CPI was obviously the big story last week.

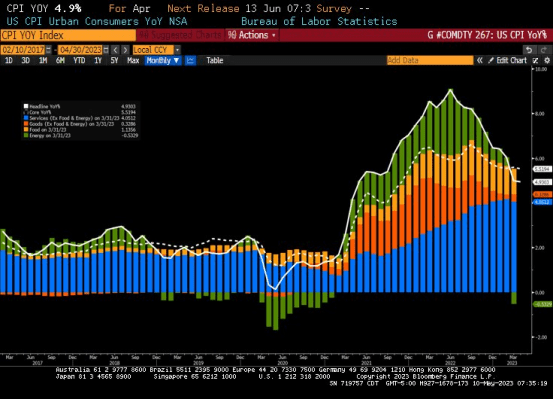

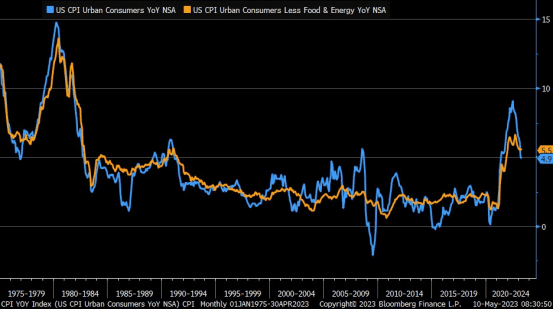

Headline CPI for April came in at 4.9% last week, which continues the disinflationary trend, while core inflation came in at 5.5%, giving the Fed room to pause.

Via BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in April on a seasonally adjusted basis, after increasing 0.1 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 4.9 percent before seasonal adjustment.

The index for shelter was the largest contributor to the monthly all items increase, followed by increases in the index for used cars and trucks and the index for gasoline. The increase in the gasoline index more than offset declines in other energy component indexes, and the energy index rose 0.6 percent in April. The food index was unchanged in April, as it was in March. The index for food at home fell 0.2 percent over the month while the index for food away from home rose 0.4 percent.

The index for all items less food and energy rose 0.4 percent in April, as it did in March. Indexes which increased in April include shelter, used cars and trucks, motor vehicle insurance, recreation, household furnishings and operations, and personal care. The index for airline fares and the index for new vehicles were among those that decreased over the month.

The all items index increased 4.9 percent for the 12 months ending April; this was the smallest 12-month increase since the period ending April 2021. The all items less food and energy index rose 5.5 percent over the last 12 months. The energy index decreased 5.1 percent for the 12 months ending April, and the food index increased 7.7 percent over the last year.

The Debt Ceiling

In 1917, the debt ceiling was created by Congress via the Second Liberty Bond Act. The United States has raised its debt ceiling at least 90 times with 78 of those times being since 1960. It has never been lowered.

Weighing on markets this week was of course the debt ceiling. While the media and fear mongering took center stage, I believe that this is overblown, although it may come down to the wire. We technically have until September before they would actually have to start cutting government spending in order to pay debts. In my opinion, this drama is a lot of political posturing so that both sides can get the legislation that they want (as usual).

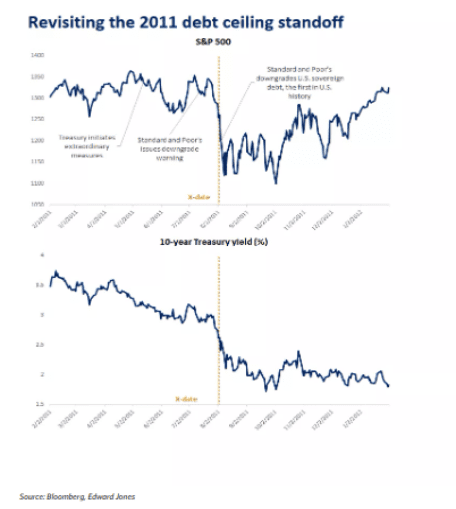

Edward Jones points out an interesting 2011 analog:

- While there have been several debt-ceiling fights over the years, we can draw some insights from the summer of 2011 when the country came the closest to default. The debt-limit crisis resulted in Standard & Poor’s downgrading the U.S. government’s credit rating for the first time in history. Like today, there was a divided Congress and a Democratic president. Eventually a default was narrowly avoided, but volatility spiked.

