Jobs were at the forefront of data last week

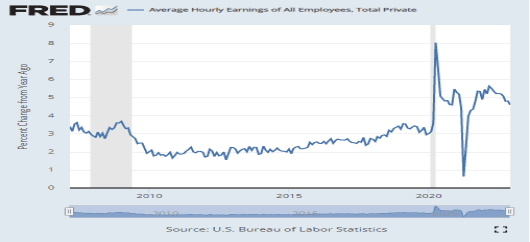

While inflation, rate hikes, and geopolitical uncertainties have posed headwinds for the market lately, employment conditions have been a bright spot. This was underscored last week by the most recent payroll figures, which showed that employment conditions remain broadly healthy.

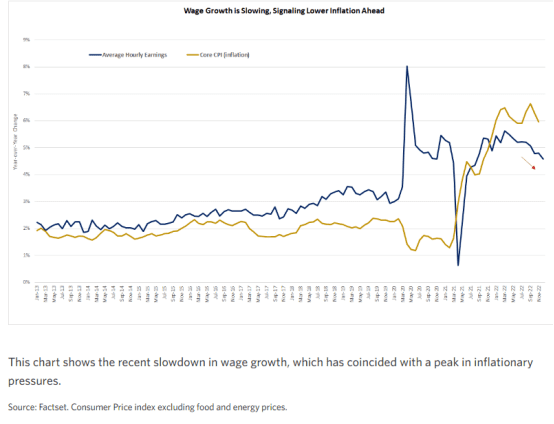

However, we are in a phase of the cycle where good news may be interpreted as bad news and vice versa. Stocks were under pressure earlier in the week as data revealed ongoing robust job openings and declining initial jobless claims. Followed by stocks that rallied following the report that showed wage growth is fading.

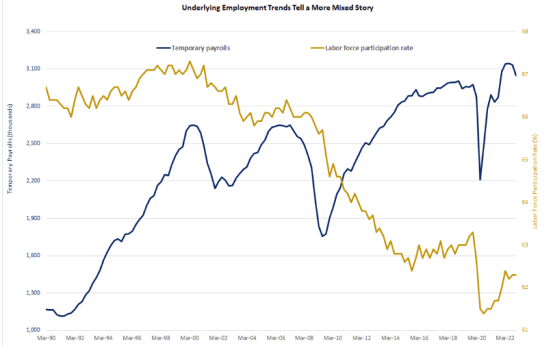

Furthermore, underlying job trends indicate a mixed picture with lingering pandemic distortions

In sum, moderating wage growth reflects a softening in the labor outlook.

The big question traders will be watching is if the Fed hikes 25 bps or 50 bps in the next FOMC meeting later this month.

