Key developments last week

OPEC + MEETING

OPEC + met today and decided to keep policy unchanged from the October meeting, delegates (all countries voted with no objections voiced).

This was pretty much an expected decision, so it should not surprise the markets. There are simply too many mitigating factors right now to cut anymore at this juncture due to the fact that price caps and EU oil embargo go into effect tomorrow (how many Russian barrels will be taken off the market due to these policies is still a question and currently Russia is threatening to slow production if necessary to keep oil prices elevated). In addition, China’s demand is a huge factor, and they are softening their zero-covid policy language. In addition, OPEC+ stressed today that they will be “proactive and preemptive” to address market developments, given the range of factors beyond their current control. No messing around.

POWELL BROOKINGS INSTITUTE SPEECH 30 NOVEMBER 2022

A huge change in Powell’s language in this speech. He was almost dovish.

“We think slowing down at this point is a good way to manage risk” – Powell

If you missed it the replay is HERE

We saw a 150-point move to the upside in the S&P 500 that day.

Michael Gayed tweeted: “A month ago, Powell was ultra-hawkish. Literally a month ago. Then he comes out and talks about slowing rate hikes. The only difference between then and now is FTX. Is that what spooked him? Does he know there’s some fallout that’s coming? The tone change makes no sense.”

I would argue that perhaps it was not FTX or solely FTX, but Blackstone real estate problems (remember Blackstone executes for the Fed):

Blackstone’s $69 Billion Real Estate Fund Hits Redemption Limit

Blackstone Real Estate Income Trust Inc. has been facing withdrawal requests exceeding its quarterly limit, a major test for one of the private equity firm’s most ambitious efforts to reach individual investors. -BBG

On better-than-expected unemployment data on Friday, we did see the market spooked a bit but basically recovered all losses by EOD. Leaving me to think the Fed this month will be more important than any data going forward.

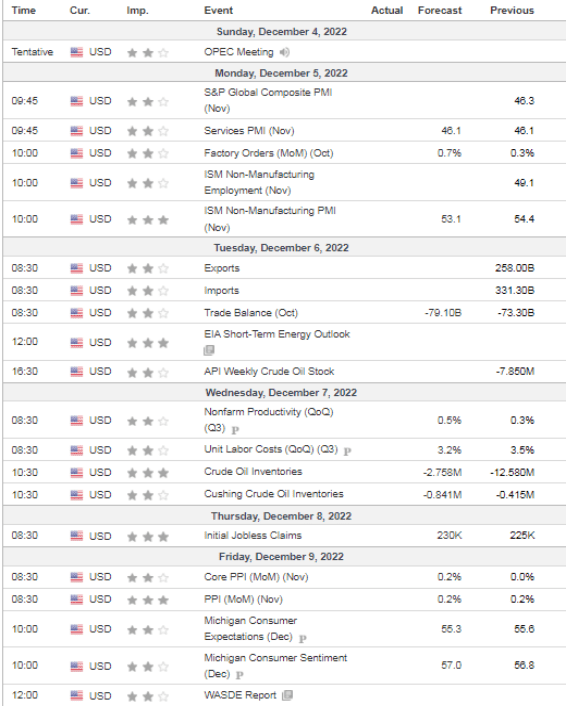

Looking forward to next week (12/5-12/9)

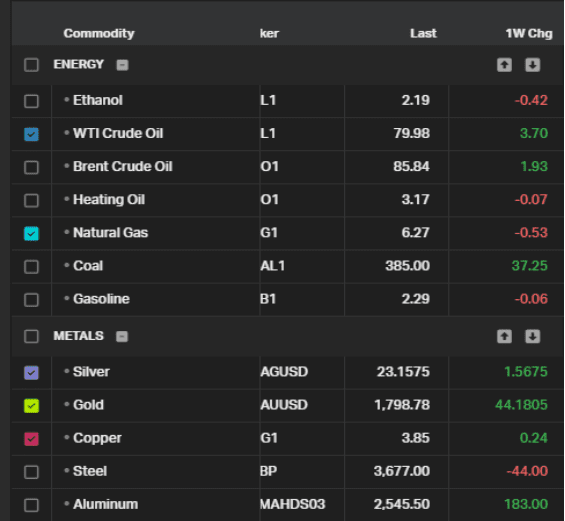

Commodities week performance:

Looking ahead this week:

Metals: Keep an eye on USD (yes again)

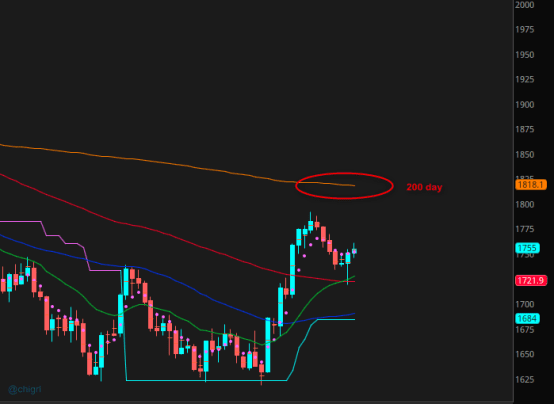

$DXY USD

We slipped below the 200-day (gold), retested, and continued down…not great for the bulls right now. Levels to watch below.

