OPEC meeting is this Thursday 30 November (it was pushed back from the original 25/26th date)

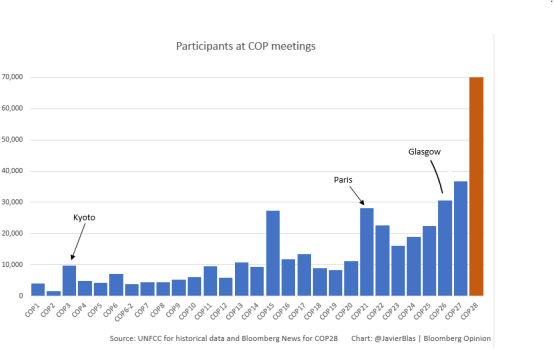

COP28 (UN Climate Change Conference) also begins this Thursday, 30 November in UAE and lasts for two weeks until 12 December…this could be the most contentious meeting yet, with a record of over 70K participants. Biden is not slated to attend at this point as his clean energy agenda faces mounting headwinds.

Shortened and quiet grind last week due to the US Thanksgiving holiday and lack of market participants

So lets us did into some data..and do a chartfest post

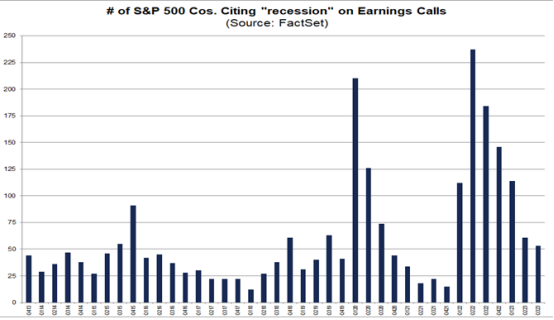

According to FactSet earnings tracker:

Seems most companies are all in the “soft landing” camp

The number of S&P 500 companies citing “recession” on earnings calls for Q3 2023 is below the 5-year average of 84 and below the 10-year average of 60.

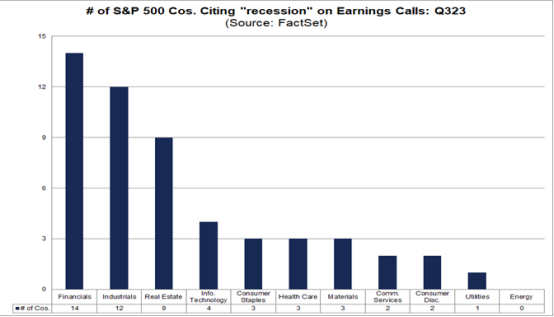

Let us break this down further

Number of S&P 500 companies citing “recession” on earnings calls Q323…broken down by sector

Notable: Zero in the energy sector

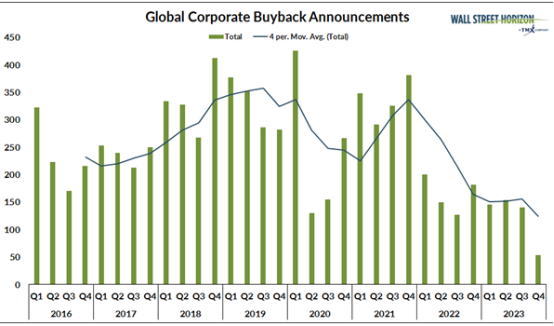

“For now, 2023 is set to mark the weakest year of global corporate buyback announcements since we began tracking this metric in 2016. Firms that executed share repurchases recently could prove to have been wise since we are closing in on two years since the S&P 500’s all-time high and many stock prices are depressed.” (source: Factset)

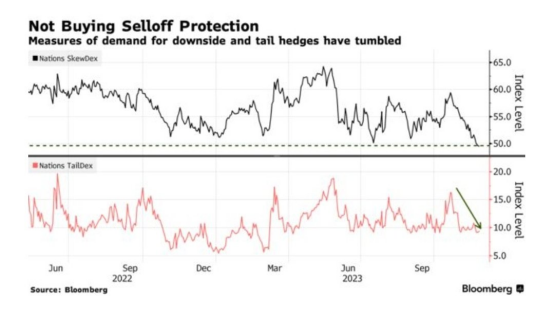

Hedging demand has fallen sharply with the cost to protect against a market selloff down by around 10%, or one-standard deviation, tumbling to the lowest ever in data starting in 2013. Demand for tail-risk hedges that pay out in an equity fall as precipitous as 30% has also dropped and is hovering around the lowest level since March.- Bloomberg

