The BIG NEWS last week was the US debt downgrade from Fitch…what does this really mean?

Via Edward Jones:

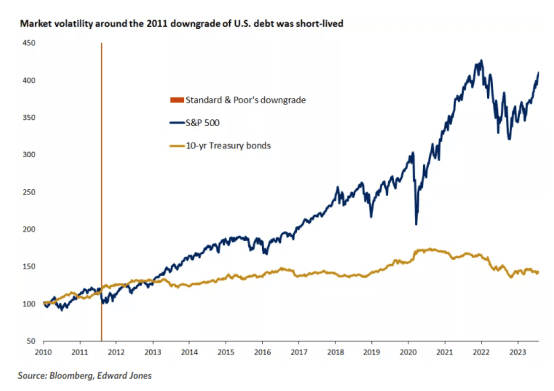

August started with a bang, as the market’s summer calm was disrupted by news that Fitch, one of the “Big Three” credit agencies, downgraded the U.S. debt rating from AAA to AA+. This is the second credit downgrade in U.S. history after a similar decision by Standard & Poor’s in August of 2011. U.S. political brinkmanship and debt concerns are not new, but the Fitch downgrade shines the spotlight on the worsening fiscal outlook.

Stocks experienced their first 1% down day since May, and the 10-year Treasury yield rose to a fresh high for the year, flirting with last year’s cycle peak of 4.25%

When the U.S. lost its AAA rating from Standard & Poor’s more than a decade ago, a decision that has not yet reversed, it triggered a 4.8% decline in the S&P 500 the day of the announcement on August 4 and another 6.5% decline on August 81. Stocks remained volatile over the following two months. But counterintuitively, investors gravitated toward government bonds and the U.S. dollar as safe havens against the uncertain backdrop.

Last week’s stock-market reaction to the Fitch downgrade was more muted, which we think is justified. Besides investors having now gone through a similar event for which there was no precedent in 2011, there are some stark differences in the economic landscape. Heading into another standoff over the debt limit and S&P’s downgrade in 2011, investor sentiment was fragile, with the memories of the Global Financial Crisis (GFC) fresh, economic growth anemic, unemployment elevated at 9%, and credit spreads wide. In contrast today, the economy has been growing at an above-trend pace over the past four quarters, the unemployment rate at 3.5% is near historic lows, and credit spreads are narrow.

Not a shift on how U.S. debt should be viewed, but likely an excuse for markets to take a breather

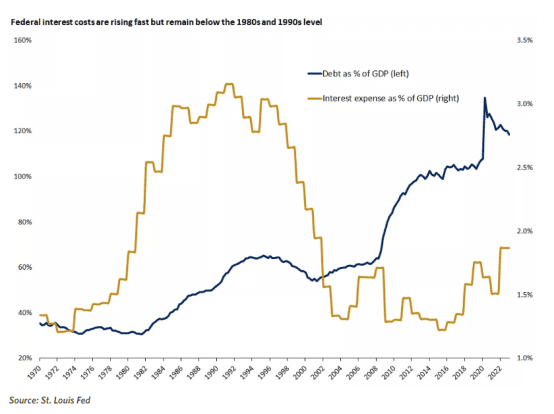

As reasons for the downgrade, Fitch cited fiscal deterioration, a high and growing government debt burden, and eroded fiscal confidence stemming from repeated debt-limit standoffs. Few would argue that these are not real concerns. For perspective, since 2008, the U.S. debt-to-GDP ratio has jumped from 60% to a high of 130% in 2020 following the pandemic stimulus, before subsiding modestly to 118% this year1. After this year’s aggressive Fed rate hikes to tame inflation, interest costs are rising fast and becoming a larger burden to the budget. Though at around 2% currently, interest payments on federal debt as a percent of U.S. GDP are well below those observed in the 1980s and 1990s2.

No doubt an ever-increasing federal debt, especially during times of economic expansion, is concerning and will likely have to be dealt with at some point in the future via a combination of tax hikes and spending cuts. But U.S. Treasuries remain the world’s premier safe asset. That is not because of the U.S. debt’s credit rating, but because of the Treasury market’s enormous liquidity and market depth, allowing international investors to store money and invest in the government debt of the largest economy, whose currency is the world’s reserve. For now, there is no other asset class to act as a realistic alternative.