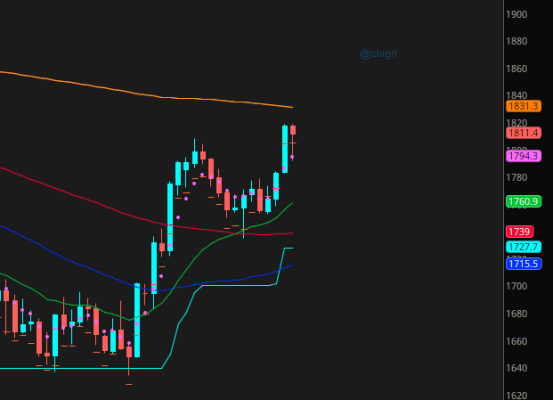

Gold:: Gold is correlated to real rates (not inflation) If real rates come down (interest rate minus inflation expectation} then likely we see a further rise in gold prices. If real rates continue higher then likely we see gold resume down. A proxy for real rates is to use the US 5 YR and subtract the 5 YR break evens (US05Y-FRED:T5YIE)

So be watching USD and real rates this week for clues on the direction. (same as last week but worth repeating)

We nailed that 200-day to the tick this week (chart from last week)

This has since moved higher and we are a bit overbought…we could see some consolidation before a move higher especially on a week with very little data to move this market.

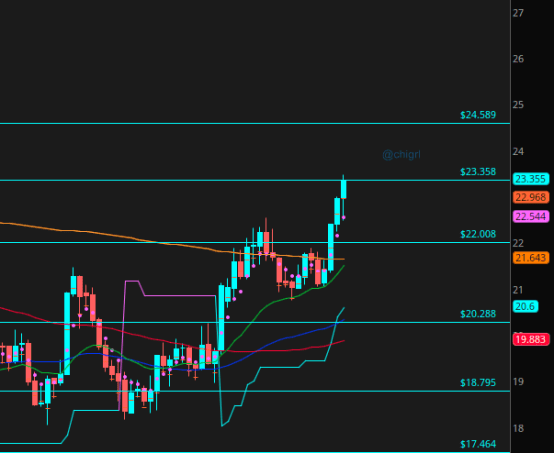

Silver: This chart is still VERY bullish. We moved above the 200 day last week. Again, we are a bit overbought as well, but silver tends to run when on a run. Levels to watch above. Silver also really likes this China zero-covid policy stance softening, as it is also used for many industrial purposes, particularly in wind turbines and solar panels which China is the biggest producer.

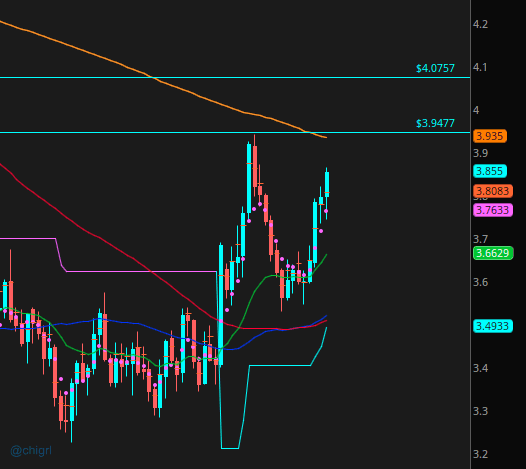

Copper: Base metals are also loving the China zero-covid policy reopening theme. 200 day above. That said, I do not think we see a real policy stance in china until after the Chinese new year, likely in Q2 of 2023. I think base and industrial metals will be a huge story H2 of 2023 into 2024.

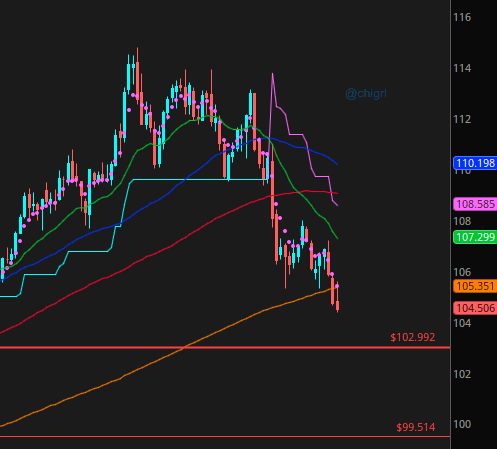

Crude oil: Crude oil is still stuck in a rut. The physical market is tight but a lot of investor sentiment has turned sour on global recession fears and the fact that it really has not moved much over the last few months (relatively speaking). We can see this in CFTC COT open interest. Longs have been bailing, but the short-side positioning has not really moved. This indicates that there is a general malaise about this market right now. Great way to just trade the intraday ranges with event contracts. I expect a sideways market.

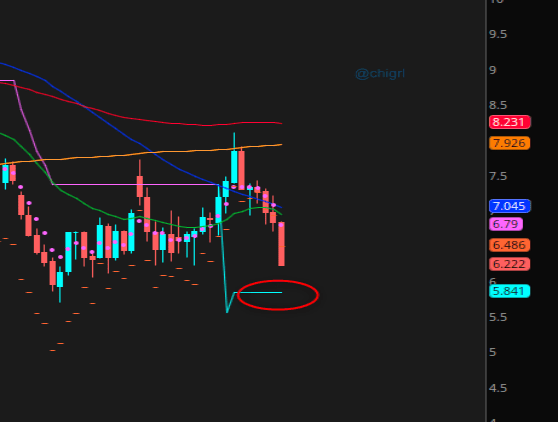

Natural Gas: We saw a nice bounce the week prior to last on reports of colder weather hitting the US and Europe, but so far that has not come to fruition, particularly in Europe. This week watch 5.841 for support. If that does not hold, we could see further downside.

Good luck and have a great week everyone!!!

3 Responses

Thanks

test

tets