2023 is off to a strong start, helped by another gain last week. Stocks are up roughly 6% so far this year. Equities rose again last week, the third weekly gain in the last four, guided by a slew of corporate earnings announcements and fresh economic readings.

So what does this mean for the year ahead? Let us look at some statistics (*past performance does not guarantee future results)

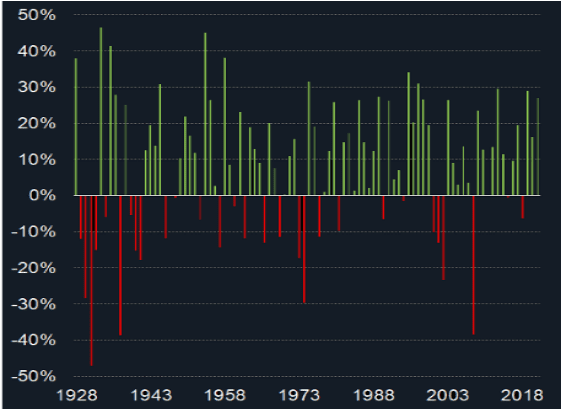

The S&P 500 declined 19.4% in 2022 (excluding dividends). Since 1928, there have been 9 previous calendar years in which the stock market fell more than 15%. US stock market has had just four multi-year losing streaks: 1929–1932, 1939–1941, 1973–1974, and 2000–2002.

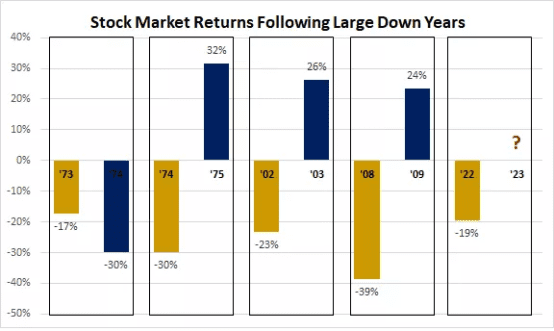

Another view From Edward Jones, but they started at 1958 as the S&P500 was established in 1957 and 1958 was the first draw-down year.

They also point out that

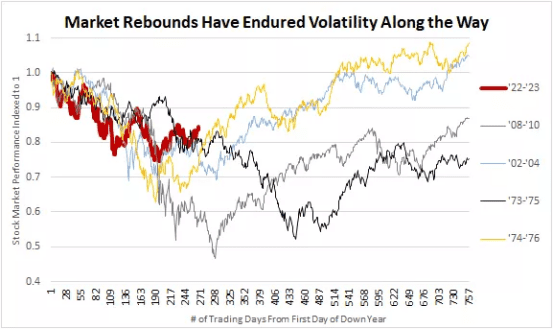

“While sizable down years have typically been followed by solid gains, the path higher has rarely been smooth.

After the declines in ’73, ’74, ’02 and ’08, the ensuing 12 months contained the following pullbacks:

1975: 14.1% and 6.6%

2003: 14.1% and 5.3%

2009: 27.6% and 7.1%*

All three of those years finished solidly in positive territory, but not without setbacks.”

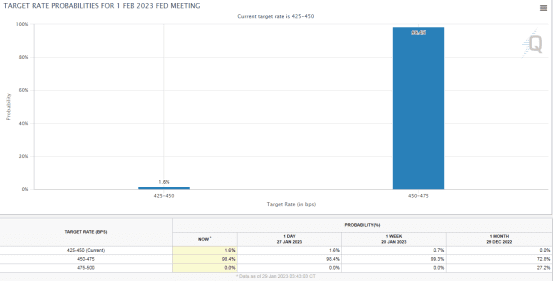

All eyes on FOMC this week.

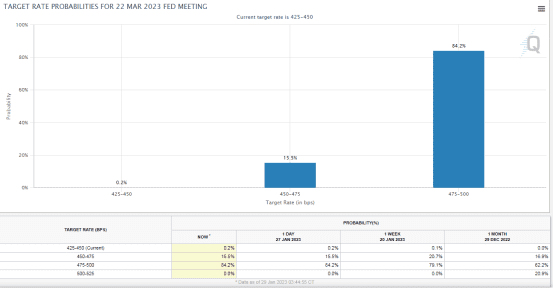

This meeting will set the tone for the rest of the year. Expected is a 25bps hike at 98.4% probability for Feb and another for 25 bps in March and then a pause. Everyone will be watching not just the press release, but more importantly the press conference afterward.

