There were 3 KEY data events that turned this market around last week

Let us take a look at what they were:

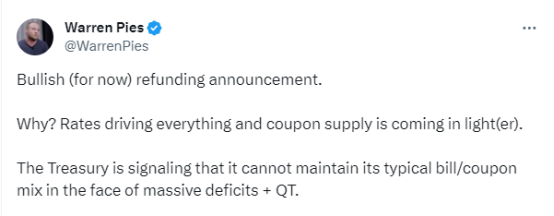

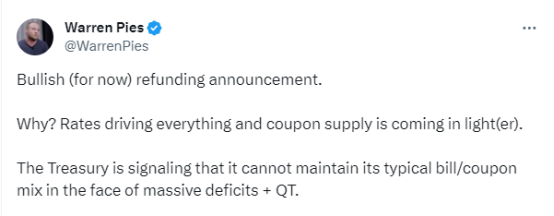

The first, and VERY under the radar, was the BULLISH US Treasury refunding announcement on Monday

This marked the low on the week, and hardly anyone was talking about it…except a few

Yellen may have delivered us a Santa Rally

Lisa Abramowicz for Bloomberg explains:

Bonds Feel the Love From Yellen’s Shift in Sale

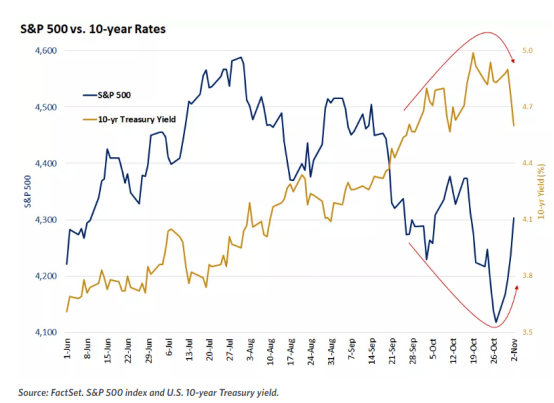

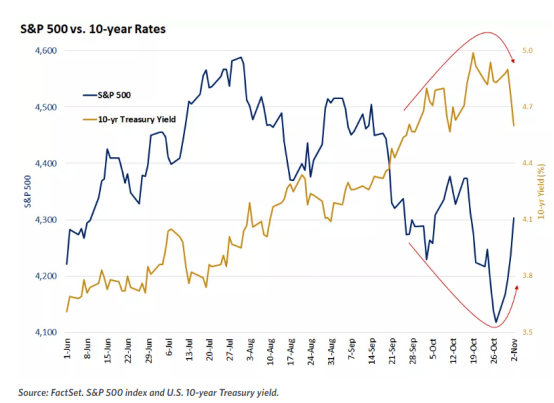

One thing and one thing only was sucking all the oxygen out of the room: the Treasury Department refunding announcement. And when it showed that the US government planned to concentrate new debt sales in shorter-term notes rather than longer-term ones, it turbocharged a rally in 10- and 30-year bonds. Add in some weaker-than-expected manufacturing data, and yields dropped even further.

There are a couple of takeaways here: First, Treasury supplies matter more than they have in decades given the growing US deficit and shifting institutional buyer base, notwithstanding Treasury Secretary Janet Yellen’s focus on economic growth as a market driver. Second, US Treasury officials are aware of the dynamic in markets and seem to be going out of their way to avoid causing any more disruption than necessary.

Or as Morgan Stanley’s Seth Carpenter suggested, Treasury officials may not be gaming the market, but they are listening to it.

“They’re looking at what is the market about, where the market wants to pay up, and where the market’s demanding a discount,” Carpenter said. “And at the margin they will lean a little bit more to where the market wants the paper, and lean a little bit away from the place where the market is pulling back.”

Mike Schumacher at Wells Fargo foreshadowed the move, saying before the announcement that just a $1 billion difference in the allocation of maturities could make a big difference.