- Here is the timeline of events and how different investments performed. From when the Treasury initiated extraordinary measures until the X-date on August 2, 2011, the S&P 500 declined about 6%1. The House passed the debt-ceiling deal a day before the deadline, and the Senate approved it, with President Obama signing it on August 2. But then, Standard & Poor’s downgraded the U.S. credit rating from AAA to AA+ on August 5, and stocks sold off another 10%1. Small-cap stocks underperformed, while the tech-heavy Nasdaq held up better. Volatility remained elevated for about two months, but the markets were able to recover the losses by year-end.

- On the fixed-income side of portfolios, one might have thought that the likelihood of default and the U.S. downgrade would have driven U.S. Treasury prices lower and yields higher. But the opposite happened. The 10-year yield fell, with long-term bonds acting as a safe heaven1.

Overall, I view this as a short term problem for the markets that will likely resolve in the 11th hour rather than drag on for months.

SLOOS ( Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices)

This survey also came out last week:

Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to large and middle-market firms as well as small firms over the first quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

For loans to households, banks reported that lending standards tightened across all categories of residential real estate (RRE) loans other than government-sponsored enterprise (GSE)-eligible and government residential mortgages, which remained basically unchanged. Meanwhile, demand weakened for all RRE loan categories. In addition, banks reported tighter standards and weaker demand for home equity lines of credit (HELOCs). Standards tightened for all consumer loan categories; demand weakened for auto and other consumer loans, while it remained basically unchanged for credit cards.

Tighter lending should in theory, slow the economy helping the Fed achieve their goals regarding inflation.

With tighter restrictions on business and personal loans, the economy will contract. As businesses are unable to procure funding, they will likely need to streamline costs, which will include conducting layoffs. These actions align with Powell’s policy to degrade the economy and labor market to beat inflation. The rationale behind the Fed’s policy is that if more people lose their jobs, they won’t spend as much money, and inflation will start easing downward. -Jack Kelly Forbes

MARKET PERFORMANCE LAST WEEK

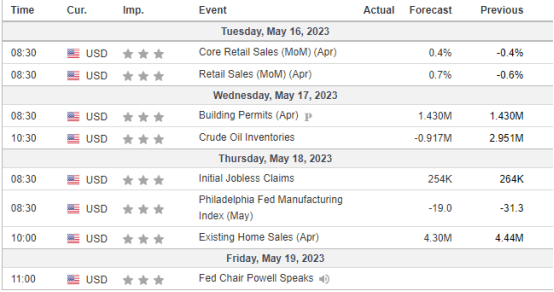

THIS COMING WEEK

Light on data as far as major market moving events.

TECHNICALS

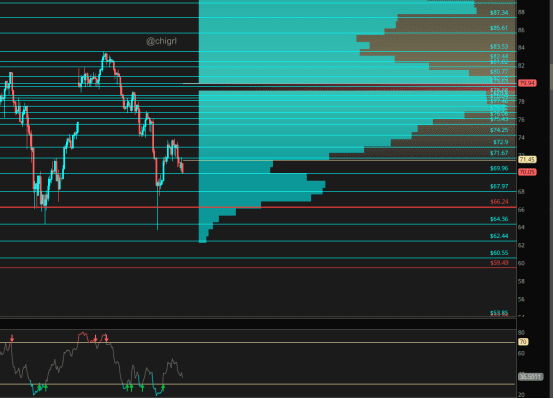

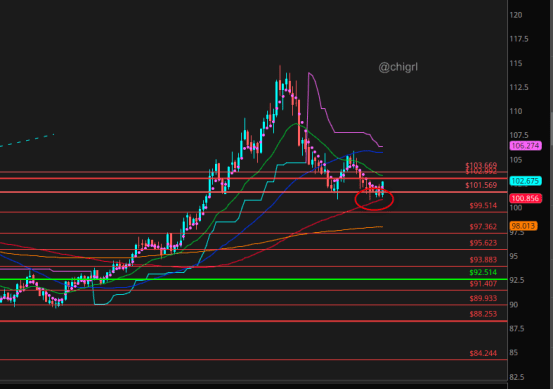

Crude Oil

Crude oil is back in a supply zone, but is not yet oversold. We either bounce up and out of this LVN or down to the HVN just below, which likely would be a buy zone.

