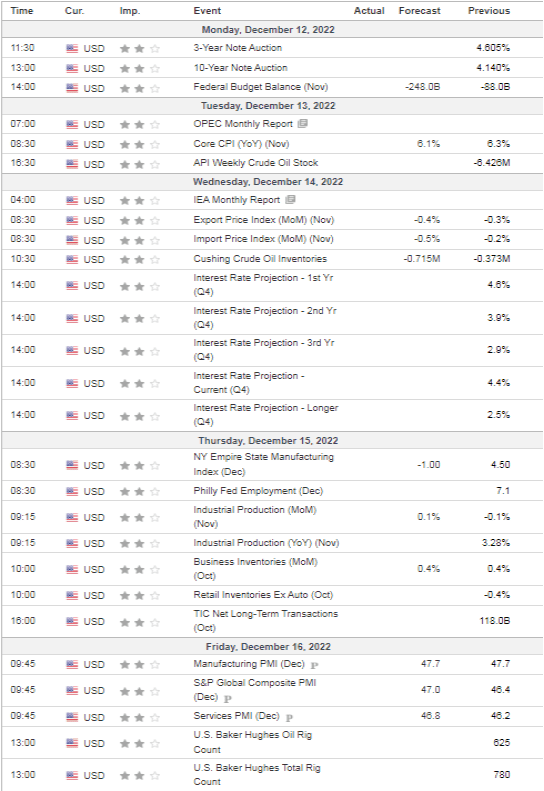

MARKET MOVERS THIS WEEK

Lots of data this week including but it’s ALL ABOUT FOMC

Top tier movers

Secondary movers

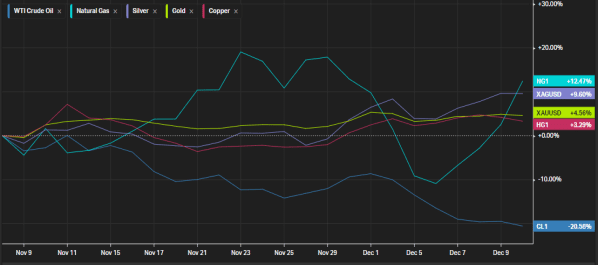

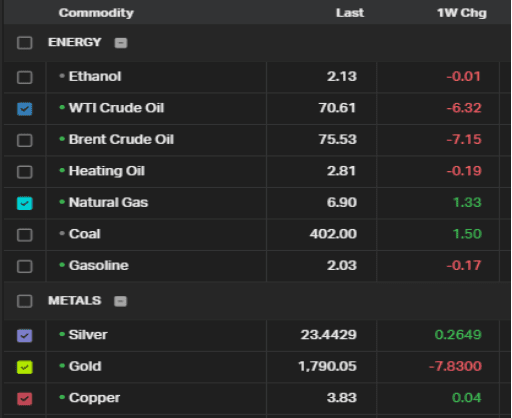

COMMODITIES PERFORMANCE

Month to Date Commodities Performance

Week to Date Commodities Performance

LOOKING AHEAD TO THIS WEEK

As always keep an eye om USD as it has been driving markets (metals in particular)

$DXY broke the 200-day, and has retested and rejected back down

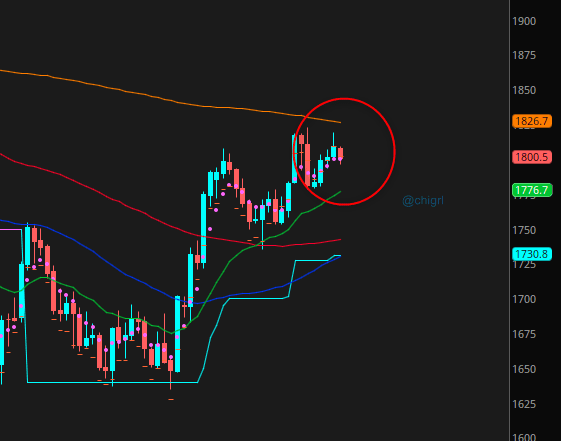

Gold: Gold is correlated to real rates (not inflation) If real rates come down (interest rate minus inflation expectation} then likely we see a further rise in gold prices. If real rates continue higher then likely we see gold resume down. A proxy for real rates is to use the US 5 YR and subtract the 5 YR break evens (US05Y-FRED:T5YIE)

So be watching USD and real rates this week for clues on the direction.

It is FOMC week, so stay nimble. This market is still a bit overbought, so we could have a sideways week this week.