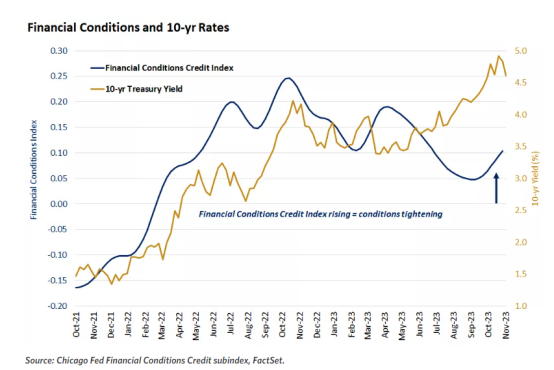

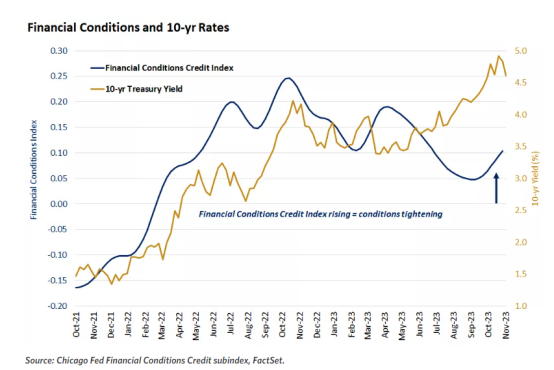

COMMENTS: The rally in bonds (or dip in yields) sparked the equity rally, that began on Monday.

Second, Federal Reserve Rate Decision

Although, last week’s decision to hold was no surprise, (the market was already anticipating this) it was Powell’s lack of confidence, and rather dovish statements at the presser that were a a further catalyst to propel markets higher.

Via Edward Jones:

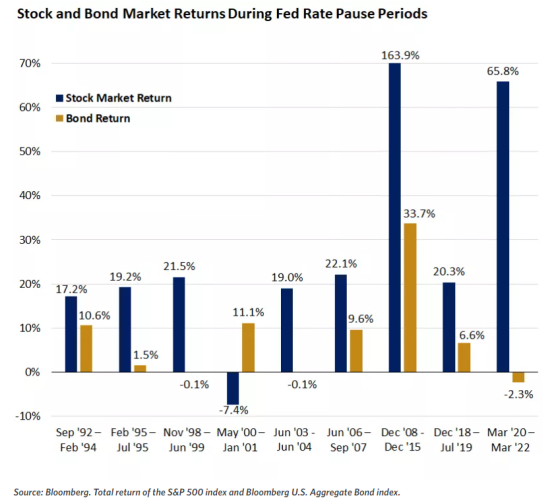

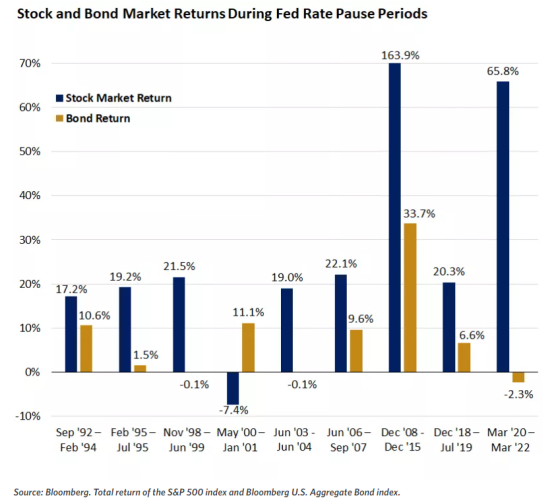

Last week’s Fed meeting provided the primary fuel source for stock- and bond-market gains. The policy rate (fed funds rate) was held steady for the second straight meeting, with Chair Powell striking a more balanced tone around future policy decisions. In our view, there is a sufficient case for the Fed to be done with rate hikes. However, we expect Fed officials to continue to use commentary that emphasizes their willingness to hike further as a way of preventing markets and financial conditions from getting too far ahead of themselves in anticipating looser policy ahead. We think the continuation of this equity bull market will ultimately become more tethered to the outlook for rate cuts (which we don’t expect until later in 2024). But for now, confidence that the Fed can remain on pause will be a key element of support for financial markets. Over the last 30 years, periods in which the Fed has kept its policy rate unchanged have largely been accompanied by strong gains in both stocks and bonds.

