Last week was all about the labor market

JOLTS

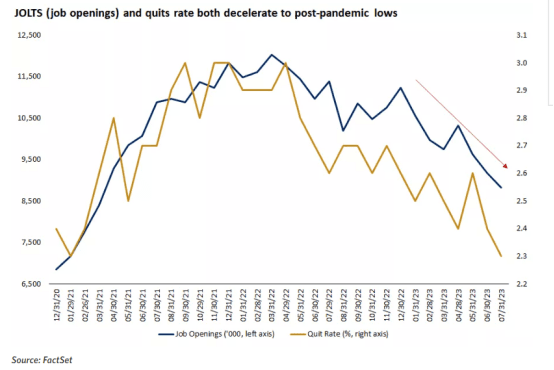

1. Job openings and quits rate are falling.

Two key leading indicators of the labor market — job openings and the quits rate — are showing signs of rolling over. This past week, the JOLTS (Job Openings and Labor Turnover Survey) data for July fell to about 8.8 million, below the expected 9.5 million and June’s 9.2 million reading. This would be the lowest reading since March 2021.

Fewer job openings and fewer workers quitting jobs generally imply lower confidence in the labor market. Typically, if workers aren’t confident they can find new jobs, they are less inclined to quit their current jobs. More broadly, a key driver of household consumption is a solid labor market and confidence in employment. If the job market is softening, this may lead to lower consumption patterns over time as well. -Edward Jones

ADP

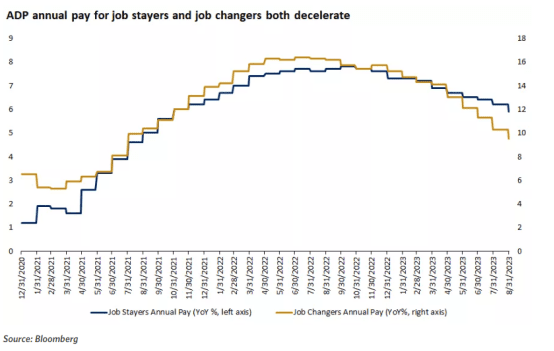

2. ADP private payrolls are cooling alongside pay gains.

The ADP private payroll data for August also came in below expectations. Total job gains were 177,000, below an expected 194,000 and well below July’s 324,000 reading. According to ADP: “This month’s numbers are consistent with the pace of job creation before the pandemic. After two years of exceptional gains tied to the recovery, we’re moving toward more sustainable growth in pay and employment as the economic effects of the pandemic recede.”**

Notably, the ADP report also highlighted softer wage growth. Job stayers saw a 5.9% year-over-year pay increase, the slowest growth since October 2021. For job changers, pay growth decelerated to 9.5%, the lowest since July 2021.

Wage growth is a key component of services inflation and a metric the Fed is watching carefully. Signs of easing wage gains support moderating inflation, particularly core inflation, and could support the Fed’s case to continue pausing rate hikes, as well. -Edward Jones

NFP

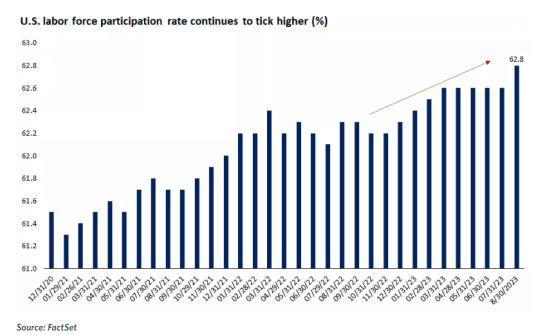

3. Unemployment ticks higher as labor force participation picks up.

Per the BLS:

Total nonfarm payroll employment increased by 187,000 in August, and the unemployment rate rose to 3.8 percent

Employment continued to trend up in health care, leisure and hospitality, social assistance, and construction. Employment in

transportation and warehousing declined.

The unemployment rate rose by 0.3 percentage point to 3.8 percent in August, and the number of unemployed persons increased by 514,000 to 6.4 million. Both measures are little different from

a year earlier, when the unemployment rate was 3.7 percent and the number of unemployed persons was 6.0 million.

Among the unemployed, the number of job losers and persons who completed temporary jobs increased by 294,000 to 2.9 million in August, offsetting a decrease of 280,000 in July. In August, the

number of new entrants edged up to 597,000.