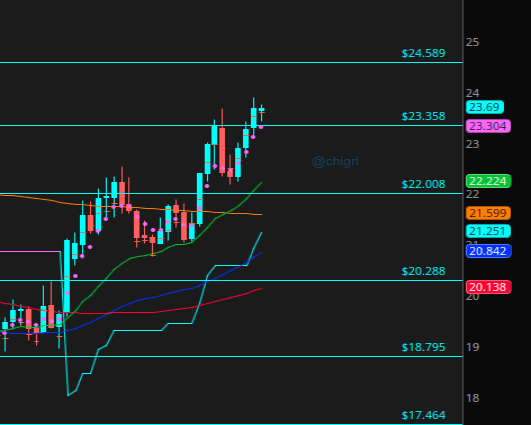

Silver: Also watch USD and rates. This chart has been much more bullish than gold. Last week I noted that although silver was overbought, this market tends to run, and indeed we did. We are well above the 200 day now. This market still has room to run.

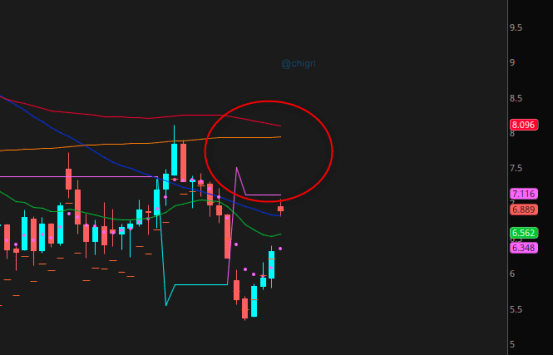

Copper: Watch the China reopening story. They have done a complete 180 as far as policy stance. That said, it will be a very choppy reopening. Copper tested the 200-day last week and was rejected down, it is also very overbought, so we could see some more downside this week before resuming higher.

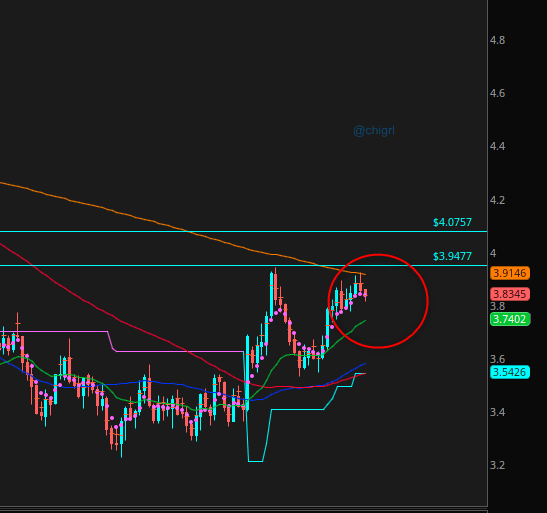

Natural Gas: The dreaded arctic weather has hit Europe and nat gas has opened gap up, to no surprise. I expect this market to be extremely volatile this week, with further upside in the following week or two depending on how fast EU storage is depleted.

We do have some resistance up above. Stay nimble. Strangles are probably the best way to play this market.

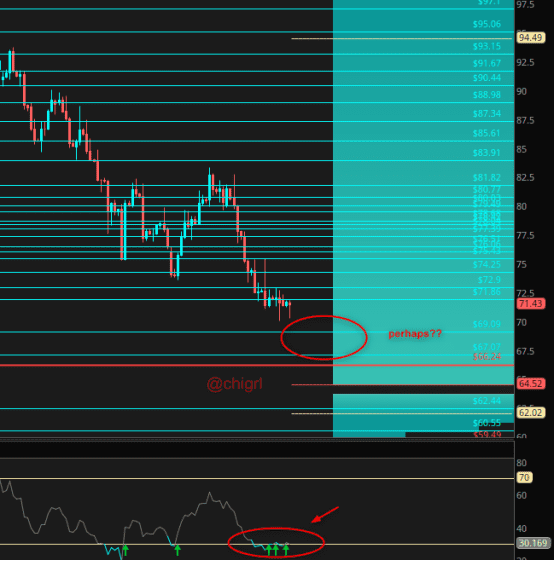

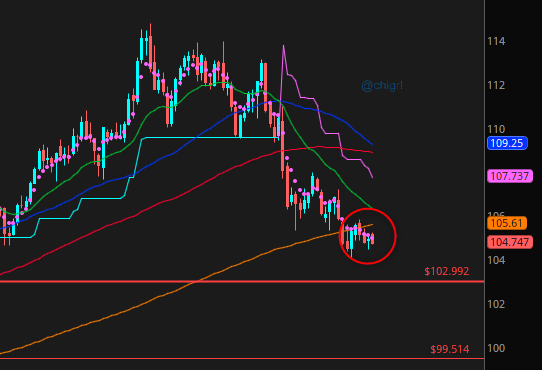

Crude Oil: Open interest continues to decline, this market is very oversold, and the sentiment is at all-time lows. I do not believe we have much further downside before a substantial bounce. With Keystone down and China reopening, this market will not be able to ignore fundamentals much longer. A swipe down into the upper $60’s would be a gift for swing traders for a move higher but given the chart structure, not sure we make it. (though anything is possible with crude).