COMMENTS: This whole market is being driven by rates right now

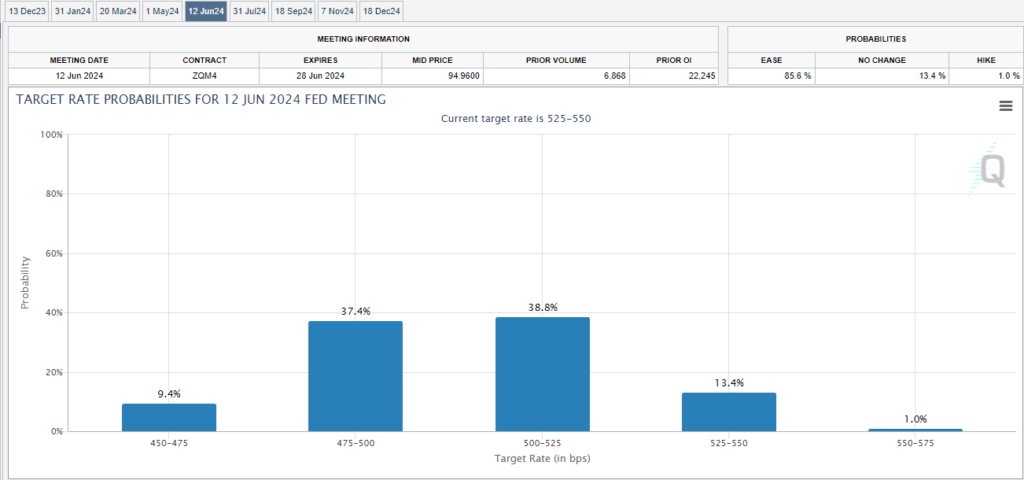

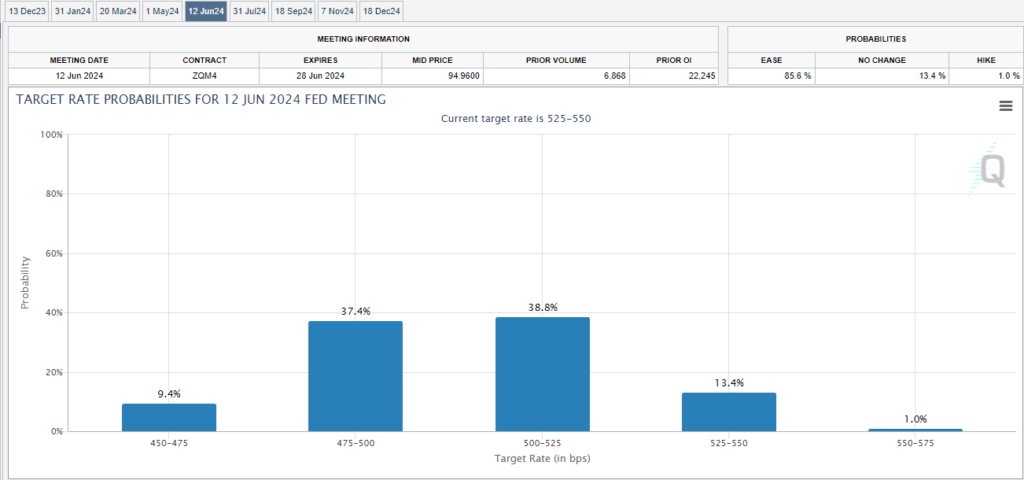

The CME group Fed watch tool is even starting to price in a CUT in June

Third, NFP Data

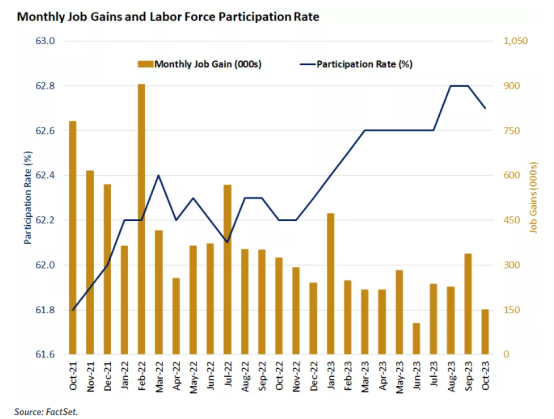

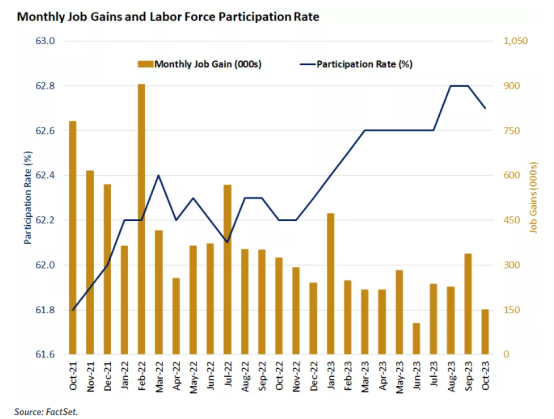

Labor market is SLOWLY moving into the Fed’s target range…they wish to cool off this white hot market.

