Last week was all about Fed/FOMC

(if you missed last weeks PYT twitter spaces before the decision you can catch the replay HERE it is well worth your time )

Federal Reserve paused (as the market suspected)

The surprise (?) was the hawkishness of the tone

Per Edward Jones:

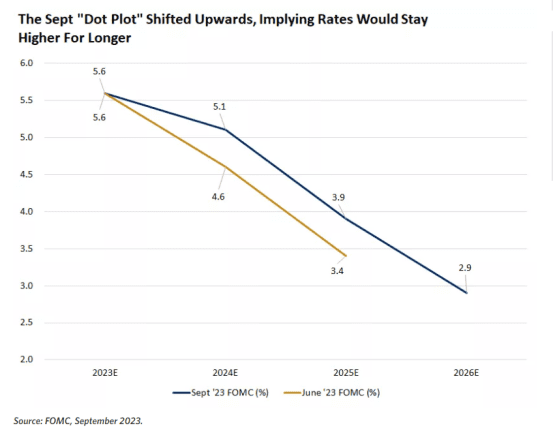

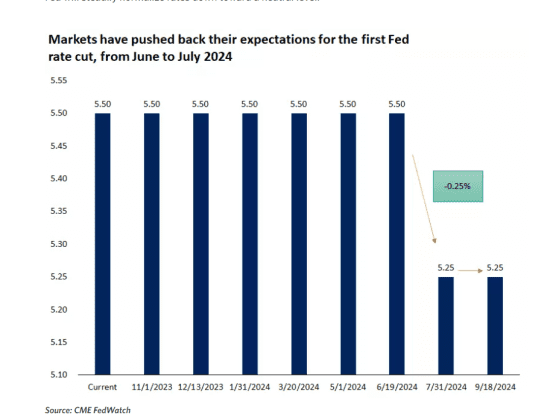

- The Federal Reserve held its September meeting this past week, and the message from Jerome Powell was clear: The Fed will continue to keep rates elevated until inflation moves more convincingly toward 2.0%. The Fed held rates steady at 5.25% – 5.5% at this meeting but kept the option of an additional rate hike on the table, maintaining its outlook for a peak fed funds rate of 5.6%. The Fed’s new set of projections also reduced the number of potential rate cuts in 2024, from 1.0% to 0.5% of cuts next year – implying that the elevated interest-rate environment may last longer than expected.

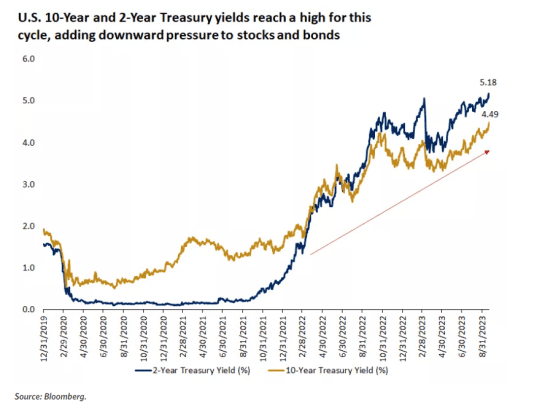

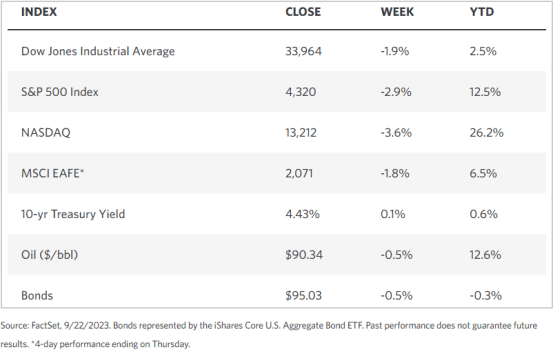

- The market was quick to react to this somewhat hawkish Fed outlook. Treasury yields moved sharply higher, as both the 2-year (which is more sensitive to moves in the fed funds rate) and 10-year yields moved to highs of this cycle, putting downward pressure on stock and bond returns. Longer-duration parts of the market, including technology and growth sectors, underperformed the broader market.

The Fed New Dot Plot

COMMENTS:Powell literally has been saying for moths and months that the Fed will not waiver. The market keeps trying to second guess him, factoring in rate cuts, but he delivers on his promise every FOMC meeting.

That said, My personal take on his presser is that he is becoming less and less confident on the hawkish stance.

WHAT HAPPENED THIS WEEK AFTER FOMC

Markets react swiftly: Yields move higher, and stocks move lower

COMMENTS: The equity markets for the second time actually reacted to the aggressive move higher in yields last week.

