The main theme this week seems to be:

The disinflationary impulse is diminishing quickly fading.

Let’s see what the banks are saying

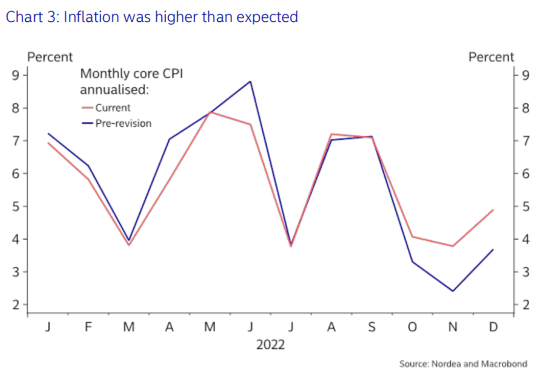

Nordea

In January headline CPI ran at a 6.2% annualised rate,

as the two largest disinflationary impulses, energy and core goods, ran out of steam, while service inflation continued to rise at a brisk pace, showing little signs of slowing down.

Looking ahead, it is clear, that the disinflationary impulse, we have all enjoyed, is diminishing. In core CPI, the car category, which has been the largest disinflationary impulse in the prior months, is forecasted to stabilise and rise, reflecting the price trend in more timely private measures – like the Manheim used vehicle price index. In addition to this, the price increases in January by other core goods – such as household furnishing and apparel – indicate, that inventory and supply are well aligned with demand, and unlikely to be

a disinflationary impulse.

All of this means, that core CPI is running significantly faster than we thought, and is likely to run at a much too high rate going forward, unless service inflation starts to slow down quickly, which is highly unlikely to

happen anytime soon. There has been a lot of CPI watchers arguing to strip out certain categories to prove inflation is higher or lower. A more neutral view to strip out volatility, and gauge underlying inflation, argues

looking at the median and trimmed mean CPI, which ran an extraordinary pace of 7.1% and 6.2% annualised in January, respectively.

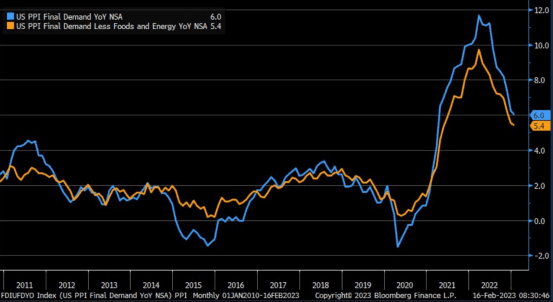

First Trust

Producer prices snapped back from a December decline to rise 0.7% in

January, as costs rose virtually across the board. As with the CPI report released this past

Tuesday, today’s inflation check reinforces the Fed’s conviction that the battle against

inflation is far from over. While it certainly does look like peak inflation is behind us, prices

continue to rise at a stubbornly quick pace that is causing at least one Fed member to question

if discussions should be less on when the Fed can pause hikes, and more on if a return to 50

basis point moves is appropriate. Taking a look at the details of today’s report shows that

goods prices – specifically energy – led the way in January, rising 1.2%. Energy prices

increased 5.0% in January as natural gas, diesel, and jet fuel costs all rose, while food prices

declined 1.0% on the back of softening prices for vegetables. Removing these typically

volatile food and energy categories shows “core” producer prices rose 0.5% in January and

remain up 5.4% in the past year, far exceeding the Fed’s 2% inflation target. While goods

prices were the key factor lifting inflation in January, this is a departure from the recent trend

of services taking charge. We believe the service side of the economy is the key area to watch

in 2023 and the Fed seems to agree, with Chair Powell noting at the most recent Fed press

conference that while supply-chain easing is moderating goods inflation, it is services that

has the Fed cautious about claiming any sort of victory. We expect the path toward the Fed’s

2% target will prove stickier than most anticipate as the economy continues to absorb the massive surge in the M2 measure of money the

Fed injected in 2020-21. Higher rates – and the economic slowdown that will accompany – are the price we pay for the “sugar high” of

stimulus we enjoyed in 2020 and 2021.

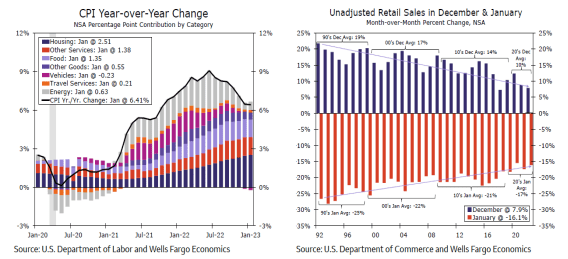

Wells Fargo

Rage, Rage Against the Dying of the Light

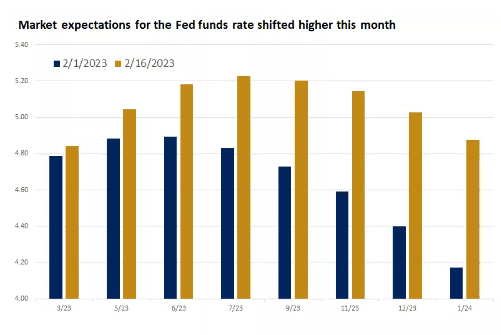

Until the release of the January jobs report two weeks ago, many measures of economic activity revealed gradual slowing mixed with outright contraction even as inflation, while still high, trended lower. Debate may have lingered about whether the economy was on a glide path to recession or a soft-landing, but financial markets generally observed that the past year’s rate hikes were having the intended effect on prices which guided market expectations for eventual rate cuts later this year.