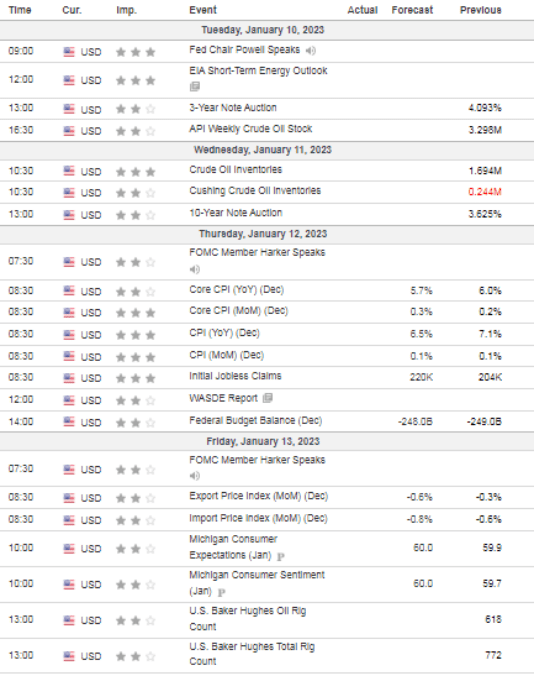

MARKET MOVERS THIS WEEK

Kind of a slow week

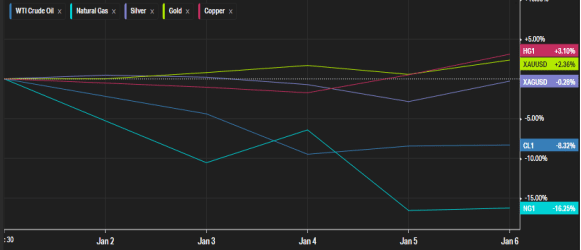

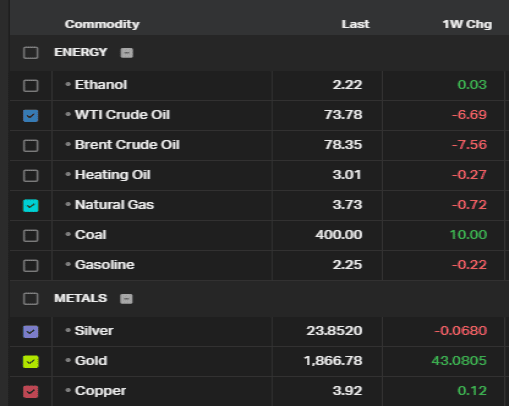

COMMODITIES PERFORMANCE

Month to Date Commodities Performance

Week to Date Commodities Performance

LOOKING AHEAD TO THIS WEEK-TECHNICALS

$DXY continues to consolidate-we are limbo

That said, USD has divorced itself (at least in the near term to the broader indexes)

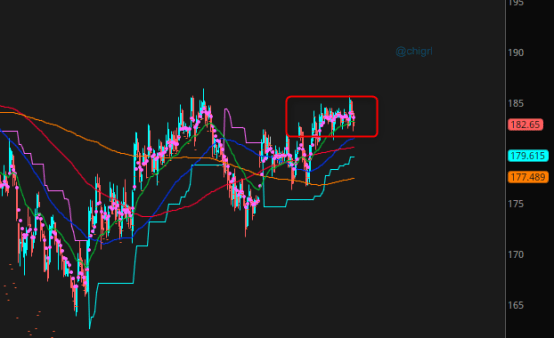

Gold: Gold is correlated to real rates (not inflation) If real rates come down (interest rate minus inflation expectation} then likely we see a further rise in gold prices. If real rates continue higher then likely we see gold resume down. A proxy for real rates is to use the US 5 YR and subtract the 5 YR break evens (US05Y-FRED:T5YIE)

Not much new here, gold continues to consolidate as well , and straddles are probably the best play here for now. I expect this to continue until FOMC.

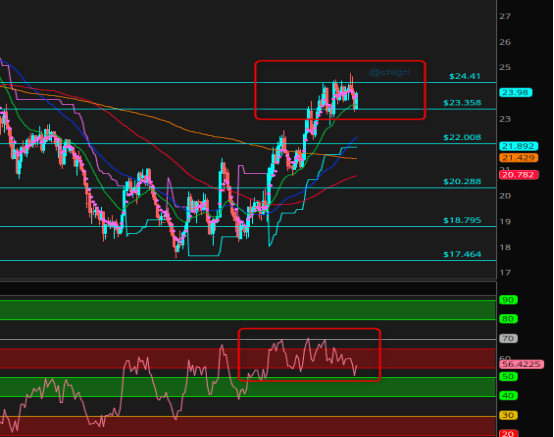

Silver: This is also consolidating, but working off over-bought territory nicely …again waiting for FOMC, but overall this chart is bullish

NOTE: Anthoney Crudele will be hosting twitter spaces this week on Tuesday 10 Jan. at 11 AM ET on gold and silver. I encourage everyone to listen in! Here is the LINK

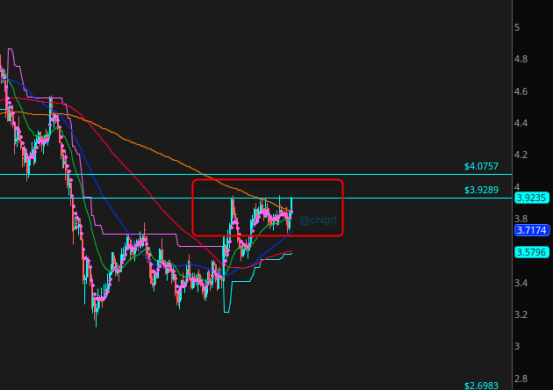

Copper: Same issue consolidation, due to USD and China re-opening…this market has made a number of attempts at $3.9 ….any positive news in China will send this contract on a short squeeze.