Both the number of persons unemployed less than 5 weeks, at 2.2 million, and the number of long- term unemployed (those jobless for 27 weeks or more), at 1.3 million, edged up in August. The

long-term unemployed accounted for 20.3 percent of all unemployed persons.

In August, the labor force participation rate rose by 0.2 percentage point to 62.8 percent, after being flat since March. The employment-population ratio was unchanged over the month at 60.4 percent.

COMMENTARY: There are two VERY important things to note in the non-farm payroll report that no one is really talking about.

Revisions: The change in total nonfarm payroll employment for June was revised down by 80,000, from +185,000

to +105,000, and the change for July was revised down by 30,000, from +187,000 to +157,000, totaling 110,000 jobs.

This is the ninth consecutive downward revision. I would not get too excited that Friday’s numbers were a beat, I expect this to get a downward revision as well. These revision were also why the unemployment number ticked higher to 3.8% from 3.5%.

Temporary Jobs: Temporary jobs increased by 294,000 to 2.9 million in August.

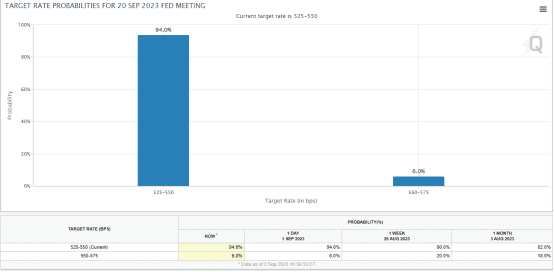

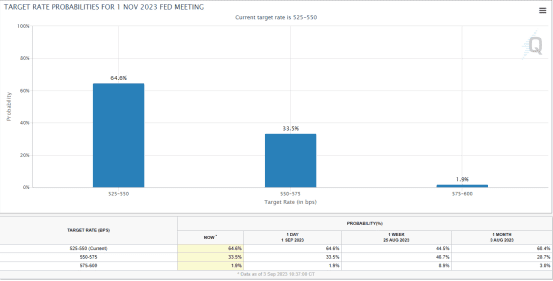

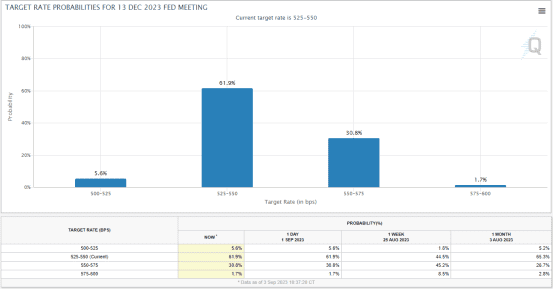

Overall, these three reports are showing softness in the labor markets – one of the main drivers for Fed rate hikes. As a result, markets are factoring in the fact that there will likely be no more rate hikes this year, with a VERY slight possibility of a cut in December (do not count on that however imho)

CRUDE OIL

I have to mention this market as it was up 7% this week.

Let’s take a look at the market fundamentals (technicals will be discussed in the technical section)

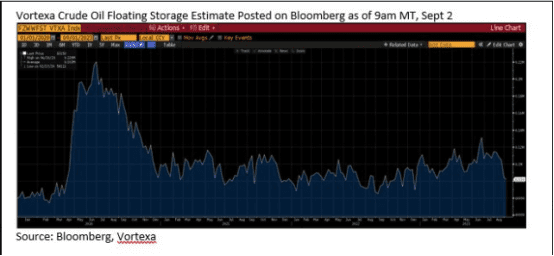

Vortexa Floating Storage

As of the week to 09/01 floating storage is down a whopping -48.88M barrels

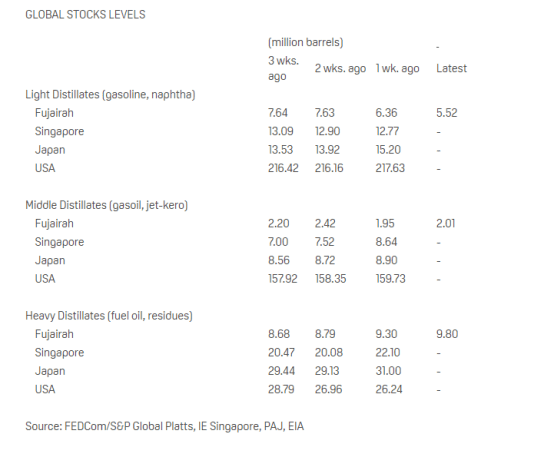

Fujairah Data (product stocks)

As of Monday, August 28, total oil product stocks in Fujairah were reported at 17.322 million barrels with a drop of 279,000 barrels or 1.6% week-on-week. The stocks movement saw a drop for light distillates, while middle distillates and heavy residues both posted builds.

