FOMC up on Wednesday, Fed is expected to hold

Data last week

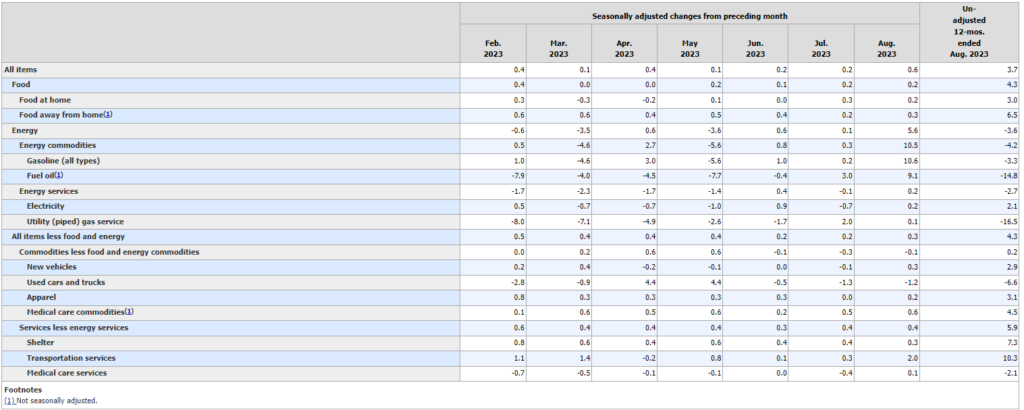

CPI

Per the BLS:

CONSUMER PRICE INDEX – AUGUST 2023

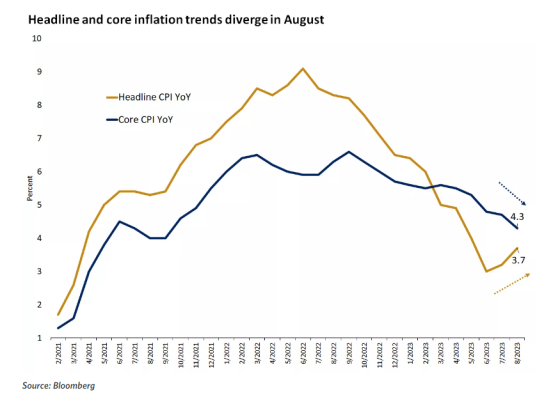

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.6 percent in August on a seasonally

adjusted basis, after increasing 0.2 percent in July, the U.S. Bureau of Labor Statistics reported

today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment.

The index for gasoline was the largest contributor to the monthly all items increase, accounting for

over half of the increase. Also contributing to the August monthly increase was continued advancement

in the shelter index, which rose for the 40th consecutive month. The energy index rose 5.6 percent in

August as all the major energy component indexes increased. The food index increased 0.2 percent in

August, as it did in July. The index for food at home increased 0.2 percent over the month while the

index for food away from home rose 0.3 percent in August.

The index for all items less food and energy rose 0.3 percent in August, following a 0.2-percent

increase in July. Indexes which increased in August include rent, owners’ equivalent rent, motor

vehicle insurance, medical care, and personal care. The indexes for lodging away from home, used cars

and trucks, and recreation were among those that decreased over the month.

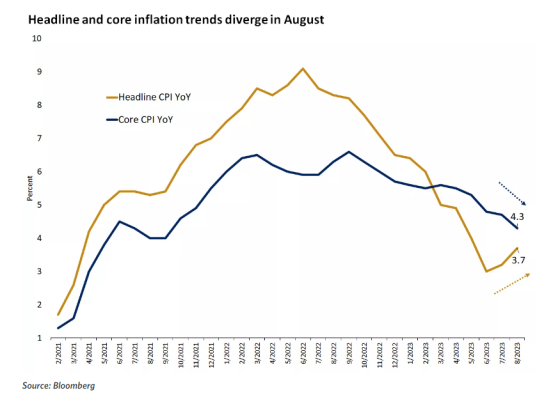

The all items index increased 3.7 percent for the 12 months ending August, a larger increase than the

3.2-percent increase for the 12 months ending in July. The all items less food and energy index rose

4.3 percent over the last 12 months. The energy index decreased 3.6 percent for the 12 months ending

August, and the food index increased 4.3 percent over the last year.