Are investors finally getting worried? Time will tell

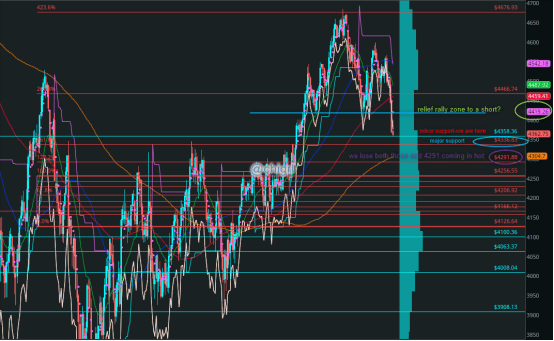

Technically speaking, here is my base case scenario for ES. A break over 4466 and short bets are off, but levels below are noted.

SILVER

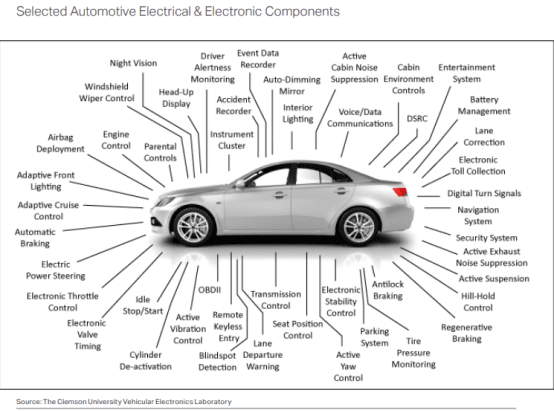

Our motor vehicles are becoming more and more computerized, and silver plays a vital role in their operation. Over 60 million ounces of silver are used annually in motor vehicles.

Every electrical connection in a modern car is activated with silver-coated contacts. Automakers today are increasingly relying on silver to enable the vast technological advances incorporated into modern vehicles (increasingly so with hybrids and EV’s) .

This has resulted in another powerful demand center for silver, with projections of nearly 90 million ounces (Moz) of silver absorbed annually in the automotive industry by 2025. (Silver Institute)

For the visual, here is just a glance at Selected Automotive Electrical & Electronic Components

COMMENTS: I love this market longer term.

WEEKLY MARKET STATS

TECHNICALS

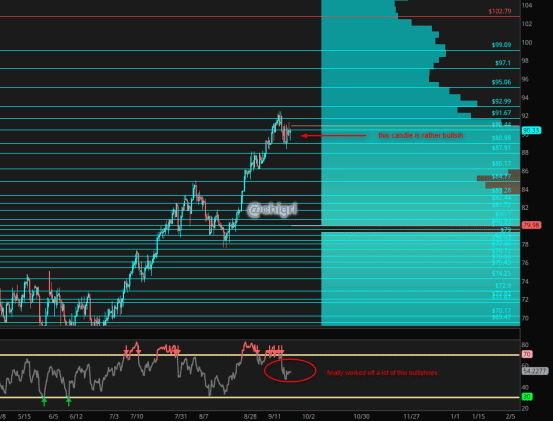

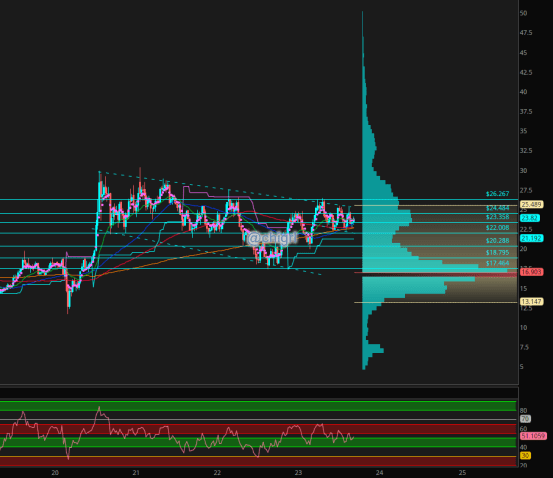

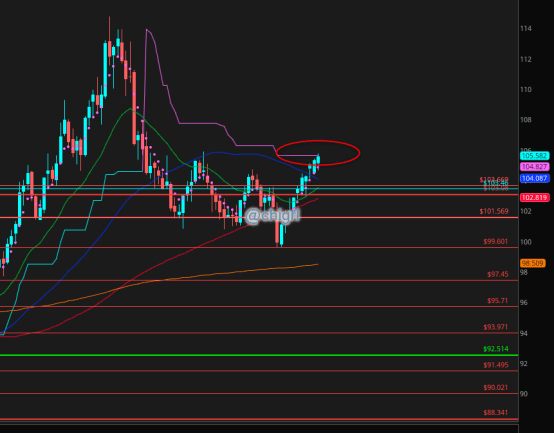

Crude Oil

Last week I noted: We could see a bit of a move higher perhaps early in the week, but I would like to see a bit of a pullback given the extreme over bought condition.