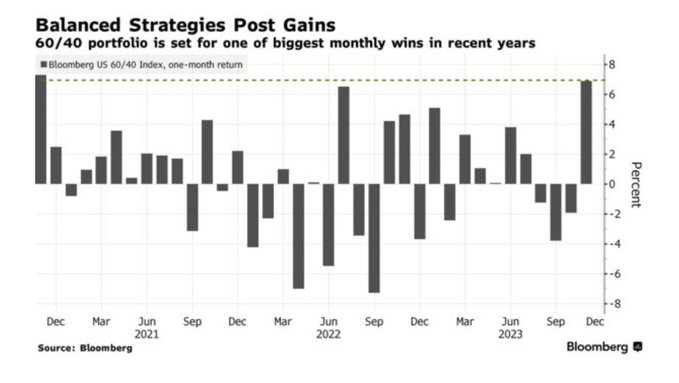

60/40 portfolio The Bloomberg 60/40 index has gained almost 7% this month and is set for one of the biggest monthly wins in recent years

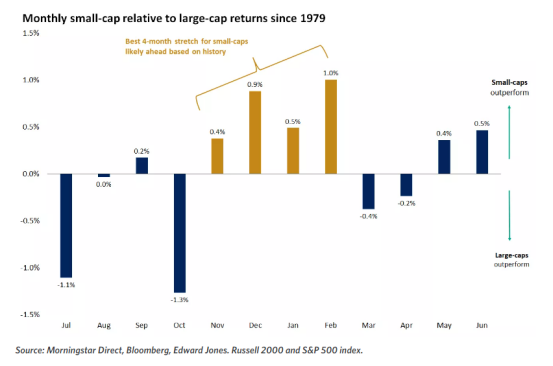

Small cap relative to large cap returns since 1979 Since 1979, the four-month stretch between November and February has been the strongest of the year, favoring small-cap over large-cap returns

Retail investors net bought +$4.8B of cash equities this past week…the highest weekly inflow recorded since April 2022.

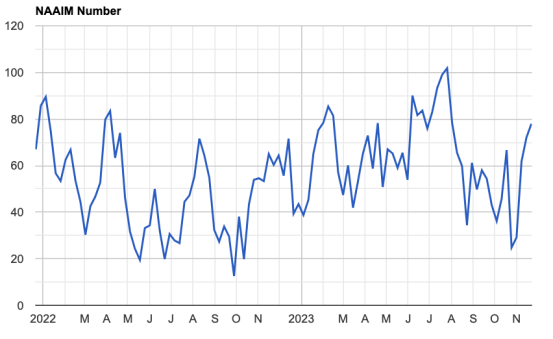

NAAIM ( The National Association of Active Investment Managers) Equity Exposure Index increased to 78 from 72 over the past week.

Via Morgan Stanley: Options data show that USD (DXY) positioning is short, while data from the futures market point to neutral USD positions

What does all this mean?

COMMENTS: It means that mean EVERYONE is literally counting on a soft landing and the boat is overloaded in one direction. Literally protection is cheaper than January of 2020 right now.

Buy protection when its cheap and not when you HAVE to (so the saying goes).

This is literally the EVERYTHING rally.

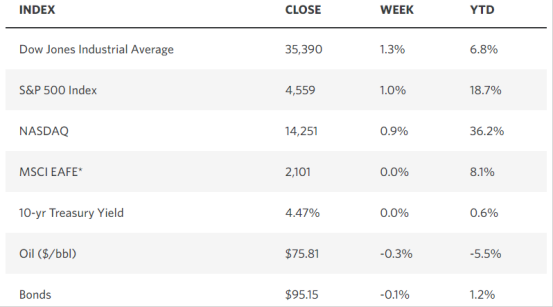

WEEKLY MARKET STATS

TECHNICALS

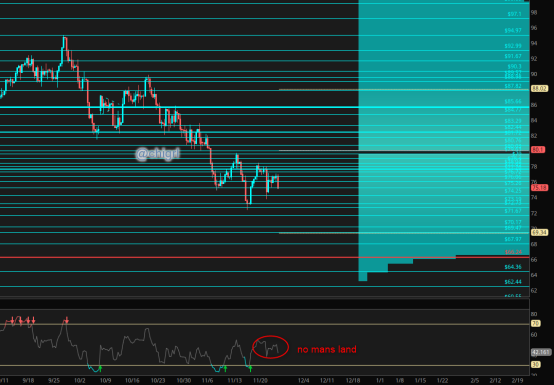

Crude Oil

We are back in no mans land after catching two nice moves.