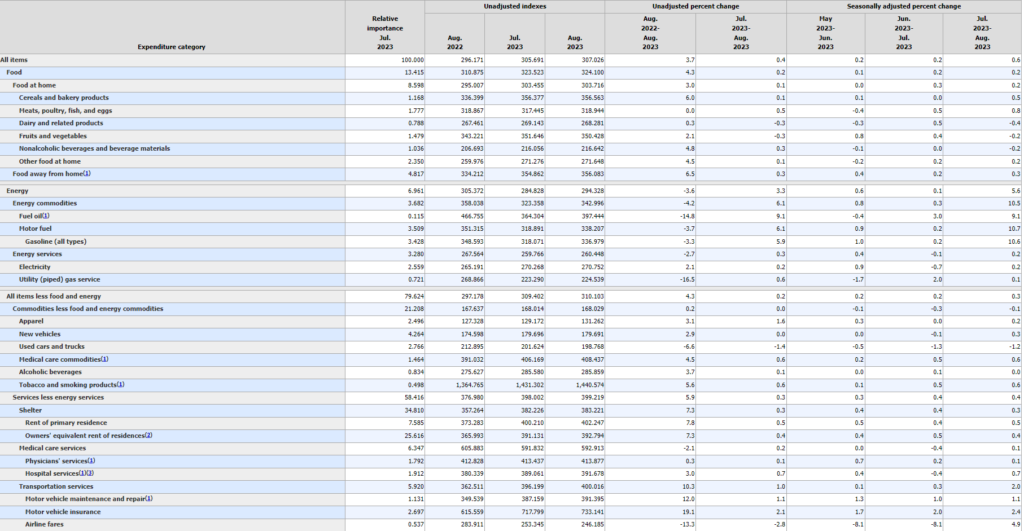

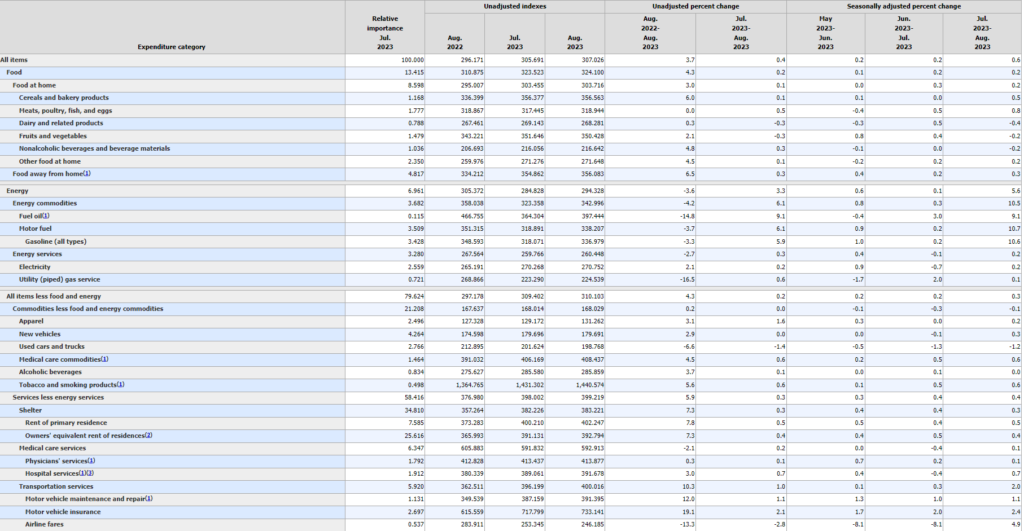

Consumer Price Index for All Urban Consumers (CPI-U):

US city average, by expenditure category

COMMENTS: The energy prices have been behind the acceleration in both consumer and producer prices over the past two months, but the drop in core inflation matters more for Fed policy. So I do not this this report will affect the Fed’s decision to hold this week.