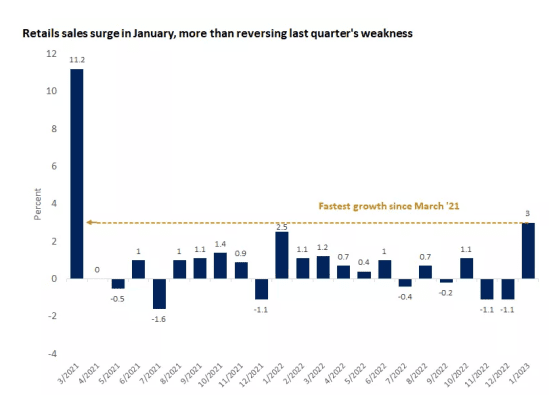

The economic data this week bucked those trends and pushed market-based rate expectations closer in line to the view we have maintained for months: that the Federal Reserve would hike its main borrowing rate higher still and hold it there through year-end. The poet Dylan Thomas urged that we ought to rage against the dying of the light and not go gentle into that good night. This week’s indicators certainly raged against any notion of dying lights for the economy. Retail sales and manufacturing production both surprised to the upside in January, and inflation posted its biggest monthly increase since October. Residential construction did slow for a fifth straight month, but even in this sector hit hard by rising rates, there was a modest uptick in permits pulled for future construction.

COMMENTARY: The jump in retail sales, together with January’s blowout jobs report and a rebound in homebuilder sentiment, paints the picture of a strong economy with positive momentum. Before last week, equity valuations were once again expanding, while tech and other growth investments sensitive to changes in interest rates have been leading the gains.

This backdrop is hardly what one would expect from an economy that is still navigating inflationary pressures and the most aggressive Fed tightening cycle in four decades. Which begs the question: Does the Fed need to do more?

The bond market thinks so but equity markets have been relatively unfazed.

Before we move on I would still like to point out that January inflation did cool, but just at a slower pace.

Although retail sales are not exceptionally high…this is notable and has people spooked.

That said, the one question I have seen no other source asking is: HOW MUCH IS THIS DUE TO GIFT CARD SPENDING AFTER CHRISTMAS? This seems a trivial question but let’s look at gift card spending.

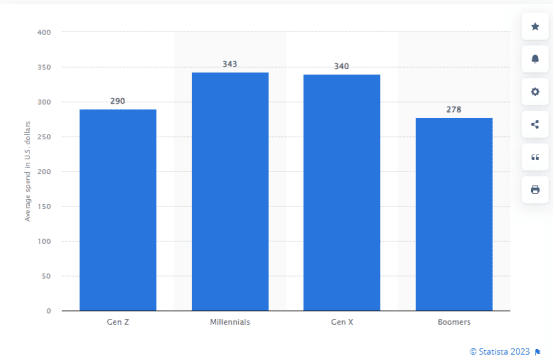

2022 Holiday season -average gift card spending on the holiday by generation

This is not as high as 2020 when the average was $822 (covid lockdowns) but comparatively speaking it is still well above the average.

The data is not currently available right now to determine how much of retail and service-related spending (restaurants) were due to gift cards, but I think it is information that should be watched.

I still believe we are in a sea of unknowns with parts of the economy falling behind and parts of the economy running hot.

Again I believe volatile markets are likely to continue.

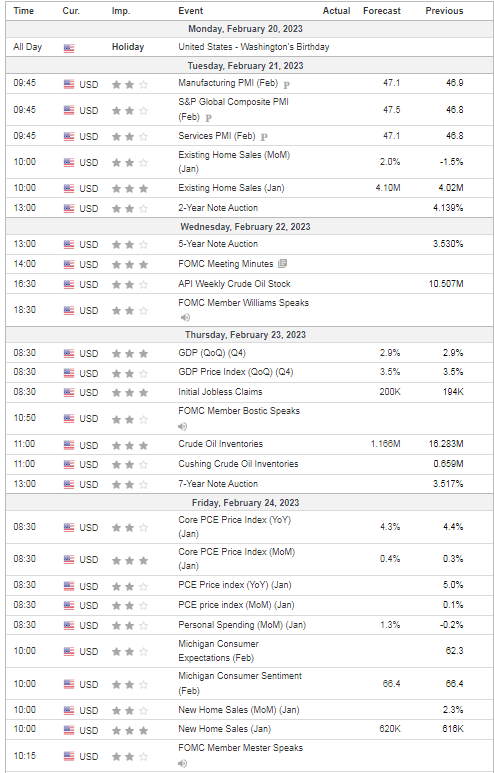

US DATA THIS WEEK

THINGS TO KEEP AN EYE ON THIS WEEK

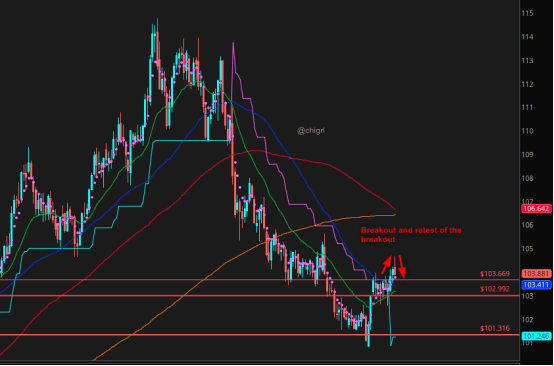

$DXY (USD)

$DXY (USD)

$DXY (USD)

Last week I noted that we were at “make or break”

We broke to the upside and retraced.

Please watch this carefully as a meaningful breakout will put pressure on risk assets and commodities.

Could this be a false breakout? Sure.

Could this be the start of an explosive move higher? Sure.

Just keep an eye on this chart.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.