Be sure to sign up for my daily blog at placeyourtrades.com where I go over Asia in the overnight and market-moving stories!

Moving on!

The Federal Reserve pauses!

Via Edward Jones:

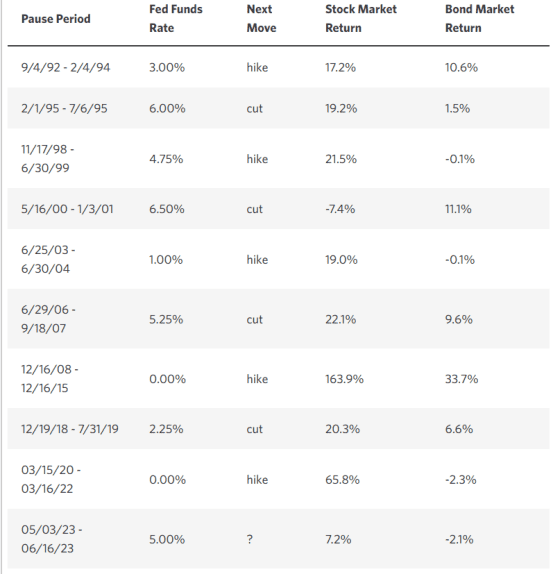

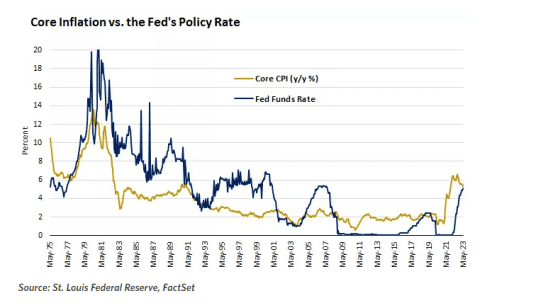

- The Fed kept rates unchanged last week, moving to the sidelines after a 14-month tightening campaign that lifted the fed funds rate by the largest amount (500 basis points, or 5%) in more than four decades2.

- While anticipated, this decision was hardly a no-brainer, as the reason for the rate hikes to begin with – high inflation – has not yet been eradicated. That said, sufficient progress has been made on this front to warrant the Fed’s pivot.

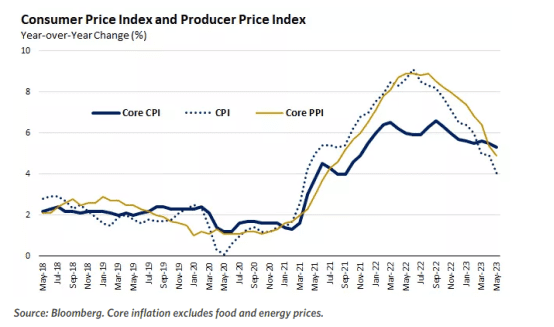

- For starters, last week’s release of the May consumer price index (CPI) confirmed that inflation remains on a downward trend. Headline CPI is at a more than two-year low (4%), helped by falling energy prices and less upward pressure from food prices (egg prices are down 14% from a year ago)1. More importantly, core CPI, which strips out volatile food and energy prices and serves as the guide for monetary policy, continues to moderate. Core inflation fell to its lowest since November 2021, helped by declines in core services, such as airfare and recreation. Looking ahead, the sharp decline in the producer price index (PPI) heralds more improvement for CPI in the second half of the year. Home prices and rents continue to be a fly in the ointment, but recent indicators suggest some relief in shelter prices may be on the way as well.

Prior Fed pauses on its policy rate have typically been accompanied by positive market performance.

