Markets took another breather this week from the summer rally

Via Edward Jones:

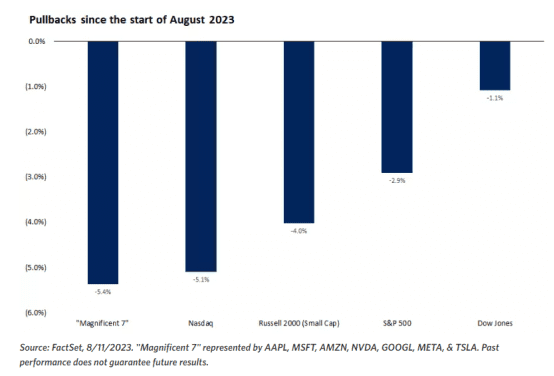

After a remarkably strong rally to start the year, markets have given back a bit in August thus far, with the S&P 500 down around 3% since its recent high on July 31. Underneath the surface, however, we see the Nasdaq is down over 4.0% during this period, and the “Magnificent 7” large-cap stocks are down over 5.0%. The parts of the market that have led the way higher are now perhaps taking a breather, which we view as a healthy development as investors digest outsized gains.

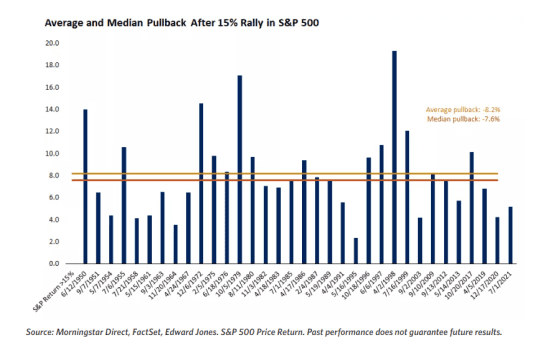

Pullbacks after strong rallies in the S&P 500 are common, and have averaged about -8% since 1950

Large-cap technology stocks have corrected the most since the start of August

COMMMENTARY: Mania always leads to revision to the mean. So, it is not surprising the largest gainers (large tech stocks *see AI) this summer have lead to the largest correction.

THE MARKET RALLY THIS SUMMER SEEMS UNDERPINNED BY STRONGER MARKET FUNDAMENLS…but will it last?

Via Edward Jones and FactSet:

- Inflation continues to trend in the right direction: This past week, investors digested key inflation reports, including U.S. CPI (consumer price index) inflation for the month of July. CPI inflation was largely in line with the expectations, with headline CPI at 3.2% year-over-year, versus expectations of 3.3%*. Inflation did tick higher from last month’s 3.0% reading, but this was largely expected given higher energy prices last month, as well as easier annual comparisons versus last July. Core inflation, excluding food and energy, came in at 4.7%, in line with expectations and below last month’s 4.8%*. The shelter component, which makes up about 40% of the core CPI basket, continued to climb at the lowest monthly pace since its recent highs*. In our view, shelter inflation in the CPI basket should continue to ease in the months ahead, as lower shelter and rent prices are reflected in CPI with a lag impact. Of note, while last week’s inflation data was moving in the right direction, the market reaction was largely muted, perhaps another sign that markets had priced in some of this good news already.

- The Fed seems likely to remain on hold for now: After the relatively benign inflation data last week, markets continue to expect the Fed to remain on hold through 2023. In our view, this is a credible scenario, and, barring any inflation shocks, we would expect the Fed to hold the fed funds rate at the current 5.25% – 5.5% for an extended period. We would, however, expect the Fed to leave the door open to additional rate hikes if needed and message this consistently. But overall, the next move by the Fed, perhaps in the first or second quarter of 2024, could be a rate cut, particularly if inflation continues to head toward its target range.