OPEC meeting is this Thursday….it will be pivotal

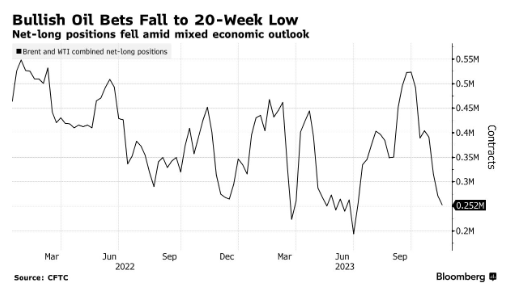

Here is what this market needs to be cognizant of

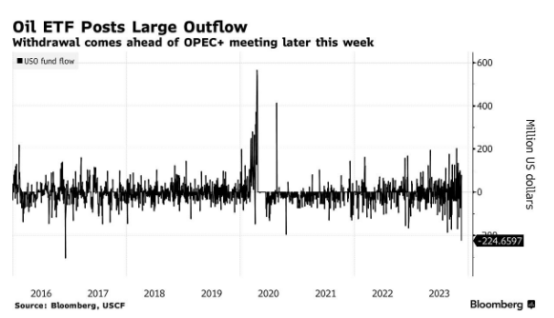

USO

As well, as I pointed out last week, in the futures market

Meanwhile we still have a persistent global distillate problem

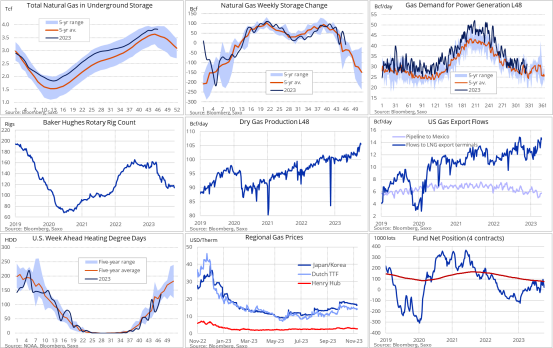

Nat Gas

We are still waffling

That said…via SAXO

US natgas prices received a small boost yesterday after the EIA reported a surprise weekly 7 bcf drop, still well above a 5-yr avg. decline of 53 bcf. Stocks totaled 3826 bcf, some 7% above the 5-yr avg. Rising demand towards heating has struggled to offset production, currently above 105 bcf/d, a y/y increase of 5.4%

I maintain my bullish long term view for US nat gas equities

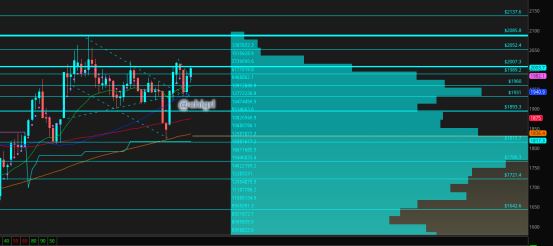

Gold

Defying all odds, this chart is looking bullish as ever, we have a double bullish pattern, that said we are butting up once again on a critical level

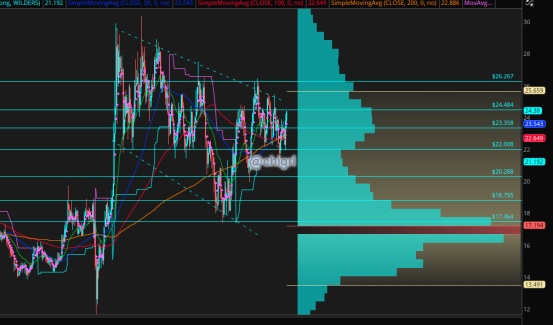

Silver

Last week I noted that Silver was the wild child but I remained bullish…this has not changed

I actually will be doing a presentation on silver this week for the Grizzle battery metal conference …follow my X stream for further details.

Copper

Weaker dollar and problems in Panama helping to boost copper again this week. Panama has completely shut down commercial mining this week.

We have a weekly breakout pattern

USD $DXY

All eyes on USD

Bearish pin bar?

Time will tell…all eyes on Yellen

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.