LAST WEEK’S DATA

Let’s break last week’s data down

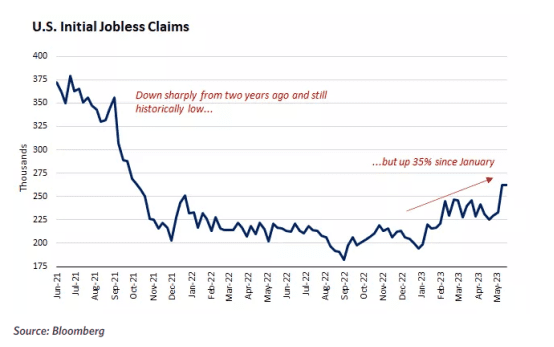

The labor market is beginning to show signs of softening

Inflation is moderating

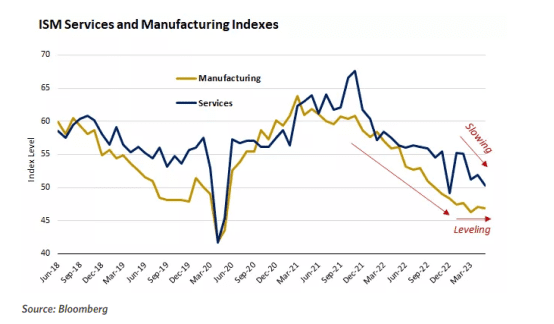

The effects of tighter monetary policy are showing up in economic activity

Core inflation -the Fed’s favorite barometer is turning over

TGA ACCOUNT

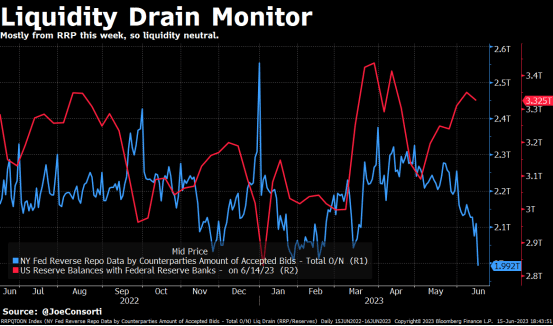

Now let move to the TGA account…last week we talked about how the refill may not be as impactful to markets as anticipated…indeed this is proving to be true.

No big liquidity drain on markets last week as the Treasury issued $296 billion of new debt last week

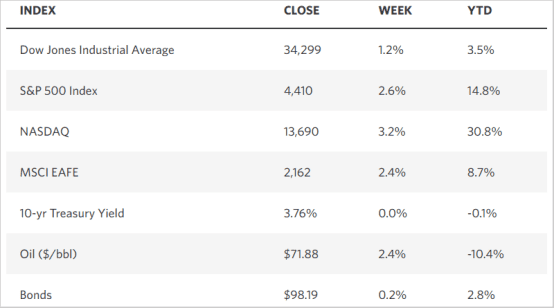

WEEKLY MARKET STATS

TECHNICALS

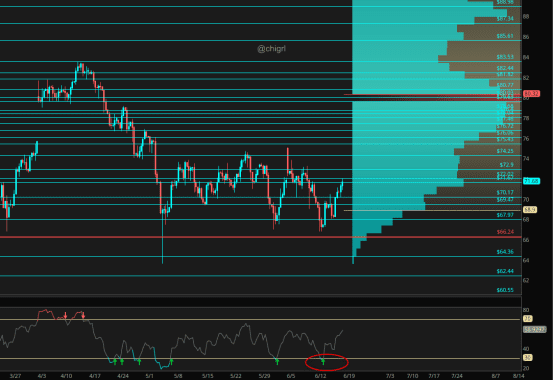

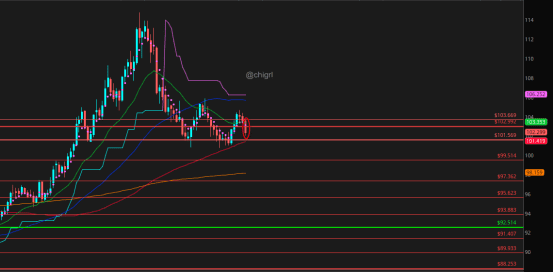

Crude Oil

Last week I warned “don’t short in the hole”