COMMENTARY: I completely agree with this assessment. *For now, there is no other asset class to act as a realistic alternative* is the key phrase here, this can be applied to USD as well despite dedollarization narratives.

INTEREST RATES ARE CLIMBING

Yes they are, but lets look at this comparatively.

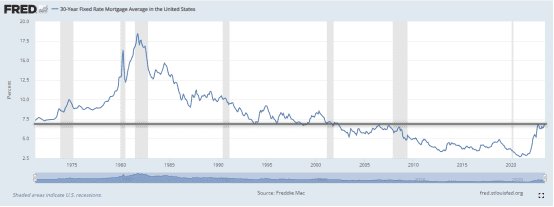

This goes for mortgage rates as well.

According to Bankrate.com‘s data, the 30-Year fixed-rate mortgage reached 7.39% on Thursday, the highest rate since November 2000, but slightly dropped to 7.38% on Friday.

30 year fixed mortgage rates are at their historical norm since 1971

I am not trying to diminish this as the rate of change has been unprecedented …but keep this all in perspective.

TREASURY YIELD BET

Bill Ackman made a bold statement this past week saying he was shorting US Treasuries, specifically the long end (30yr)

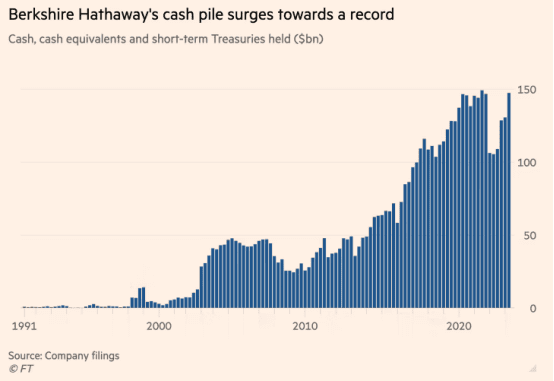

The media (and others) were trying to somehow correlate this to Warren Buffett’s bet on UST, but Buffett is buying short dated 3 and 6 month UST …no idea how people made this a contest…it is an entirely different bet (never underestimate the media’s pension for click bait material I suppose). Let’s look at both trades

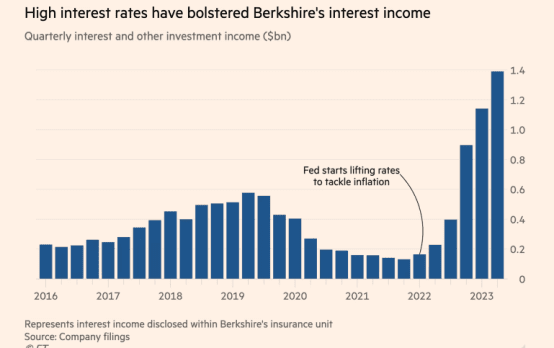

Buffett have a $147B in part due to his position in short term treasuries that are providing a healthy yield.

Bill Ackman just announced his short bet on the long end of UST (I am under no delusions that he probably has had or has been putting on this bet for awhile before the announcement)

That said….

The market things that Fed rate hikes are coming to an end shortly

Over the past 40 years, Treasury yields have always declined six months after the last Fed hike

Is Ackman talking his book or selling to you? No idea…just somethings to keep in mind.

CRUDE OIL

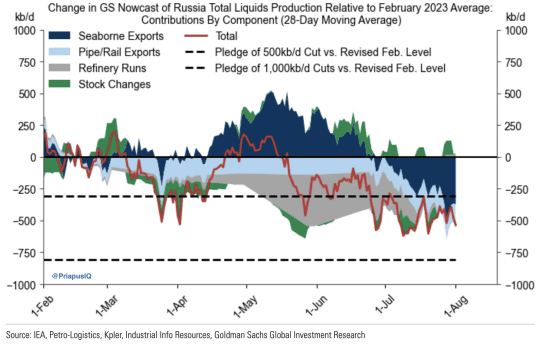

Via @PriapusIQ (on X):

Goldman Sachs on Crude Oil

The large drop in Russia crude seaborne exports in July drives the drop in our production nowcast over the last month (Chart 1, dark blue area).