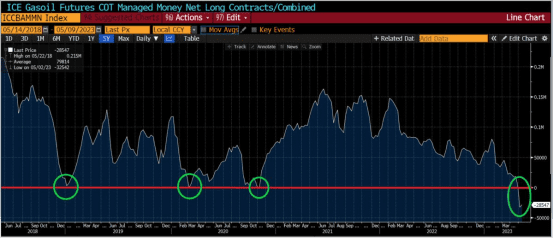

Bigger picture Warren Pies pointed something out very important last week.

Hedge funds/CTAs are now massively net short gasoil futures. In last five years, Managed Money has been net short only three other times: -Late 2018, -COVID (3/20), Late-2020. Big oil rally followed every case.

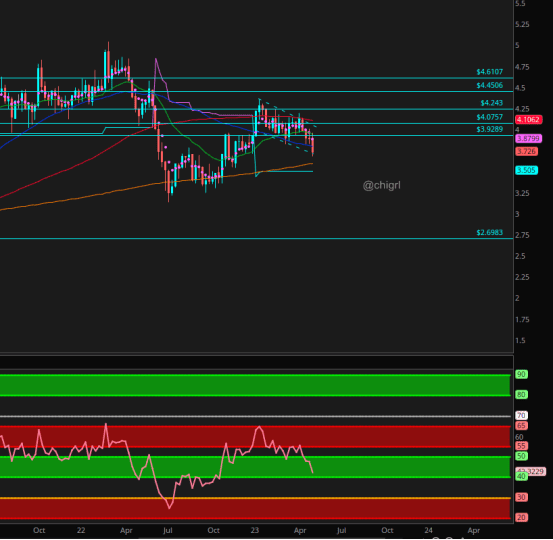

Nat Gas

Still no change to my view.

Nat gas is still waffling in a supply zone, again, really hard for me to get excited about this market.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

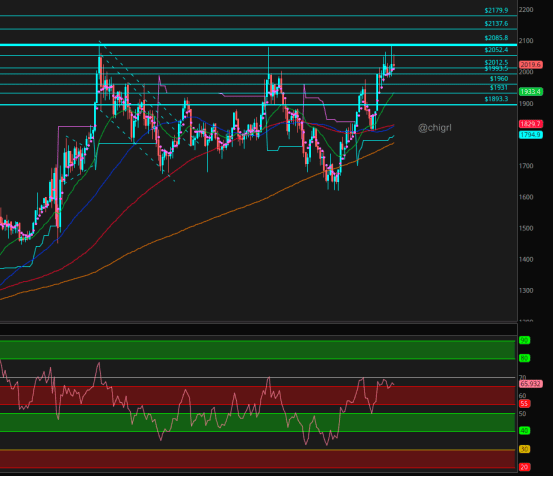

Gold

We still have not managed to break that triple top, but the fact that it is staying over $2000 says a LOT. We could dip further on a debt ceiling resolution but keep your eye on banks, I think this problem is far from over and likely puts a floor under gold for now. Overall the chart remains bullish.

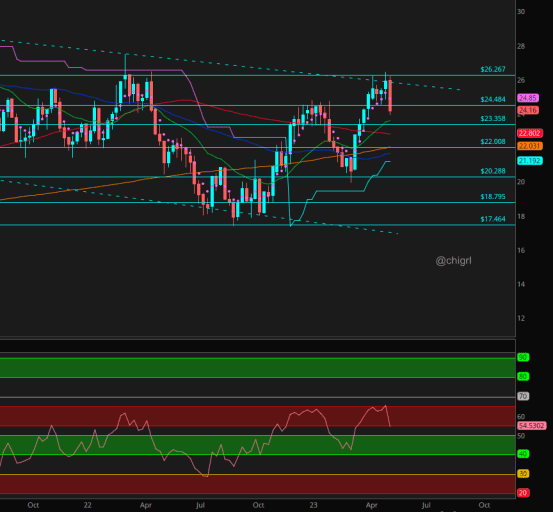

Silver

Could see a further pull back, but downside seems limited for now with weekly support at $21.192.

Copper

Still in that weekly flag. It tried to break below this week, but was unable. It is starting to get a bit oversold.

Longer term, copper is still bullish as demand set to outstrip supply.

USD

$DXY is bouncing off that 100 day, where I thought it would.

We could have some further upside, but may be limited, especially if we see a pause in the next FOMC.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.