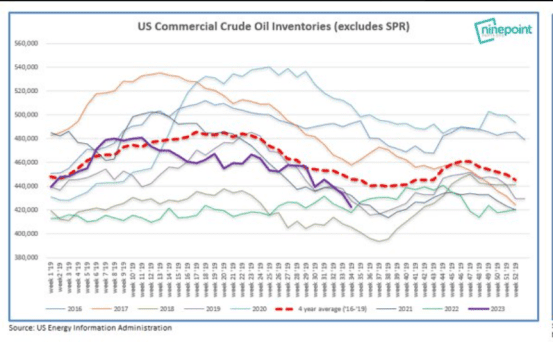

US inventories including SPR

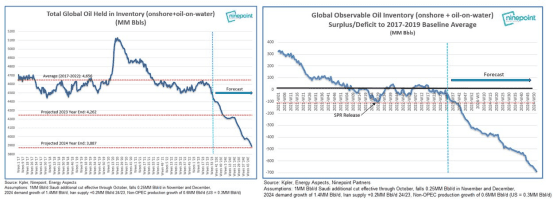

Global Inventories

COMMENTARY: I do not think this needs much explanation.

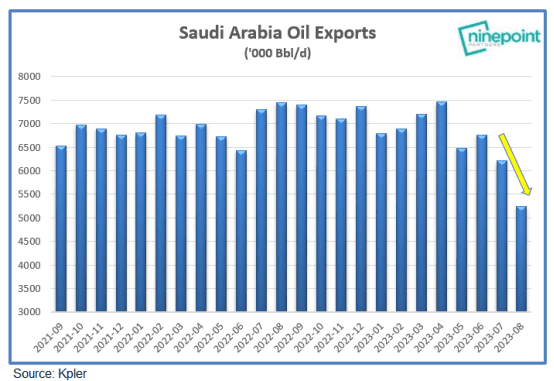

Saudis are keeping to their word and a decision this week will be made on whether or not they are going to continue the 1M bpd cut for October, that was already extended to September.

In addition, this week Russia announced possible cuts this week.

Per Bloomberg:

Russia Agrees on Further OPEC+ Oil-Export Cuts, Novak Says

Russia has agreed with its OPEC+ partners on further cuts to its crude exports, Deputy Prime Minister Alexander Novak told President Vladimir Putin.

“We have agreed, but we’ll announce main parameters next week,” Novak said at a televised government meeting with Putin.

Russia has pledged to curb its crude exports by 500,000 barrels a day in August, then taper the curbs to 300,000 barrels a day next month. On Wednesday, Novak said that Russia was discussing extending the September export reduction into October, according to media reports.

Pay close attention this week for these announcements.

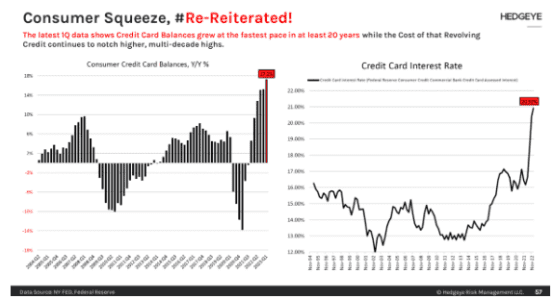

CONSUMER CREDIT

Something to watch right now

Via HedgeEye

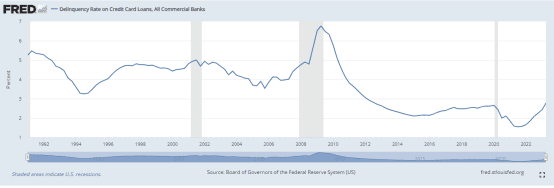

“The interest rate on a credit card is above 20%. Going back to the 1990s, the peak was 16%, not 21-23%. U.S. consumers are tapped out,” McCullough says.