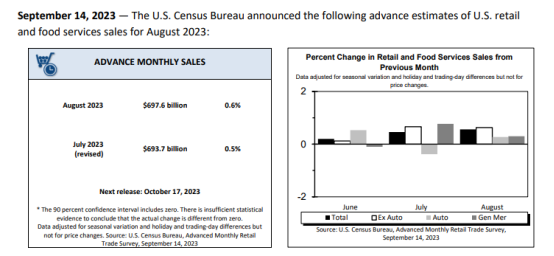

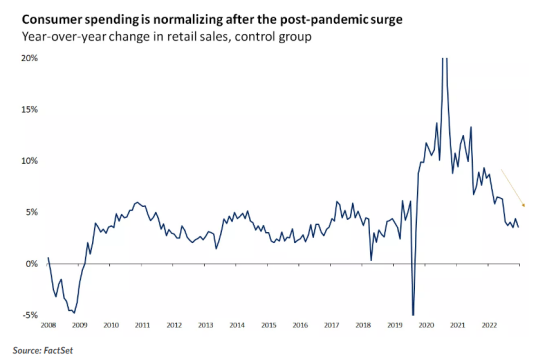

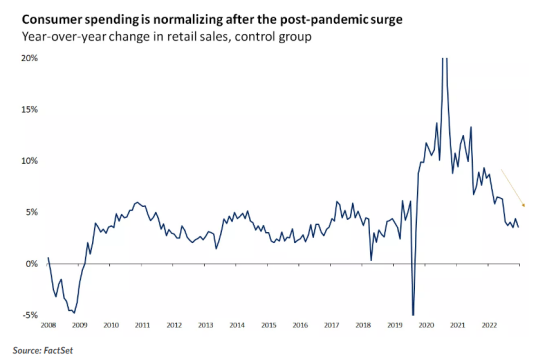

RETAIL SALES

Energy prices had a noticeable impact on consumer spending. Retail sales rose 0.6% in August compared with July, above the 0.1% rise that was expected, but that was largely due to strength in gasoline sales. Taking out gas, retail sales rose 0.2%, and control sales that feed into the GDP calculation increased only 0.1%, while the July sales were revised lower.- Edward Jones

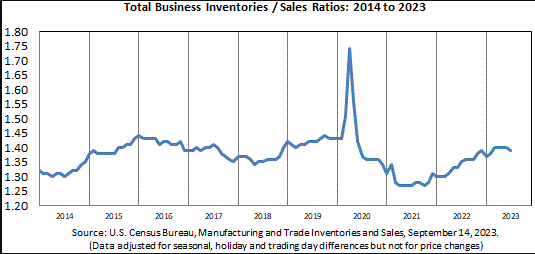

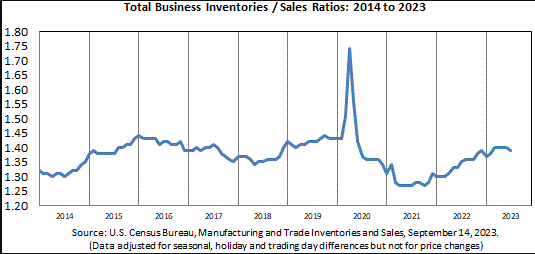

Business Inventories were released as well

US total business end-of-month inventories for July 2023 were $2,538.1 billion, virtually unchanged (+/- 0.1 percent)* from last month. U.S. total business sales were $1,828.4 billion, up 0.6 percent (+/- 0.1 percent) from last month

COMMENTS: Overall consumer spending is normalizing, another reason for the Fed to pause this month. That said, it is possible that the Fed has raised too much too fast and we see further deterioration in Q1 of 2024 to recessionary levels. Just something to keep an eye on.

