Short week last week. Most data came on Wednesday with crude inventories and FOMC minutes.

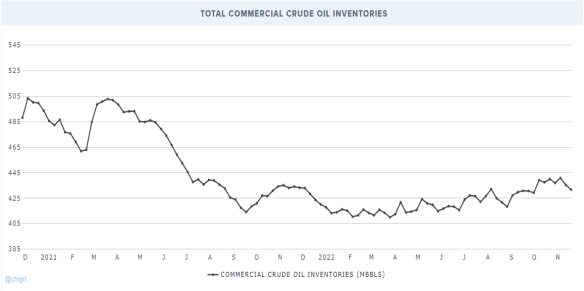

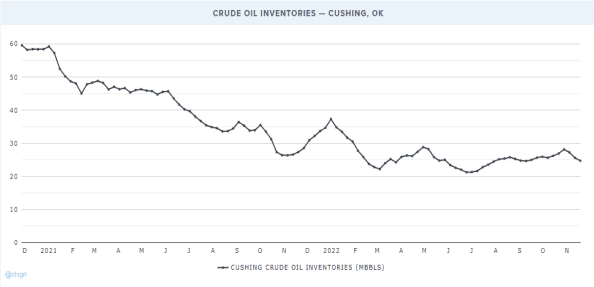

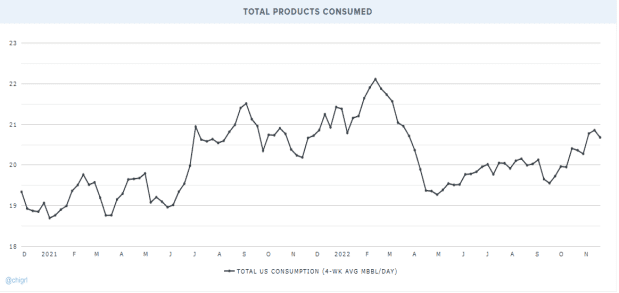

Crude inventories:

Crude: -3.691M

Cushing: -0.887M

Gasoline: 3.058M

Distillates: 1.718M

Great report this week!

Despite a great report, we saw weakness in crude Wednesday as the price cap on Russian oil has proven to be a non-sequitur. G7 nations are looking at a price cap on Russian oil at $65-70/bbl. Meanwhile, Urals crude delivered to northwest Europe is trading around $52, well below the price cap. That said, I have been stating forever, price caps are not enforceable, but the markets were looking for a stronger stance from the G7 and EU.

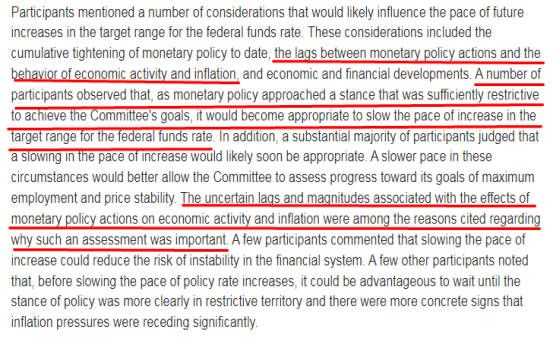

FOMC Minutes

Risk assets ripped higher as most officials backed slowing the pace of rate hikes soon. Participants agreed that there were a few signs of inflation pressures easing and that the possible effects of the Fed’s rate hikes are probably yet to be seen.

This is probably the most important paragraph that affected the markets.