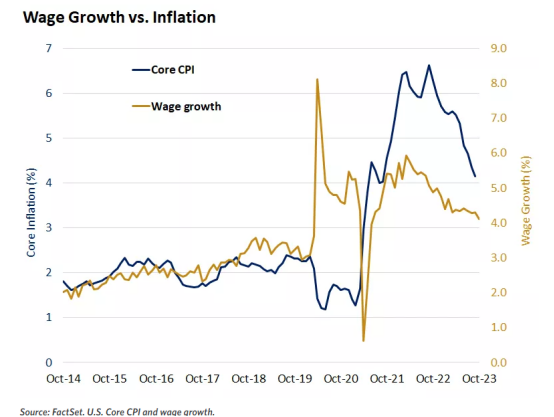

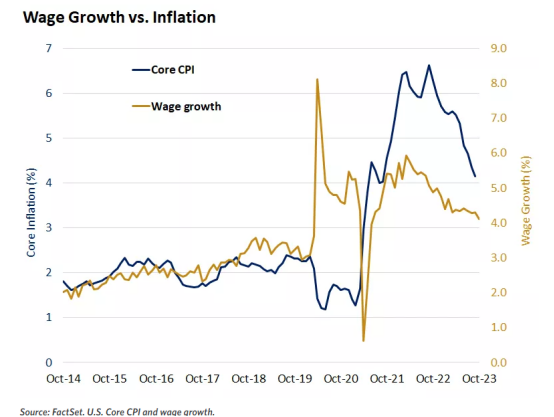

The latest read on employment conditions appeared to hit the sweet spot within last week’s Fed policy-outlook narrative, insofar as it signaled the labor market is not too hot to re-stoke rising inflation pressures, and not too cold to undermine consumers and economic growth. The October jobs report showed the economy added 150,000 jobs last month. It’s positive to see that hiring gains continue, while at the same time it’s clear that some softness is emerging in the labor market, as October’s payroll gains were half that of September and down from the 216,000 average over the last six months. The coincident trends of ongoing job gains and moderating wage growth is the zone that the market will likely cheer as we advance, as that combination would be consistent with hopes for a soft landing in the economy. The rise in the labor-force participation rate is encouraging, as it reflects a growing supply of labor, which can enable hiring growth and low unemployment to persist while allowing wage pressures to moderate. The October report revealed that average hourly earnings rose by a modest 0.2% from the prior month and are up 4.1% on an annual basis – the slowest since June 2021. Data earlier last week showed that the job quit rate continues to decline, offering another signal that wage growth, and thus inflation, should continue to moderate ahead.-Via Edward Jones

Perhaps the best post I read on substack on employment data this week was from Mike Green (@profplumb99)