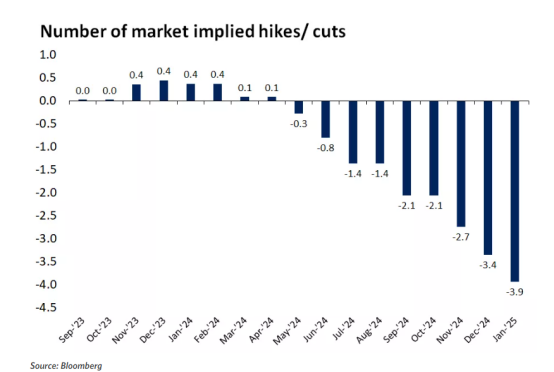

FOMC

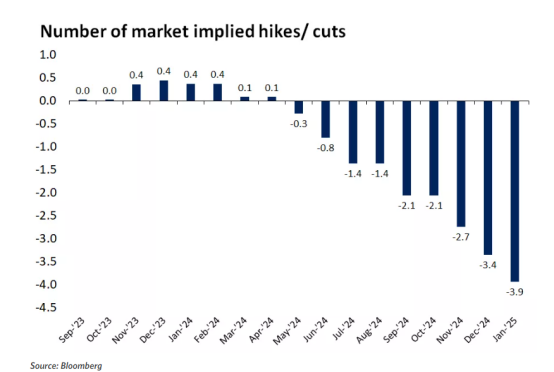

Heading into FOMC this week, here is what the situation looks like as far as implied hikes/cuts

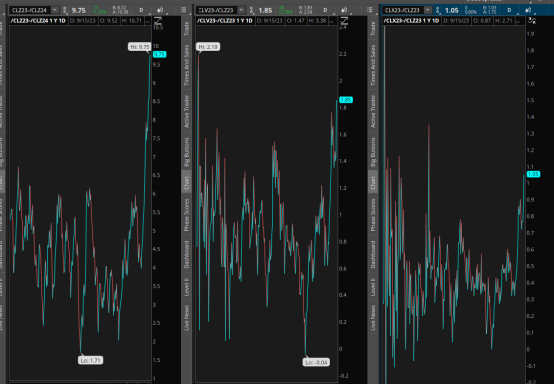

CRUDE OIL COMMITMENT OF TRADERS

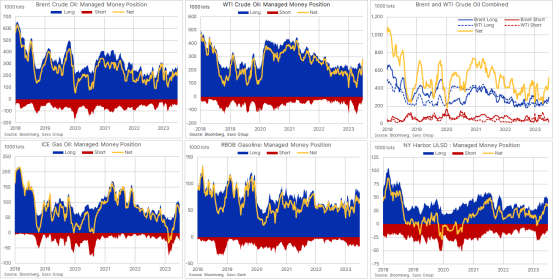

Via Ole Hansen from SAXO

COT on crudeoil: During a two-week period to Sept 12, the comb. leveraged fund long in Brent and WTI has jumped by 137k contract or 35% in response to the Saudi and Russian yearend production extension. The comb. net long reached an 18-mth high at 527k contract last week with buying led by WTI (+30k to 279k) as inventories at Cushing, the delivery hub, continued to shrink. The WTI long/short ratio meanwhile has spiked to 14.6 longs per 1 short, from a June low at 1.5. Gasoil’s strong rally was met by increased short selling while length was added to the RBOB and ULSD contracts.

COMMENTS: Commercials are adding shorts (hedging here) which is not surprising given the prices, they are the natural shorts in the market. Although retail and money mangers have increased longs, we are no where near other historical levels during of periods of higher prices. That said this market is looking overbought. I would love to see a bit of a pullback/price correction as it would also indicate a healthier market, and increase odds of price stability. This would be better for producers and thus energy equities.