- The economy is holding up better than expectations: Perhaps the most notable shift in market and investor sentiment has been around better-than-expected economic growth. Markets seemed to have embraced the notion that the economy may avoid a recessionary period and could perhaps grow above-trend this year. Recent data has supported this view as well, with the Fed’s own GDP-Now forecasting tool pointing to third-quarter U.S. GDP growth of a remarkable 4.1%. In our view, some form of a rolling downturn in the back half of 2023 and early 2024 could be likely, as parts of the economy may stabilize, like manufacturing and housing, while other parts may soften, like services sectors. Overall, while we may see a cooling in growth to below trend, we may avoid a traditional recession of consecutive quarters of negative economic growth.

COMMENTARY: My fear here is that inflation rears its ugly head again (watch the energy markets which have staged a huge rally of over 16%) the markets seem to be sussing this out, ahead of the recent data, with this recent pullback. Be careful here.

BIG ARTICLE FROM BLOOMBERG

Look to the Options Market for Signs of Stock Market Trouble

Deep within the underbelly of the options world lies a threat to the stock-market calm that’s prevailed all year.

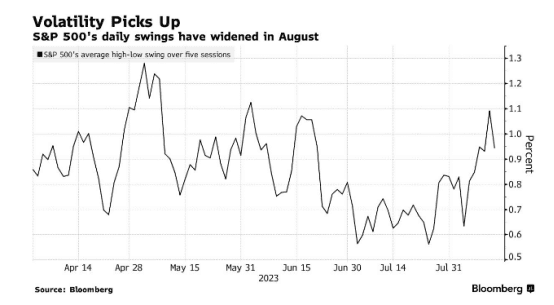

While benchmark indexes just limped to one of their smallest weekly changes of 2023, intraday moves tell a different story. Up-and-down swings in the S&P 500 are the widest since June and double what they were last month. Twice in the past six sessions the index’s futures erased a 0.9% gain, the first time that’s happened since February.

While uncertainty about the economy and central bank policy was one instigator, something else may be contributing to the volatility: Market makers repositioning their exposures. There’s evidence that these Wall Street dealers — with the capacity to move millions of shares to hedge their books — have shifted to a posture where their selling has the potential to exacerbate market swings.

Any turbulence is likely to be temporary and betting against price swings remains a popular trade. But this change in dealer positioning is a departure from the first seven months of the year when the cohort played a major role curbing price swings, according to a model kept by Goldman Sachs Group Inc.’s managing director Scott Rubner.

“Market moves are exacerbated, and no longer muted,” Rubner, who has studied flow of funds for two decades, wrote in a note Thursday. “This is new.”

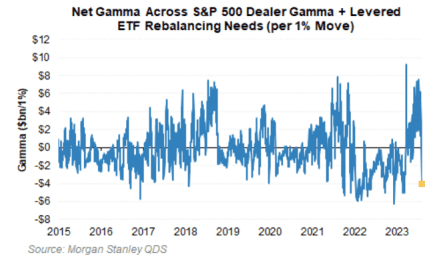

And right now, two widely followed Wall Street trading desks are sounding alarms over potential turbulence on the horizon as option dealers move away from their “long gamma” position — a status that previously obliged them to go against the prevailing market trend, selling stocks when they go up, or vice versa.

By Goldman’s model, the group’s exposure to S&P 500 options flipped this week to negative for the first time this year, while that for all index contracts was the most short since last October.

That, combined with the activity of leveraged ETFs right now — those employing derivatives to generate performance that’s multiple times that of the underlying asset — means the market is susceptible to larger moves, according to the Morgan Stanley team.

“The Street will sell into a down tape and buy into an up tape,” they wrote. “This is likely temporary – but for now, it leaves the market free to move.”

Commentary: Dealer gamma has shifted.

LET’S TALK OIL

Three big reports out this week EIA, OPEC, IEA

Although I think we are in for a massive 2.1M bpd deficit heading into H2

That said, I am bucking the narrative here and saying I think we see softer demand from China in H2

Here is why:

China’s seaborne crude imports slumped below 10mbd in July, down 13% m-o-m from June’s 3-year highs. But imports have been higher compared to the same period in the past two years, as fuel demand has recovered from pandemic restrictions.