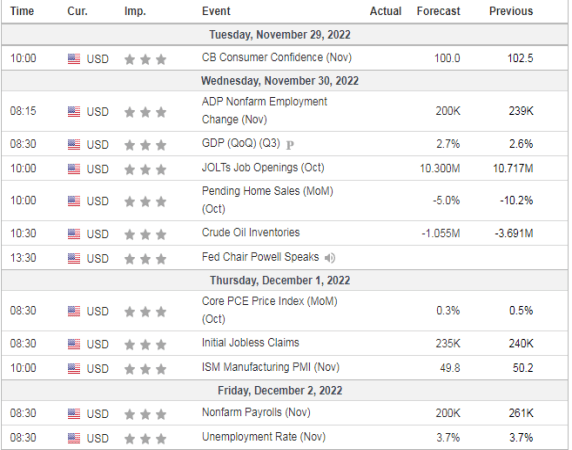

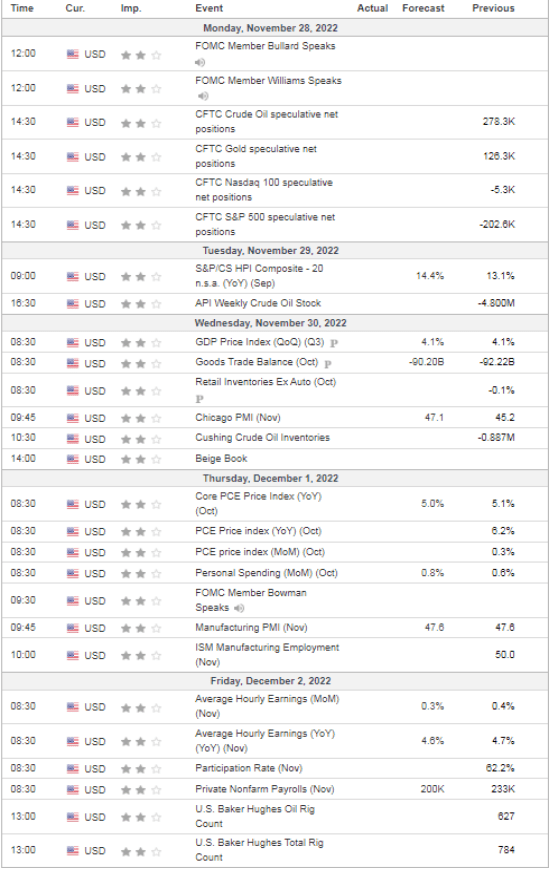

Looking forward to next week (11/28-12/2)

Lots of data this week!

Largest market movers:

Second-tier market movers:

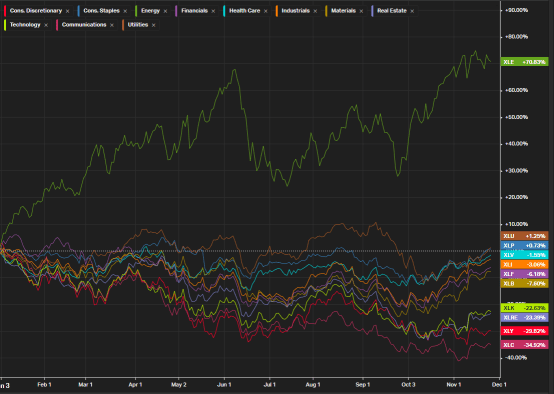

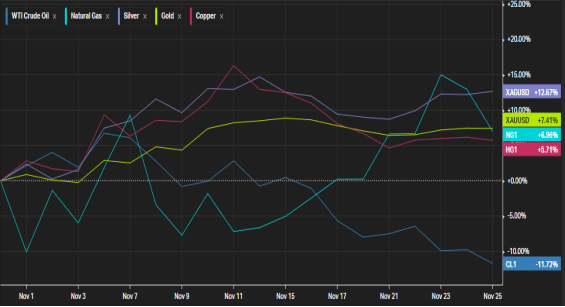

Charts of Interest:

YTD Sector Performance

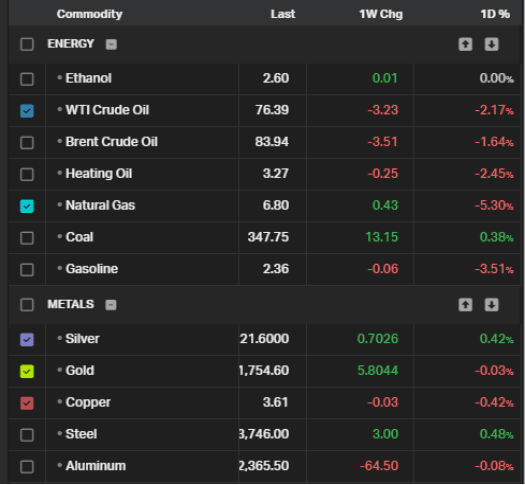

Month-to-date commodity performance

Commodities week performance

Looking ahead this week:

Metals: Keep an eye on USD

This will also be important for indices as the dollar of late has been the key driver for risk assets. I will be watching for a reaction at the 200 day.

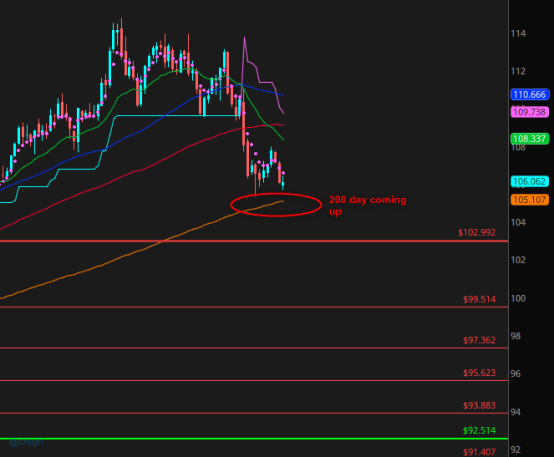

$DXY

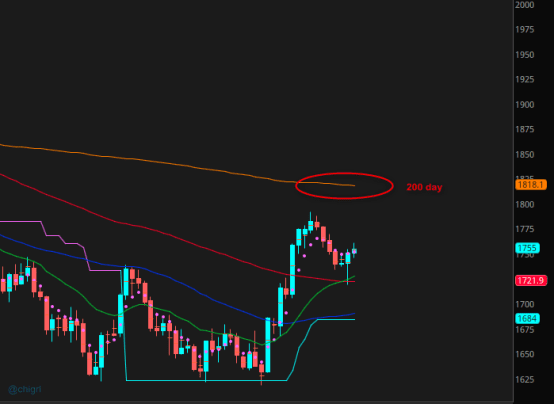

Gold: Gold is correlated to real rates (not inflation) If real rates come down (interest rate minus inflation expectation} then likely we see a further rise in gold prices. If real rates continue higher then likely we see gold resume down. A proxy for real rates is to use the US 5 YR and subtract the 5 YR break evens (US05Y-FRED:T5YIE)

So be watching USD and real rates this week for clues on direction.