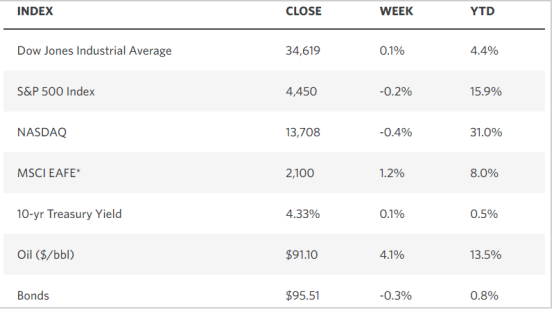

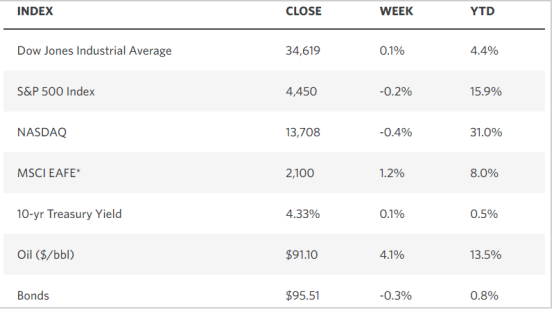

WEEKLY MARKET STATS

TECHNICALS

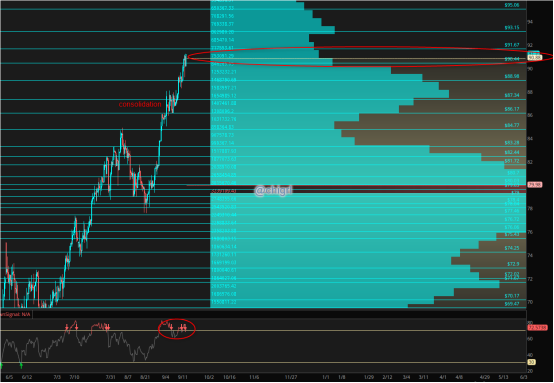

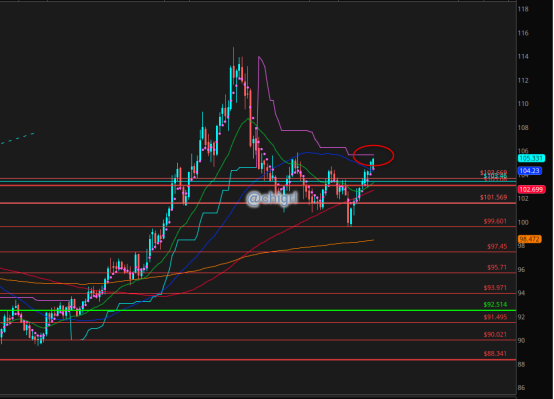

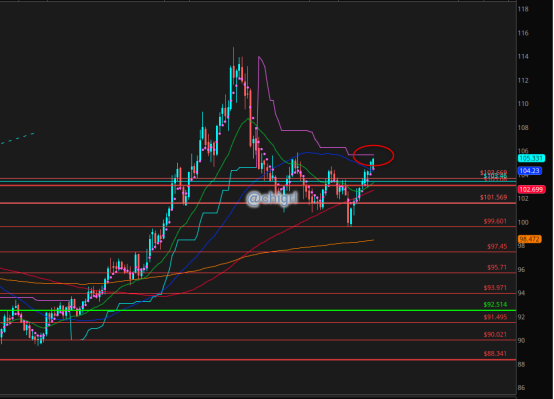

Crude Oil

Last week I noted that we spent the week consolidating and were likely to see an explosive move …and that we did to the 90.88 level market on chart

We could see a bit of a move higher perhaps early in the week, but I would like to see a bit of a pullback given the extreme over bought condition.

FOMC this week so all eyes on that.

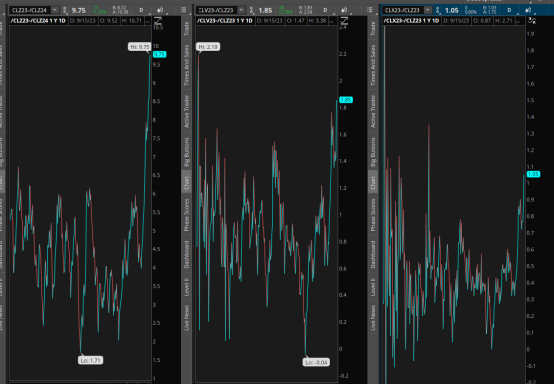

Calendar spreads remain strong

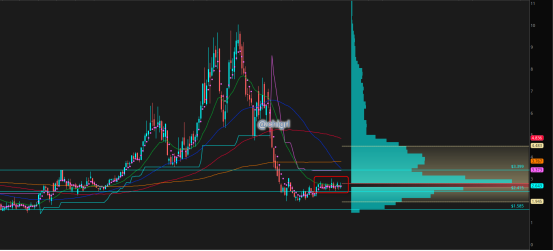

Nat Gas

This market is still in consolidation, August 20th I noted: If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino. (I still like this play)

This could break either way, but I lean toward the upside. This market may not move much until we get closer to winter, meaning, I am not expecting much during September.