Meanwhile, China’s onshore crude stocks climbed at an average rate of over 1.1mbd for three straight months since late April and registered a new record at 1.02bb at end July, as crude imports rose, refinery throughputs were seasonally low during spring turnaround, and the recovery in domestic demand, particularly from manufacturing, fell behind expectations in the past four months. The somewhat unplanned stock build allows Chinese refiners to slow down crude purchases in the weeks ahead as prices go up.

I spoke about this for Complete Intelligence this Week: time mark 20:05

My point is here, I expect slowing demand from China as prices rise, as they have build considerable stocks at cheap prices (as they do with all commodities) but overall demand to remain strong.

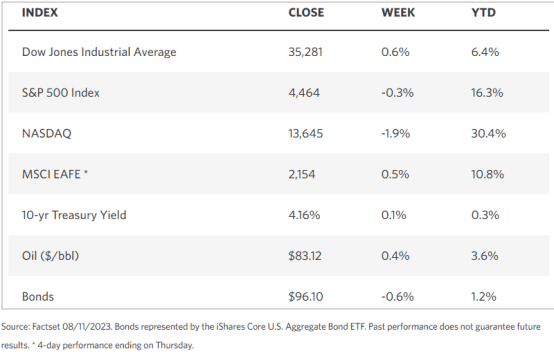

WEEKLY MARKET STATS

TECHNICALS

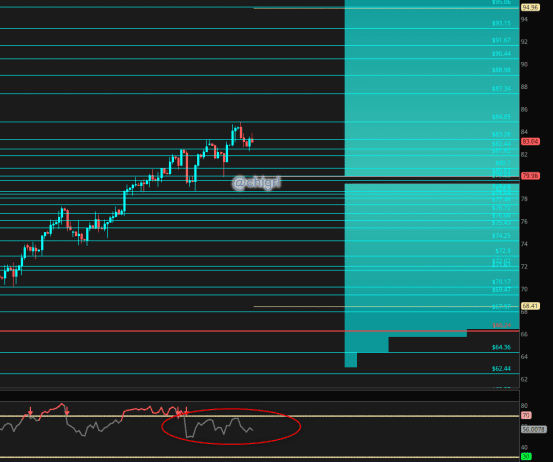

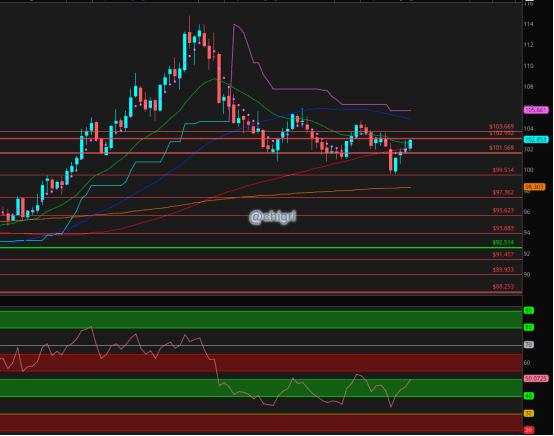

Crude Oil

This market was WELL over bought but has been working this off

Chart remains bullish

Nat Gas

I noted last week: Nat gas is still waffling in a supply zone, but has regained a critical area.

This was due to geopolitical issues that faded last week.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

If you are a long term investor, might not be a bad time to start a position here (note this is the first time since 2022 I have been remotely interested in this market) as I think that this winter will be much different than last for Europe due to El Nino.