For the first time in over a decade, people didn’t pay off credit card debt going from 4Q 2022 to 1Q 2023.

Things didn’t get any better in 2Q. 30+ day delinquency rates for Capital One, Synchrony and Discover all increased from June 2022 to May 2023.

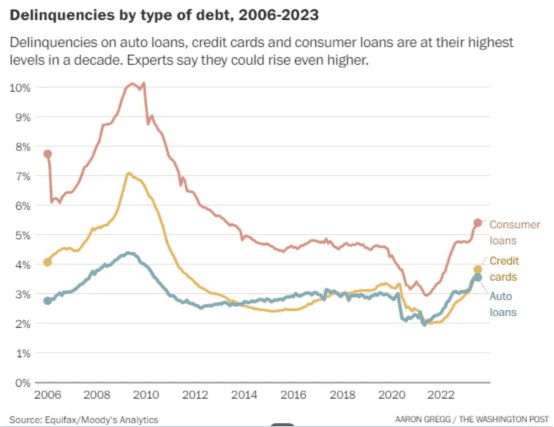

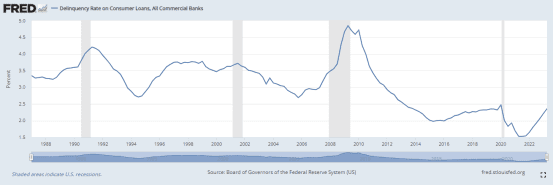

Delinquency rates are upticking on credit cars, auto loans, and consumer loans

COMMENTARY: These delinquencies are coming from a very low base, but it is the rate of change that is concerning.

Delinquency rates credit cards

Delinquency rates all consumer loans

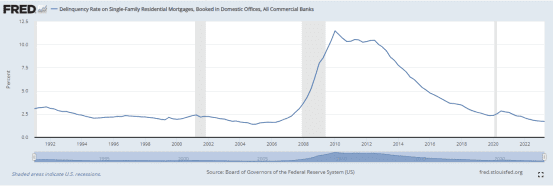

The good news is, we are not seeing this on single family home mortgages …yet anyway

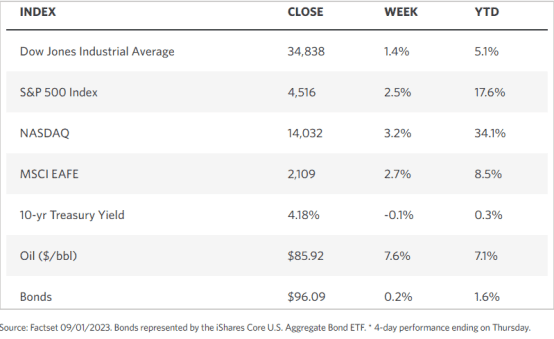

MARKET STATS THIS WEEK

TECHNICALS

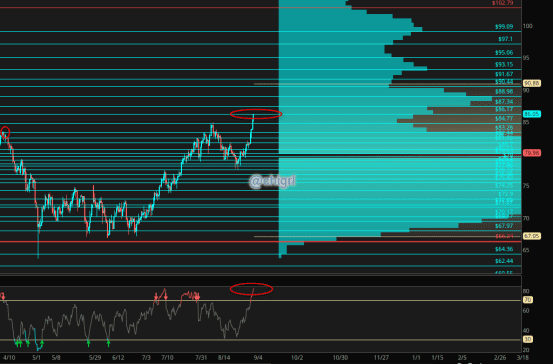

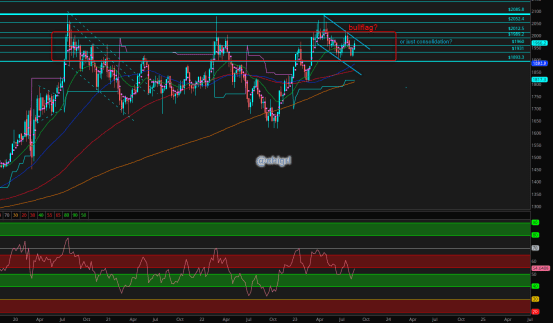

Crude Oil

This chart remains bullish, as we broke the last longer term swing high from April.

That said we are WELL OVERBOUGHT

I would not be surprised to see a pullback this week, which would be healthy for this market. Parabolic markets always end terribly.