CME Group Fed Watch Tool -February

CME Group Fed Watch Tool -March

See what happens when we get to May? A pause

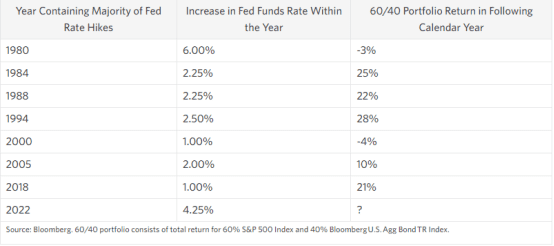

Market performance in the year following Fed hiking cycles.

What is consistent here is that following sharp rate hikes, the Fed tends to be more accommodative. Will this year be the same? Time will tell. Markets will like it if it is.

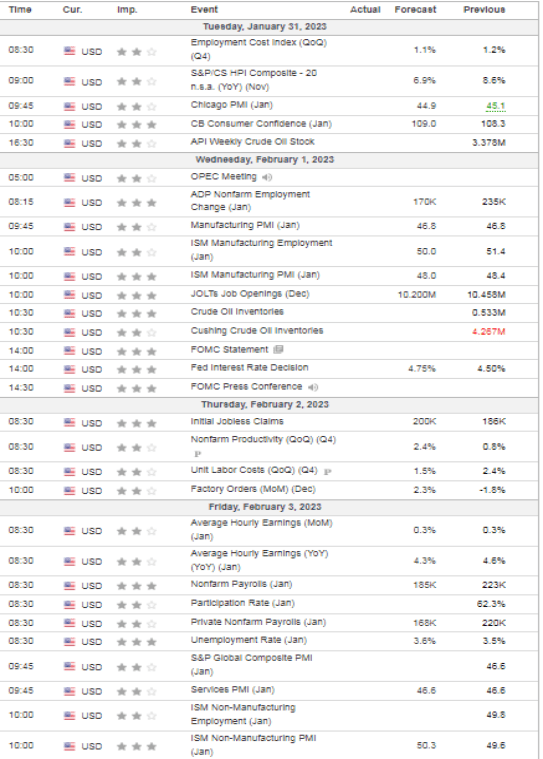

MARKET MOVERS THIS WEEK

Big Data Week-FOMC

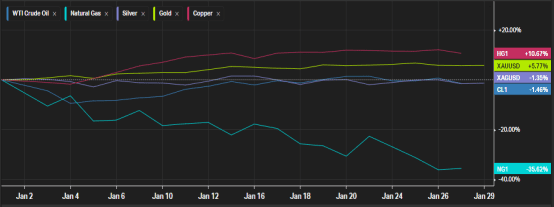

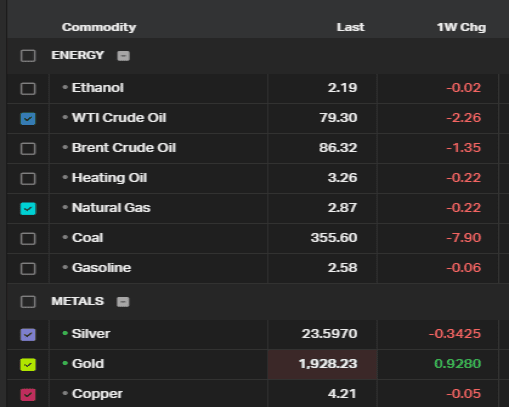

COMMODITIES PERFORMANCE

Month to Date Commodities Performance

Week to Date Commodities Performance

LOOKING AHEAD TO THIS WEEK-TECHNICALS

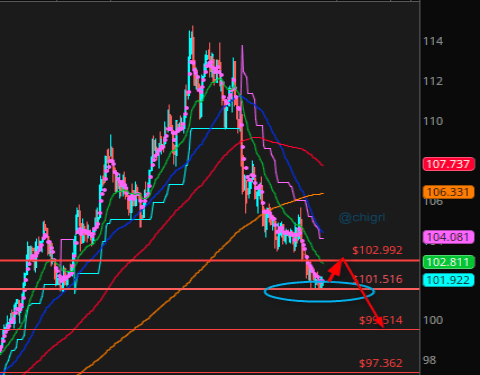

$DXY

We hit a big level this week, we could see a bounce before resuming a downtrend (Fed dependent)

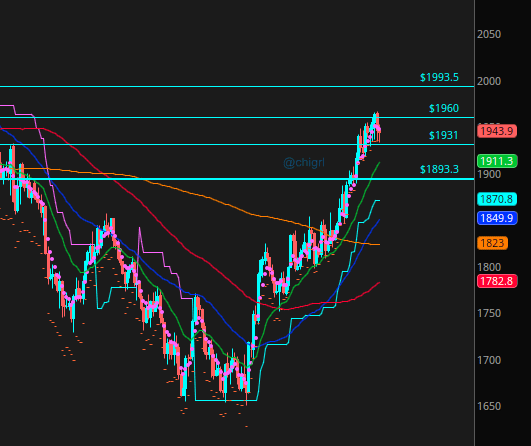

Gold

Last week I said to watch $1960…that is exactly where we paused.