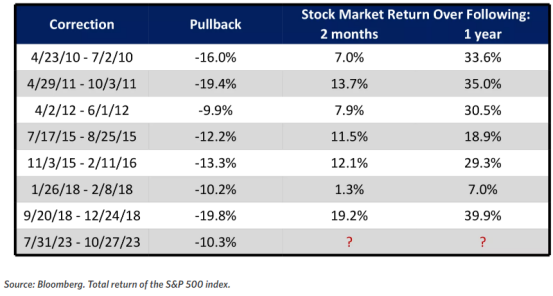

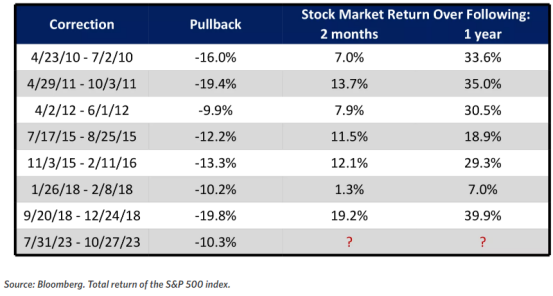

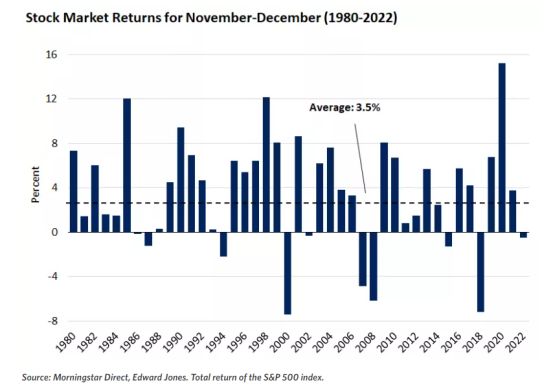

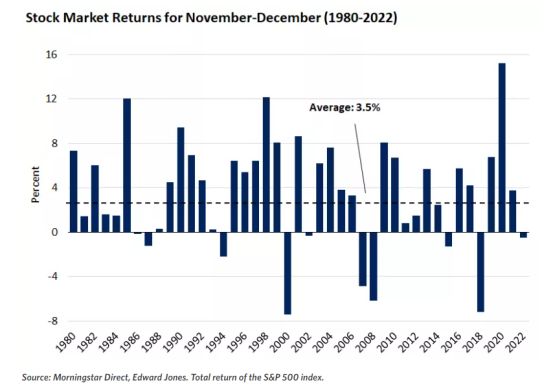

STOCK MARKET RETURNS AFTER A PULLBACK

(2020 was omitted for obvious reasons)

Stock market returns for Nov/Dec 1980-2022

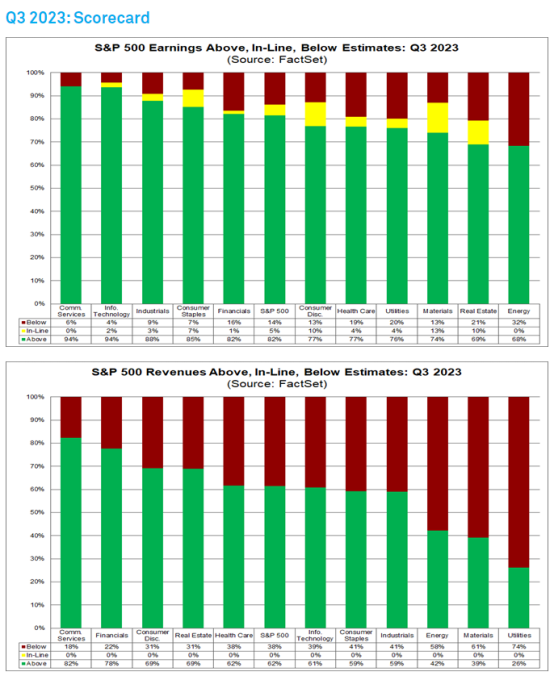

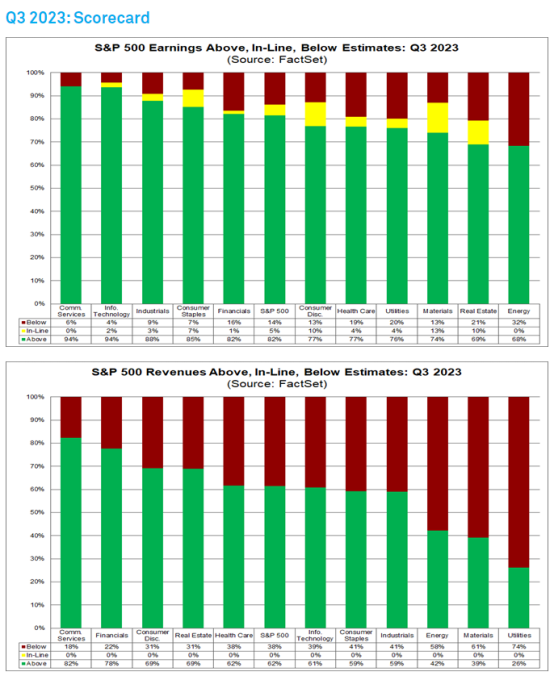

EARNINGS SEASON UPDATE

At the end of the peak weeks of the Q3 earnings season for the S&P 500, both the number of positive earnings surprises and the magnitude of these earnings surprises are above their 10-year averages. As a result, the index is reporting higher earnings for the third quarter today relative to the end of last week and relative to the end of the quarter. The S&P 500 is now reporting year-over-year growth in earnings for the first time since Q3 2022.

