Key Takeaways from Last Week’s Data

Consumer price index (CPI) inflation came in cooler than expected

CPI inflation data for November came in below expectations, with headline inflation of 7.1% year-over-year versus expectations of a 7.3% figure. Core inflation came in at 6.0%, also below forecasts for 6.1% and lower than last month’s 6.3%. Overall, inflation is trending in the right direction, although CPI remains elevated and well above the Fed’s 2.0% target. Goods inflation continues to ease, with areas like used cars, apparel and even toys showing moderating price pressures. Parts of services inflation, including medical and transportation services (like airline fares), were lower this month. However, core shelter and rent prices in the CPI basket remained elevated.

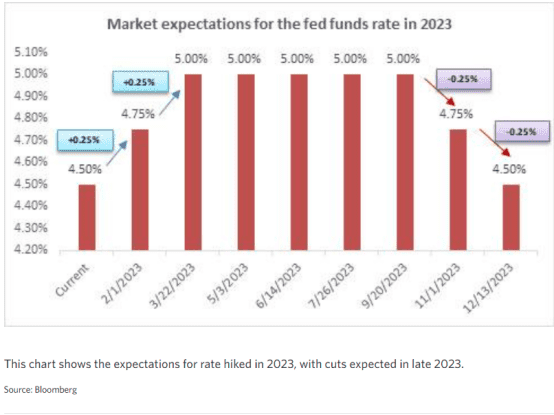

The Fed raises interest rates by 0.50% and indicates a 5.1% peak fed funds rate

As expected, the FOMC raised rates by 0.50% at its December meeting last week, bringing the fed funds rate to about 4.5%. Perhaps what was less expected by markets was that the Fed’s “dot plot,” or estimates of where interest rates are headed, indicated a peak fed funds rate of 5.1% in 2023. This rate was slightly above market consensus of 4.8% – 5.0% heading into the meeting, although not meaningfully above market expectations. In his comments, Fed Chair Powell went out of his way to say that while recent inflation data has been encouraging, inflation broadly remains elevated and well above the Fed’s 2.0% target. Fighting inflation continues to remain its top priority, not the impact of higher rates on economic growth

The Fed indicates no rate cuts in 2023 and about 100 basis points (1.0%) of rate cuts in 2024

While the Fed acknowledged that pausing rate hikes at some point (likely in the first quarter) was likely, Chair Powell and team noted that it was too soon to discuss rate cuts. Their own projections do not include rate cuts until 2024, and the Fed has indicated it will remain restrictive with its monetary policy until inflation clearly heads back toward 2.0%.

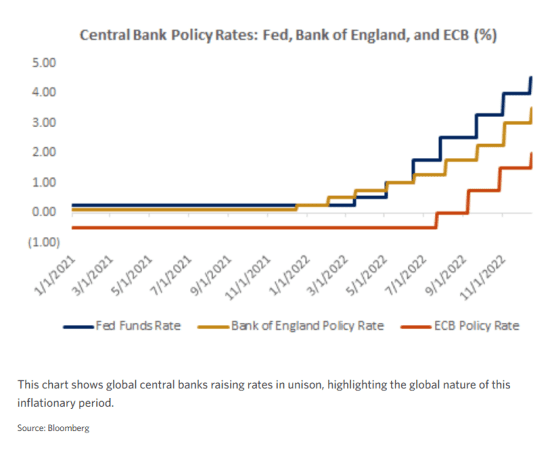

Global central banks raise rates by 0.50% alongside the Fed

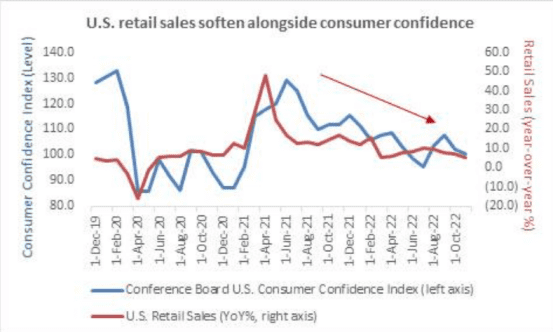

Retail sales for November came in weaker than expected

US retail sales for the month of November came in below expectations, falling -0.6% month-over-month, versus forecasts of down 0.15%