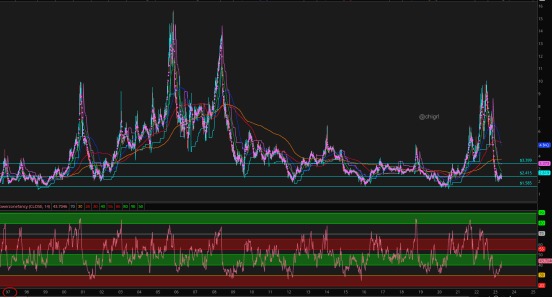

Natural Gas

Kind of tired of talking about this market

No change to my view.

I actually talked about this market last week on a podcast …if anyone is interested.

Nat gas is still waffling in a supply zone going back to 1996

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

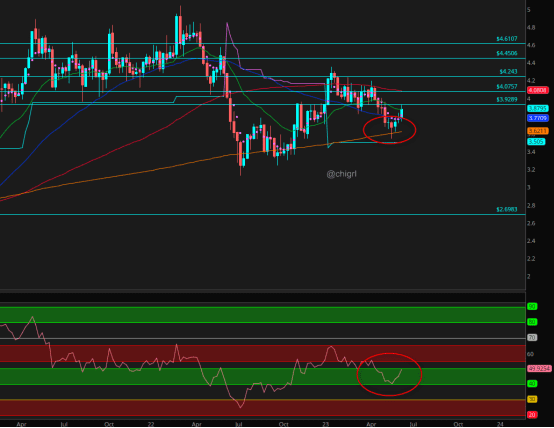

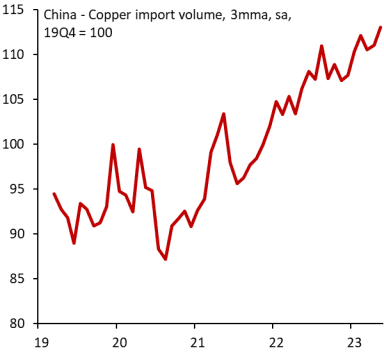

Copper

The 200 day held, we did not even make it to 3.50 support .,..keep an eye on China

Just for some reference, according to Oxford Economics, copper imports from China continue unabated

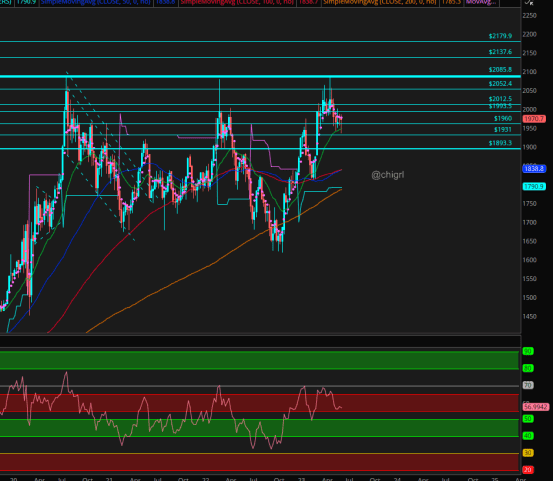

Gold

Still kind of in no man’s land

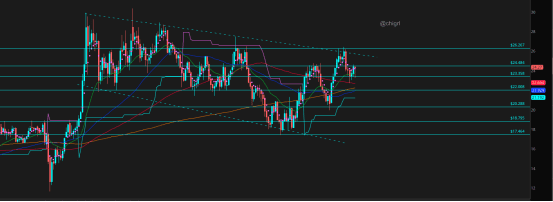

Silver

I particularly like this market. I also was on a macro podcast last week talking specifically on this market.

USD

$DXY

I noted last week that this market was about to roll over. Indeed it has, that said, we are coming up on support so keep an eye out.

If we break this recent double bottom, commodities will like it.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.