This is exactly how this scenario played out.

That said we have worked off a lot of bullishness over the past week.

Again, imho, I would be looking to long this, not short this (unless for a day trade). This is the exact same environment we saw in 2016, but with stronger fundamentals.

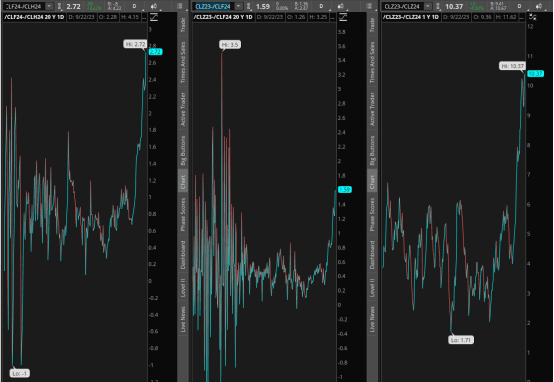

Calendar spreads are still ripping…going to be hard to short this market

Nat Gas

No change to my thoughts.

This market is still in consolidation, August 20th I noted: If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino. (I still like this play)

This could break either way, but I lean toward the upside. This market may not move much until we get closer to winter, meaning, I am not expecting much during September.

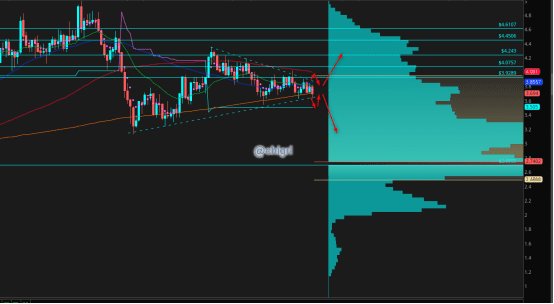

Copper

No change to my thoughts

Same view as last week :

We could see more consolidation in this triangle until we have a clear understanding of China markets/stimulus.

Technically to play this, one would wait for the break and retest to initiate a trade.

That said, I am partial to an upside break given the fundamentals of this market.

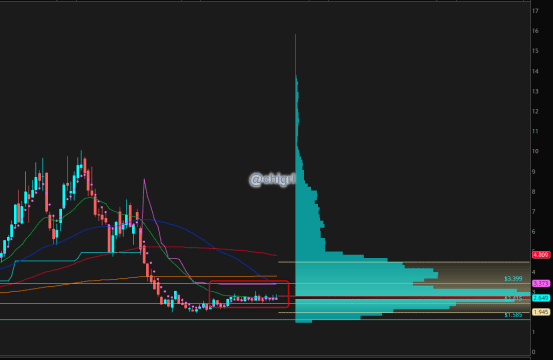

Silver

This market could continue to waffle in this bullish wedge (have said this for weeks now).

That said, I remain bullish this market not only for technical reasons, but fundamental reasons at well. Im my opinion, it is not *if* but when will this market break higher.

Last week I noted : Notable we did put in a weekly bullish candle last week

We did indeed have an upside week

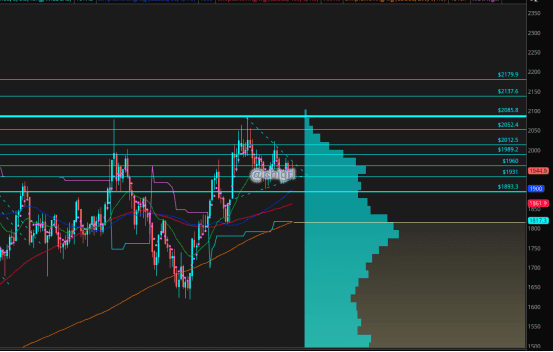

Gold

Last week I said:

Again I am kind of agnostic here on gold again this week, we are still in no mans land, but the fact that it is holding up so well is amazing.

That said, longer term, I think this moves higher out of this symmetrical triangle..but when is the question.

We may waffle in the inside for longer.

That is indeed what happened

Same view as last week

USD $DXY

Finally hit that weekly resistance. Next week will be interesting

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.

One Response

nice review, thanks! keep it up!