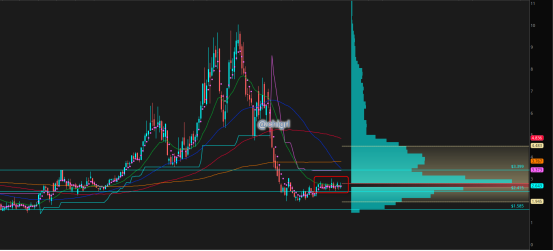

Copper

Same view as last week :

We could see more consolidation in this triangle until we have a clear understanding of China markets/stimulus.

Technically to play this, one would wait for the break and retest to initiate a trade.

That said, I am partial to an upside break given the fundamentals of this market.

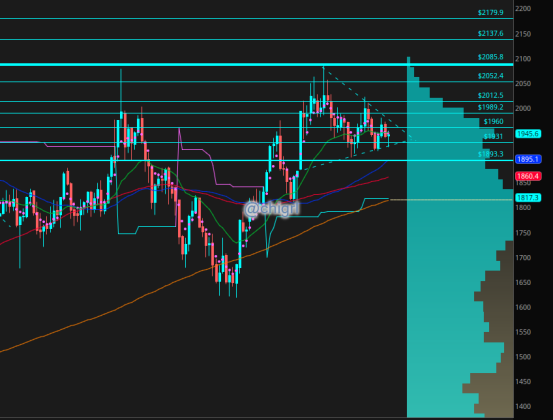

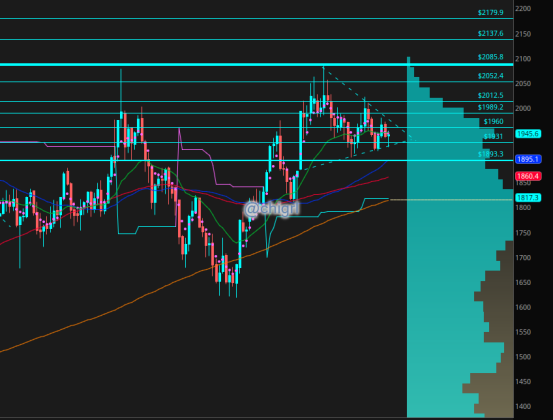

Gold

Again I am kind of agnostic here on gold again this week, we are still in no mans land, but the fact that it is holding up so well is amazing.

That said, longer term, I think this moves higher out of this symmetrical triangle..but when is the question.

We may waffle in the inside for longer.

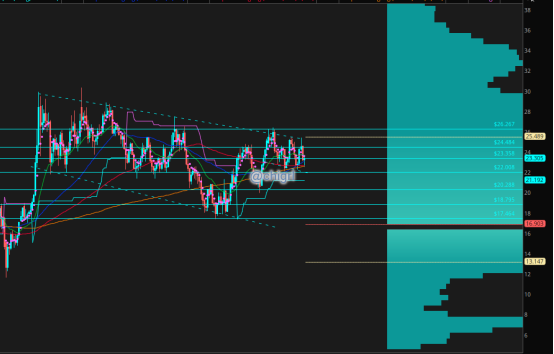

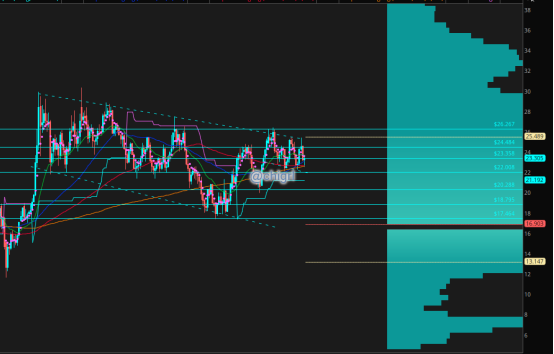

Silver

This market could continue to waffle in this bullish wedge (have said this for weeks now).

That said, I remain bullish this market not only for technical reasons, but fundamental reasons at well. Im my opinion, it is not *if* but when will this market break higher.

Notable we did put in a weekly bullish candle last week

USD $DXY

Almost to weekly resistance, I would expect a bit of a pullback there next week.

For USD it will be all about FOMC and Powell (hawkish or dovish)

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.

3 Responses

thanks Tracy for your weekly updates. Very helpful

Great review of the landscape as always

thank you!