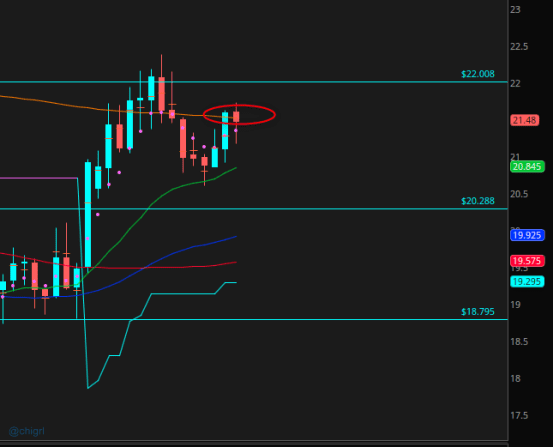

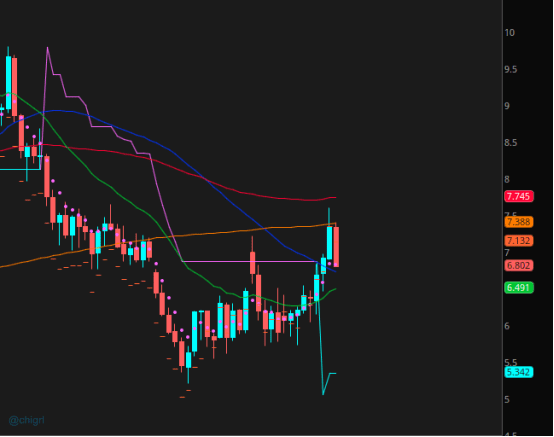

Silver: Also watch USD and rates. This chart is much more bullish than gold, but we are sitting right on the 200 day. A sustained move above could lead to a move much higher in this extremely volatile market.

Copper: Mass protests have broken out in many cities in China this weekend against the extreme zero-covid measure. These protests could make the base metal markets extremely jittery. If Xi decides to crack down further or if violence erupts between the government and the citizens, we could see further downside.

Levels to watch

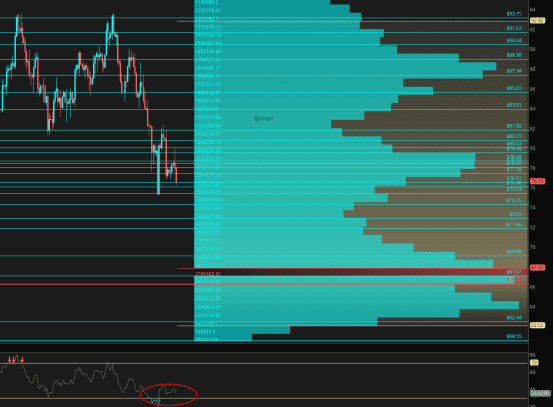

Crude Oil: Still no resolution on price caps this weekend. Protests in China. We could see some further downside, particularly on the market open tonight. That said we are getting very oversold. With OPEC meeting on December 4th, I suspect toward the end of the week we start hearing rumors of another cut in production, which likely will lead to a bounce in the market.

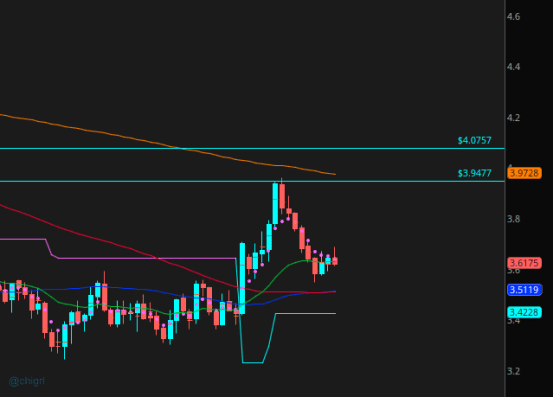

Natural Gas: We saw a nice bounce last week on reports of colder weather hitting the US and Europe (starting the week of December 5 and lasting for two weeks). In addition, Norway today, reported an unplanned outage of natural gas delivery to Europe of -15MCM/day from November 29th-December 3rd. 15% of the total consumption of natural gas in Continental Europe is distributed through Norway’s Gassco, we could see a gap up on the open tonight. I expect this market to be extremely volatile this week, with further upside in the following week or two depending on how fast EU storage is depleted. Stay nimble. Strangles are probably the best way to play this market.

Good luck and have a great week everyone!

2 Responses

Thanks!

I like what I saw going on with silver. Hoping my calls jump up early in the week. I’ll be playing CVX when it drips. Have a great week. This background needs to be darker so I can read what I type. 🙂

Thank you Tracy Big hug!