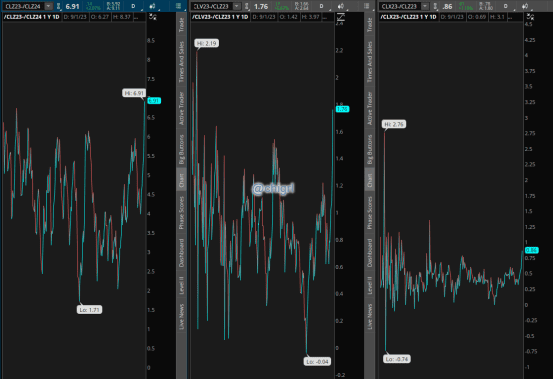

Also note that the calendar spreads are blowing out again (long and near term)…this means that backwardation is steepening which is bullish.

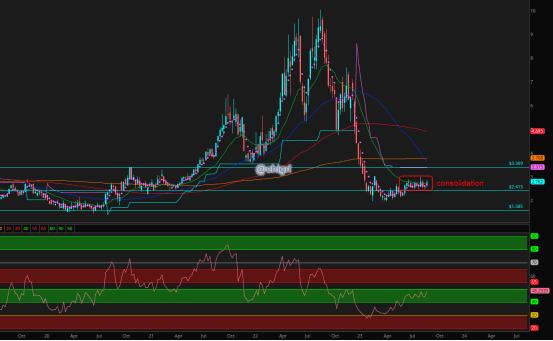

Natural Gas

This market is still in consolidation, August 20th I noted: If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino. (I still like this play)

This could break either way, but I lean toward the upside. This market may not move much until we get closer to winter, meaning, I am not expecting much during September.

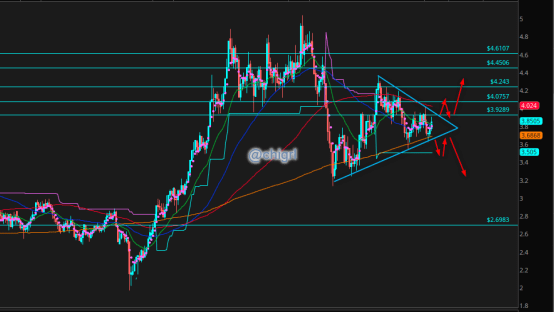

Copper

We could see more consolidation in this triangle until we have a clear understanding of China markets/stimulus.

Technically to play this, one would wait for the break and retest to initiate a trade.

That said, I am partial to an upside break given the fundamentals of this market.

Gold

Again I am kind of agnostic here on gold again this week, we are still in no mans land.

There are a couple ways to look at this.

That said, longer term, I think this moves higher..but when is the question.

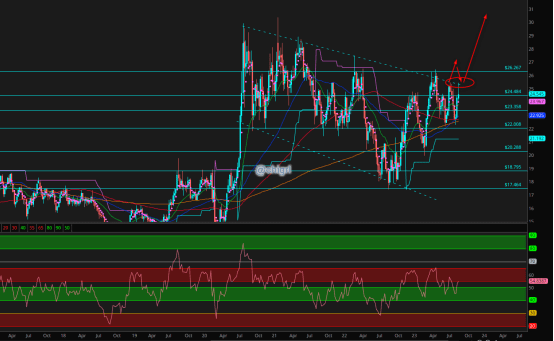

Silver

This market could continue to waffle in this bullish wedge, but it has remained at the top end. I remain bullish this market not only for technical reasons, but fundamental reasons at well. In my opinion, it is not *if* but when will this market break higher.

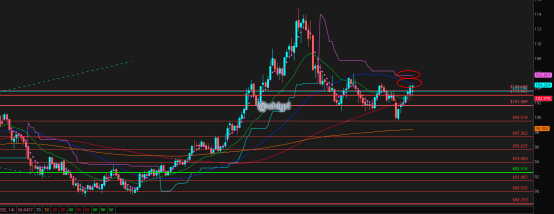

USD $DXY

USD still has yet to break higher over the 50 day…Yellen has to be careful here.

That said it should be noted that energy and metals did well last week despite a stronger dollar. This is why I always say, it is never a 1:1 correlation, ESPECIALLY when it comes supply/demand issues.

Levels to watch above are noted, but I am not sure we get there.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material.

We recommend that you consult with a licensed and qualified

professional before making any investment or trading decision