With a particularly large drop in Russian exports to India (Chart 2).

“If Russia were to cut output by the full additional 500kb/d, then we estimate that Brent would reach $98/bbl in 2024Q3, moderately above our $93/bbl baseline.”

FACT SET EARNINGS UPDATE

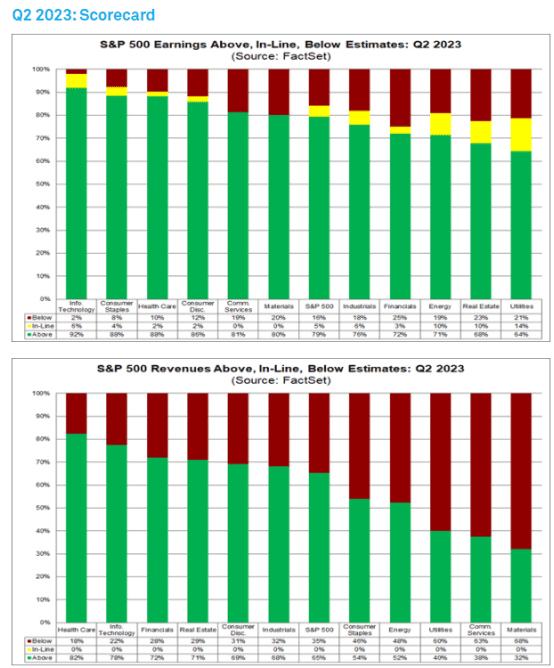

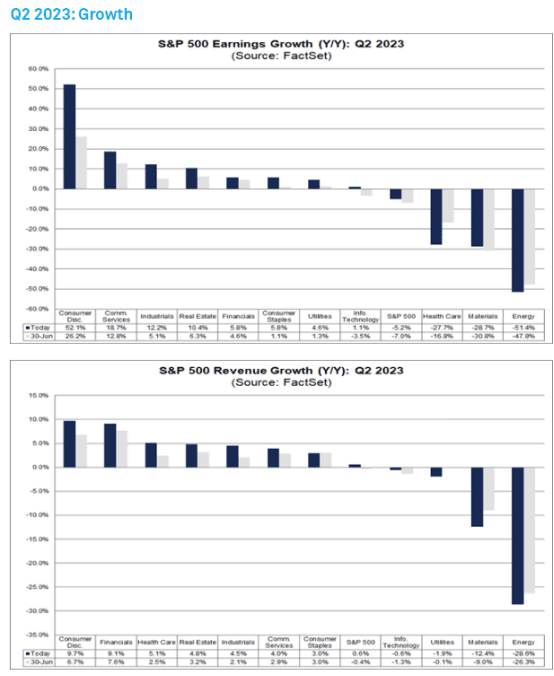

At this late stage of the Q2 earnings season for the S&P 500, both the number of companies reporting positive earnings surprises and the magnitude of these earnings surprises are above their 10-year averages. As a result, the index is reporting higher earnings for the second quarter today relative to the end of last week and relative to the end of the quarter. However, the index is also reporting its largest year-over-year decline in earnings since Q3 2020.

Overall, 84% of the companies in the S&P 500 have reported actual results for Q2 2023 to date. Of these companies, 79% have reported actual EPS above estimates, which is above the 5-year average of 77% and above the 10-year average of 73%. This number also marks the highest percentage of S&P 500 companies reporting a positive EPS surprise since Q3 2021 (82%). In aggregate, companies are reporting earnings that are 7.2% above estimates, which is below the 5-year average of 8.4% but above the 10-year average of 6.4%.