Chart is still bullish, but I expect this market sideways to down in front of the Fed decision.

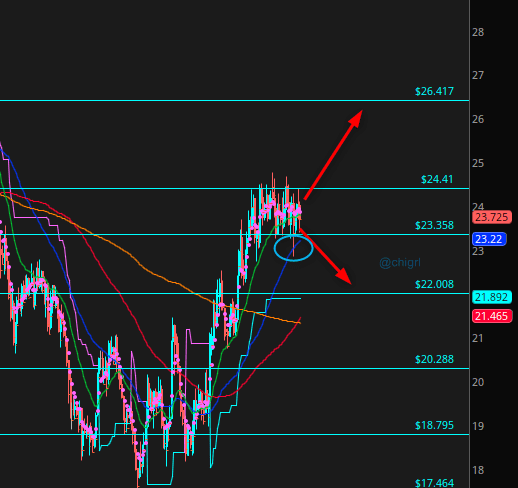

Silver

Last week I noted that we were in two weeks of consolidation and silver was poised for a big move …a move we got at the beginning of the week, but by the end of the week, we ended up back in the consolidation area. This market is still wound tight. Bigger moves coming.

Copper

Last week I urged caution on this market as it was the Chinese New Year Holiday and we could see consolidation, so far that is true. Same caution this week as the holiday continues, although the market is still constructively bullish.

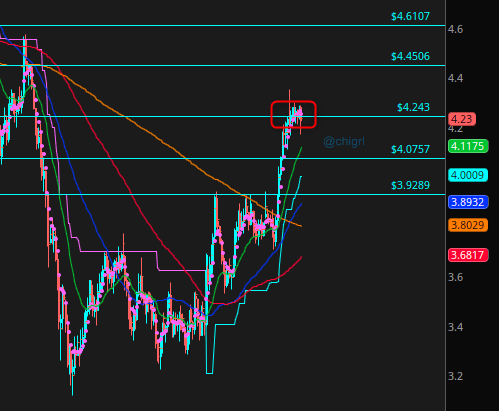

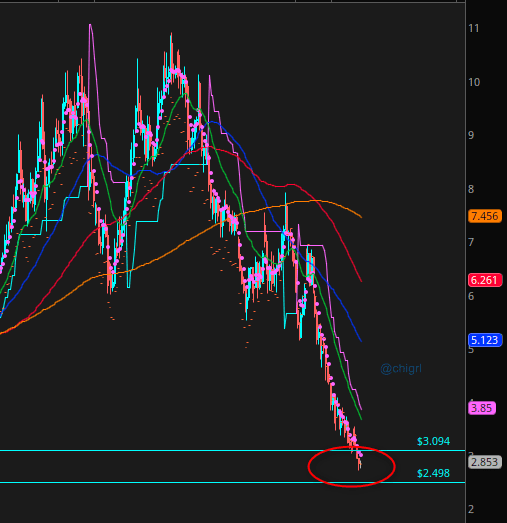

Natural Gas

Last week I said “We are at a big level for this market. We could see a bounce here soon, otherwise, we will see consolidation in the ~3.00 ~2.50 area”

We are now in that zone. I do not expect much change to this market this week… a sideways consolidation in 3-2.50 area as Freeport likely will not be fully operational until March now.

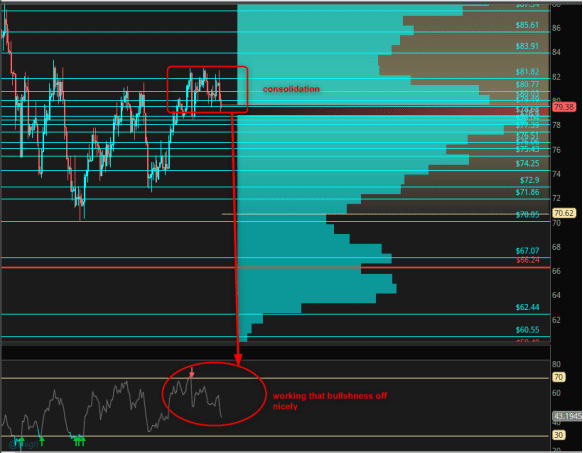

Crude Oil

Geopolitical risk this week with events in Iran. Many explosions across the country, including some near refineries. There was no oil production affected, that said, markets may gap up on geopolitical risk, especially after IRGC headquarters were bombed tonight. Be careful with shorts this week.

Opposite of last week with gasoline cracks unwinding that limited the upside.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.

One Response

Great stuff. Glad to see that you’re putting concise market thoughts out there.

I hope that you’ll take a look at the coal stocks, sometime $BTU is very cheap and reports the first week of February.