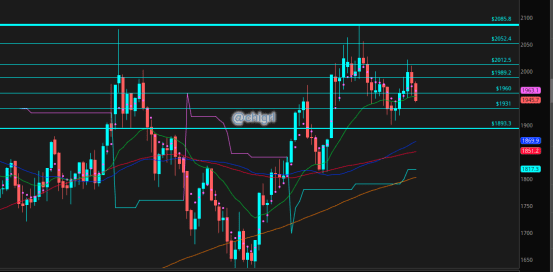

Gold

As much as I like gold over the long term…last week’s candle is not promising.

Love to buy this lower

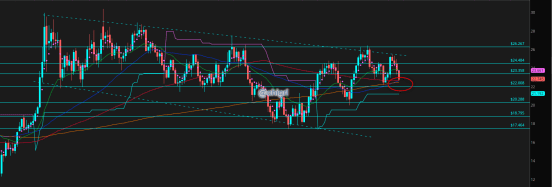

Silver

Interesting spot

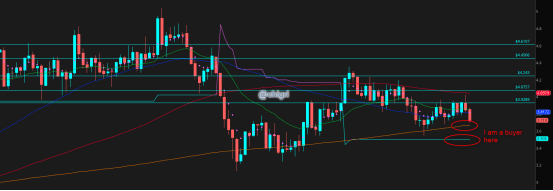

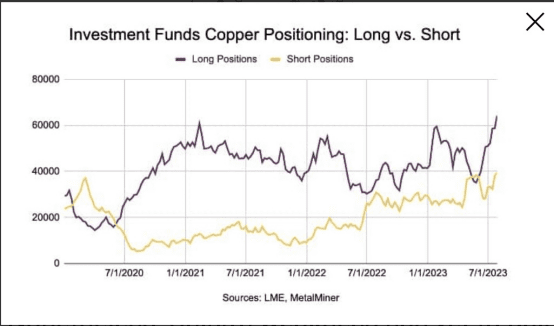

Copper

I am a buyer where noted

Here is why:

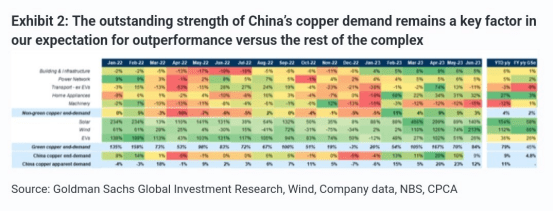

Per $GS (no I do not always subscribe to what they have to say, but in this case, they are correct)

Copper exceptionalism continues. Despite the general negativity on the industrial metals complex at the current juncture, the outstanding strength of China’s copper demand remains a key factor in our expectation for outperformance versus the rest of the complex. With the latest full supply chain data now available for June, we see China copper end demand having risen 3% y/y for the month and 9% y/y for the 23H1. That compares to equivalent apparent refined copper demand growth of 12% y/y in June and 11% y/y for the year-to-date. This contrast with a 5% y/y year-to-date contraction in onshore steel demand, and indeed an environment of stagnant manufacturing PMIs, typically a well correlated indicator with copper demand. This exceptionalism reflects very strong growth trends in China’s green sector, grid investment and property completions, all of which are already underpinned by policy support enacted well before the latest Politburo meeting. The early evidence for Q3 suggests that whilst some of the usual seasonal slowdown has occurred, onshore copper demand has remained in a clear expansionary state, with an estimated apparent demand growth rate in July of 11% y/y. With onshore and bonded stocks now just 154Kt, implying only 4 days of demand coverage, as the seasonal demand uplift plays out from September onward, we expect further draws and support for a grinding increase in refined imports over the remainder of the year. With such limited inventory cover in China and on Western exchanges, we see significant right-tail risk to the copper price if, for example, there was a material supply disruption or upside surprise in China policy support announcements. Indeed, our dialogue with the investment community so far in Q3 suggests interest in copper downside has now dissipated and buying copper dips is the predominant strategy, which in turn suggests any moves towards the low $8,000s will become increasingly limited as China’s seasonal lull ends this month.

$DXY USD

Lower lows and lower highs so far

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.