MARKETS AT A GLANCE

FOMC

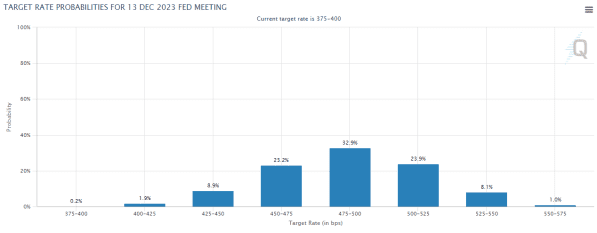

Last week the Federal Reserve (Fed) raised the fed funds rate by 75 basis points (0.75%) at its November FOMC meeting. This was the Fed’s fourth consecutive 75-basis-point rate hike, which brings the fed funds rate from near zero to 4.0% in about eight months, an unprecedented pace of interest-rate hikes in the U.S. economy.

The press conference also offered a glimpse into the Fed’s risk calculations around this tightening cycle. Chair Powell noted that he sees a higher risk of prematurely pausing or easing rates, versus the risk of over-tightening.

LABOR MARKETS

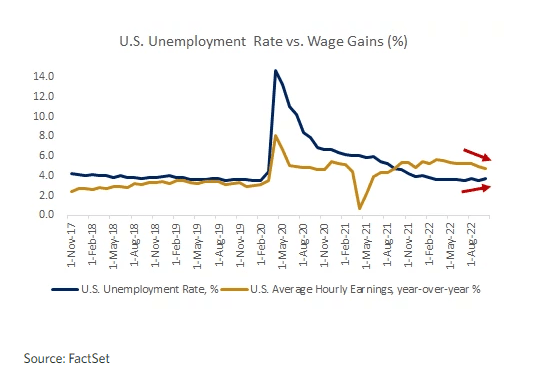

While the labor market remains resilient, unemployment rates are starting to tick higher, while year-over-year wage gains are softening. We may see this trend continue in the months ahead.

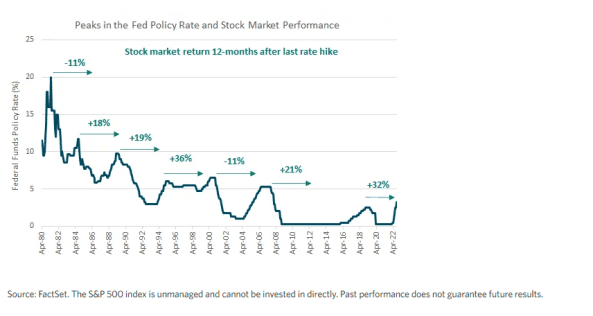

While volatility may persist as we get through this perhaps final leg of the Fed tightening phase, the good news for investors is that the period after the last Fed rate hike tends to be positive for markets.

Monday: Consumer Credit

Wednesday: Crude Inventories

Thursday: CPI

Friday: Michigan Consumer Sentiment

A gaggle of Fed speakers next week as FOMC blackout period is over

Monday: Mester

Wednesday: Williams

Thursday: Waller, Mester, George

ENERGY AND MATERIALS

COPPER: Huge rebound in copper last week on rumors that China would be reopening. Last week I highlighted the fact that I was bullish longer term and I still am. That said, Bloomberg came out with an article this weekend that refuted the reopening rumors: China Markets Set for More Volatility as Covid-Zero Policy Stays. we may see a pullback in this market early in the week.

GOLD AND SILVER: Both gold and silver also staged a rally finishing the week with the highest prices in a month. Last week I mentioned that for intraday trading, traders needed to pay close attention to $DXY and/or $DX_F for clues on the direction of these markets. The pullback in the dollar indeed helped fuel the rally of these metals last week.

CRUDE OIL: Crude oil also ended the week at the highest in a month. SPR releases are starting to taper off and this was reflected in inventories as we had a -3.11M draw last week. I expect this trend to continue, which is highly bullish for the market. The rally was also fueled by China reopening rumors. Technically, we just retested the 200 day, so we may see a pullback early in the week, but Wednesday’s inventories should be bullish again.

NAT GAS: Nat gas had a rather volatile week, but also ended the week higher as colder weather is forecast in the US and Europe in the weeks ahead, coupled with Freeport (US distribution hub) reopening this month, and lower nuclear output in Europe. We likely see higher prices this week as well, caution at 6.872 resistance area.

HAVE A GREAT WEEK EVERYONE!

One Response

Great recap!