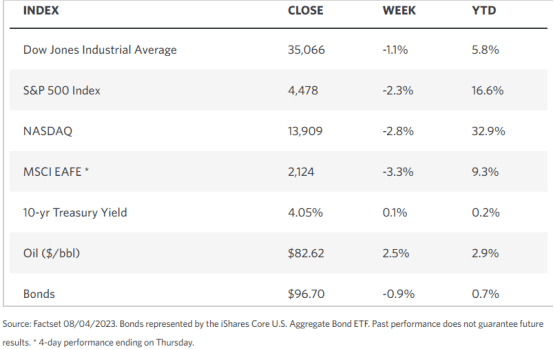

WEEKLY MARKET STATS

TECHNICALS

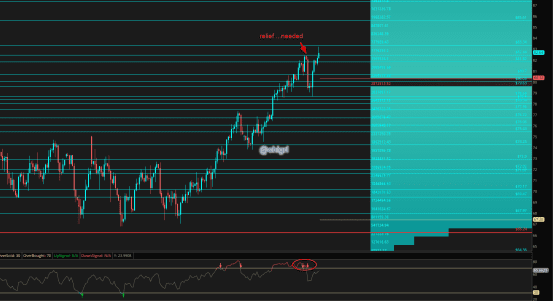

Last week I noted: I thought last week would be more volatile due to the Fed, and we did consolidate a bit, but no where near the volatility I expected. -this market is strong.

We made it over the yearly HVN which is very positive, but are in over bought territory.

We finally got a well needed pullback (due to the Fitch downgrade) but recovered quickly, again this market is strong

Nat Gas

Nat gas is still waffling in a supply zone, but has regained a critical area.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

A reminder on this market is an El Nino year..this means we will see colder than usual temperatures in the Northern Hemisphere this year. (perhaps a longer term buying opportunity at these depressed levels)

Gold

This chart is still constructively bullish, though that solid break above $2000 once again is sticky

Silver

I am bullish this market due to mostly fundamentals (see report two weeks ago), the chart supports this thesis.

However, his multi year bullish wedge keeps holding.

That said, when this thing breaks out, It may be monumental.

Copper

Copper is still waffling, the market is not yet ready to believe the China stimulus story. That said this market is fundamentally tight and set to get tighter over the next years.

The short positioning could also lead to a squeeze …on any given news.

I am neutral this market in the short term, bullish long term.

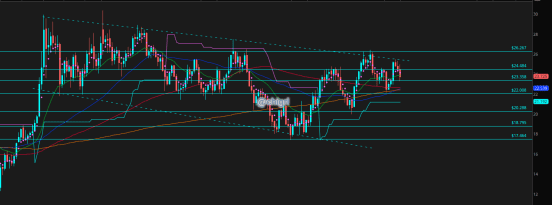

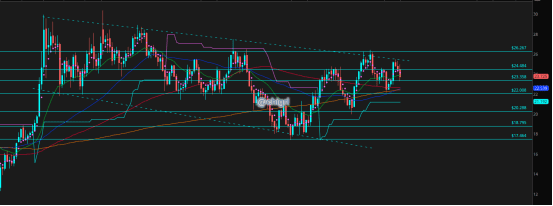

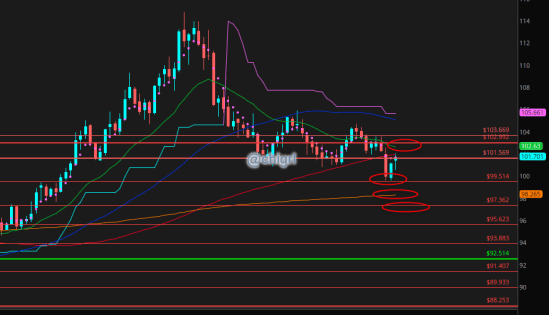

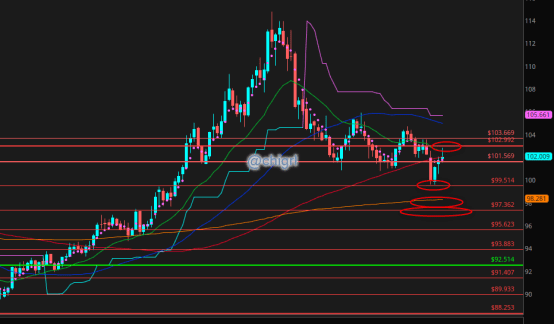

USD $DXY

Last week I noted that: we were very oversold and we may see a bounce (much due to the Fed raising rates), but that the upside would be limited and to watch chart levels.

Last week chart:

This week …almost bang on before a retreat. Keep watching levels.

If Yellen gets uppity, we could move higher..keep that in mind. (upside is still capped though for right now imho)

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.