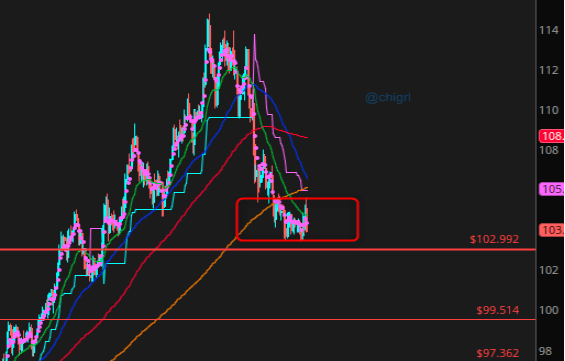

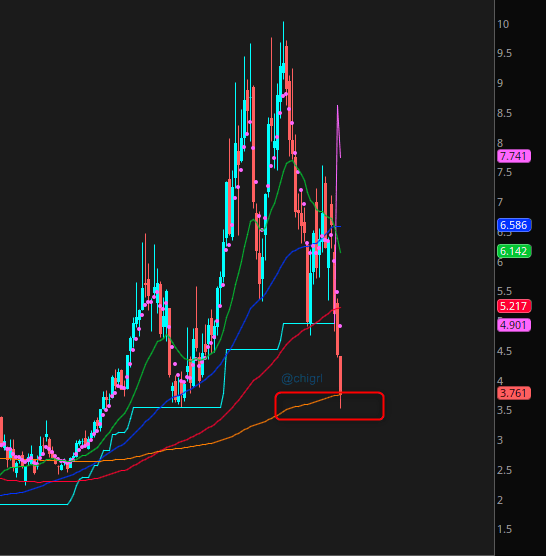

Natural Gas: For the last month I have been saying this chart is very bearish. We are hitting some sort of support and this market is very oversold. That said, I think we consolidate down here for another week or two before the cold front moves into Europe.

Watch that weekly 200 day that we are sitting on.

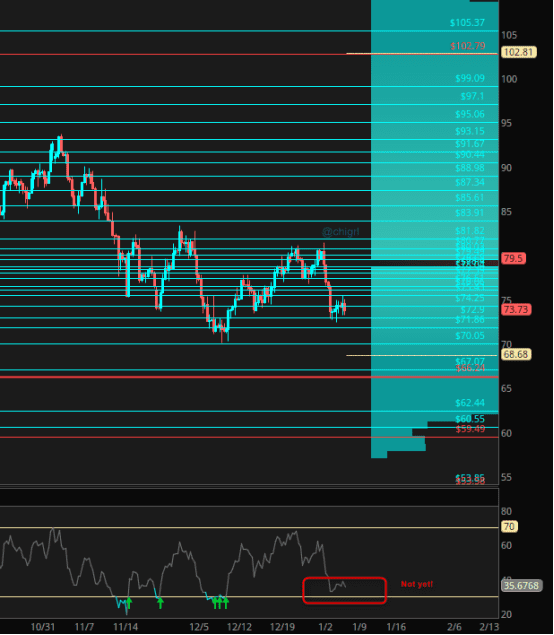

Crude Oil: I expect his market to remain volatile for all of January. We are oversold, but not enough to issue a swing buy signal *yet*. Best to watch order-flow and trade this market with event contracts in the 30 minutes before close (market close is 2:30 PM ET)

Good news, Place Your Trades is coming out with an educational series that should help navigate the waters during these tumultuous times.

HAVE A GREAT WEEK EVERYONE!!

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.