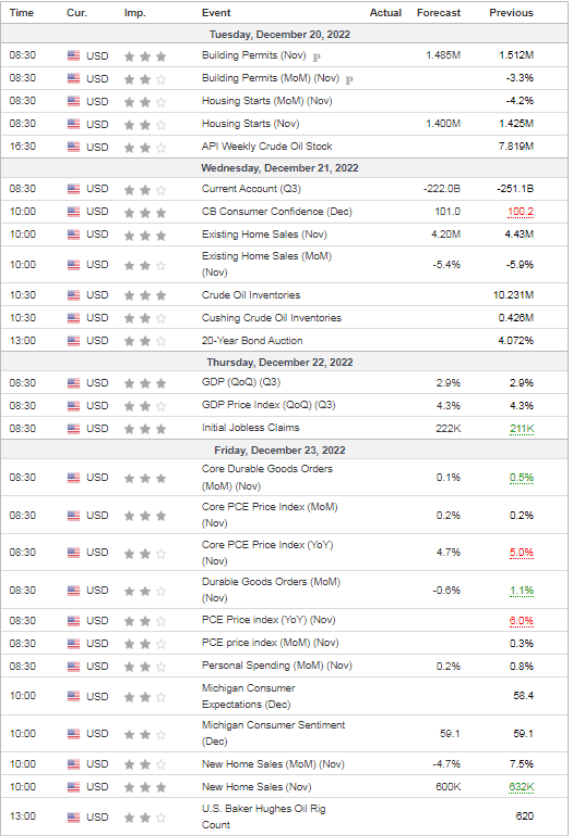

MARKET MOVERS THIS WEEK

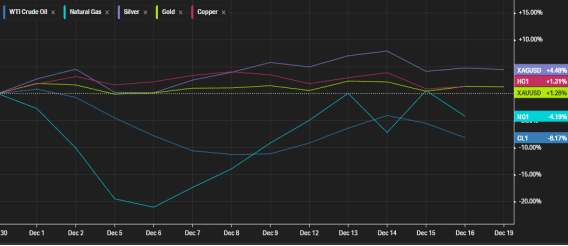

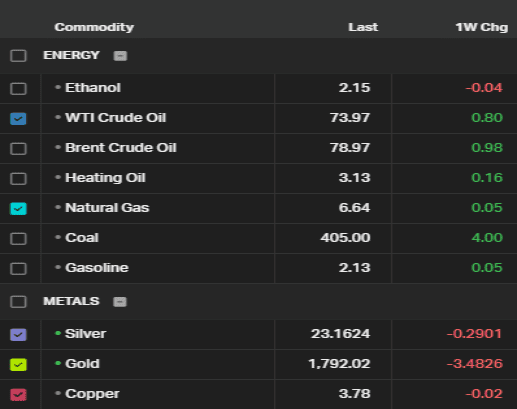

COMMODITIES PERFORMANCE

Month to Date Commodities Performance

Week Commodities Performance

LOOKING AHEAD TO THIS WEEK

As always keep an eye in USD for metals in particular

$DXY broke the 200-day, and has retested and rejected back down

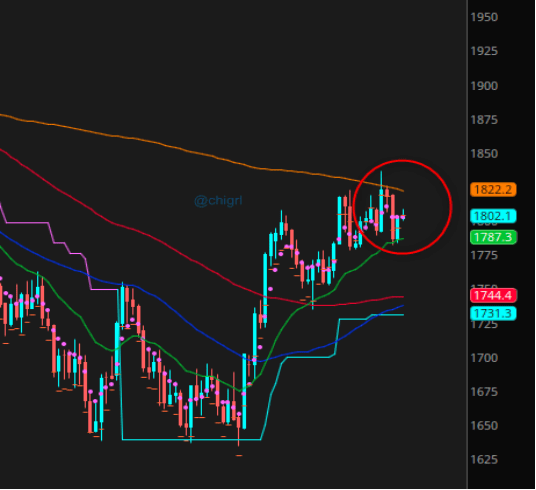

Gold: Gold is correlated to real rates (not inflation) If real rates come down (interest rate minus inflation expectation} then likely we see a further rise in gold prices. If real rates continue higher then likely we see gold resume down. A proxy for real rates is to use the US 5 YR and subtract the 5 YR break evens (US05Y-FRED:T5YIE)

Last week because of FOMC and gold being a bit overbought, I said I thought we would see a sideways market which is exactly what has happened.

This market is working off a lot of the overbought territory.

On a larger time frames (week/month), this chart is very bullish.

We still may have some sideways action this week, but a move over the 200-day could be explosive.

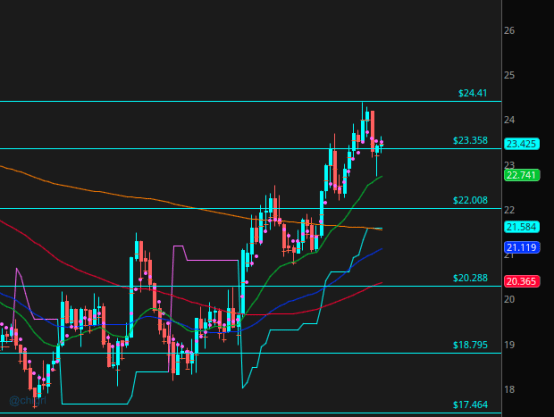

Silver: Also watch USD and rates. This chart has been much more bullish than gold. Nice pullback last week as silver was extremely overbought. Silver still remains well above the 200 day and the trend remains up!

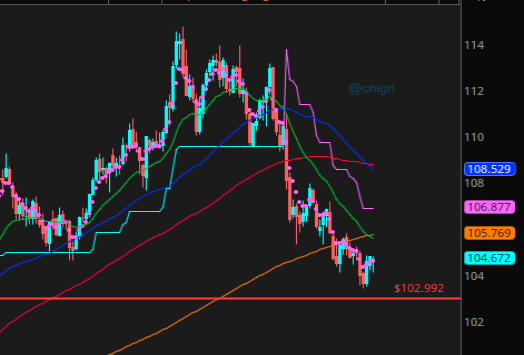

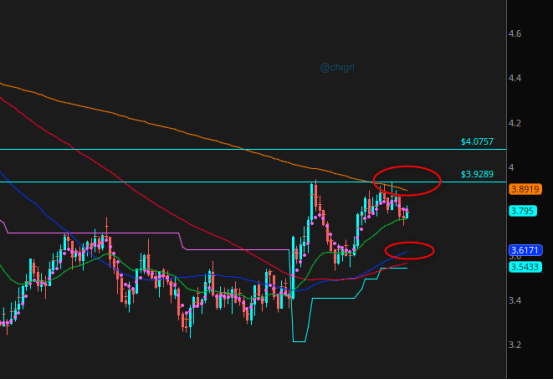

Copper: This is still very much a China re-opening story trade, but again it’s going to be a rocky road! Last week I said I think we would see a pullback and indeed we did. This week could be a sideways week, downside risk to 3.6, a move over the 200-day and this could rocket.

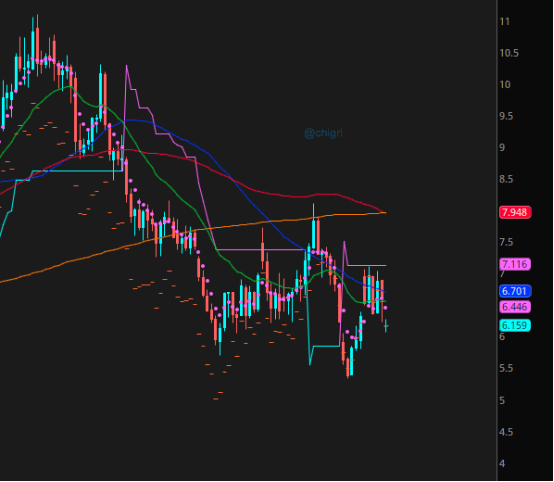

Natural Gas: After opening gap up last week due to colder weather in Europe, we spent the week sideways and opened down last night. Overall this market looks pretty weak so we could see a move downside until next week as temperatures are expected to dive in the US.

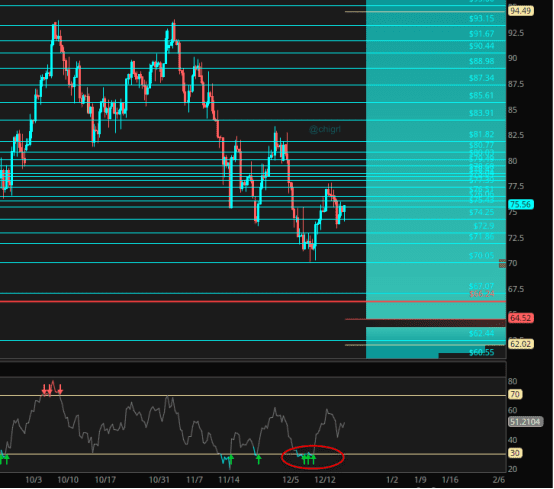

Crude Oil: Last week I mentioned to expect a bounce, with Keystone down and China reopening. Technically we were very oversold. We did bounce at the beginning of the with a pullback toward the end of the week with the broader market sell-off. This still has room to the upside this week.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.