Overall, 81% of the companies in the S&P 500 have reported actual results for Q3 2023 to date. Of these companies, 82% have reported actual EPS above estimates, which is above the 5-year average of 77% and above the 10-year average of 74%. If 82% is the final number for the quarter, it will mark the highest percentage of S&P 500 companies reporting a positive EPS surprise since Q3 2021 (also 82%). In aggregate, companies are reporting earnings that are 7.1% above estimates, which is below the 5-year average of 8.5% but above the 10-year average of 6.6%. -FactSet

OTHER NOTABLE

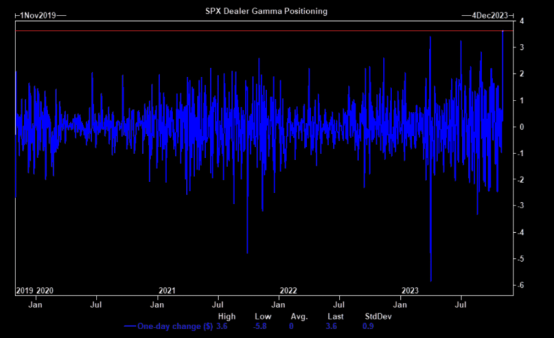

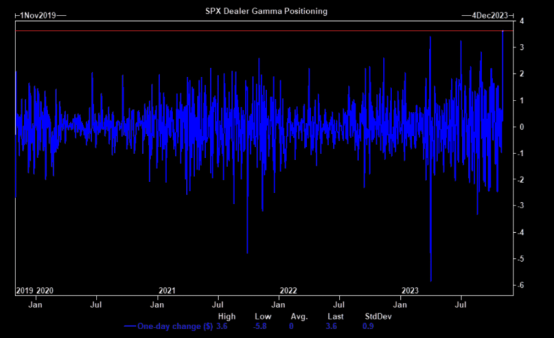

Dealers are now LONG ~$4bn of SPX gamma. Highest GEX move on record via Goldman Sachs

(h/t to @MenthorQpro for pointing this out)

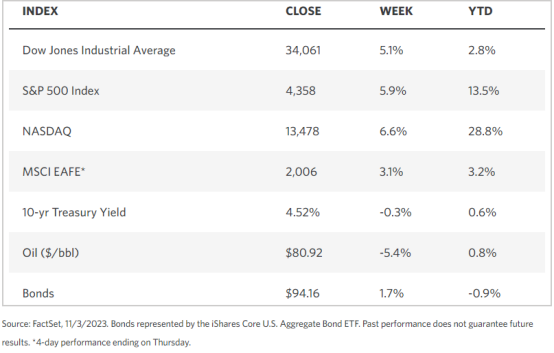

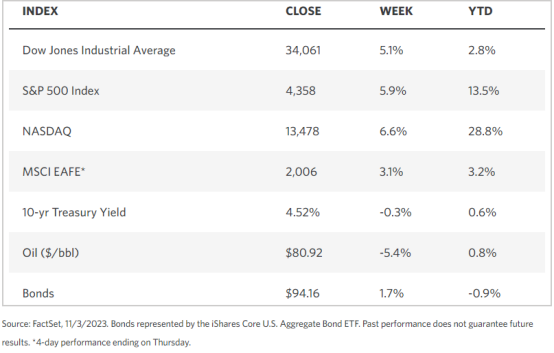

WEEKLY MARKET STATS

TECHNICALS

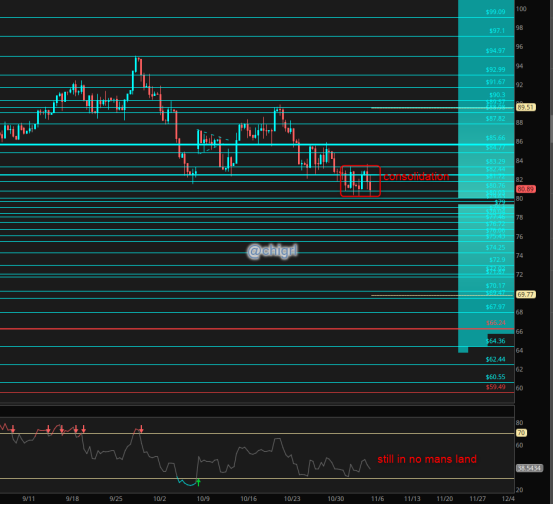

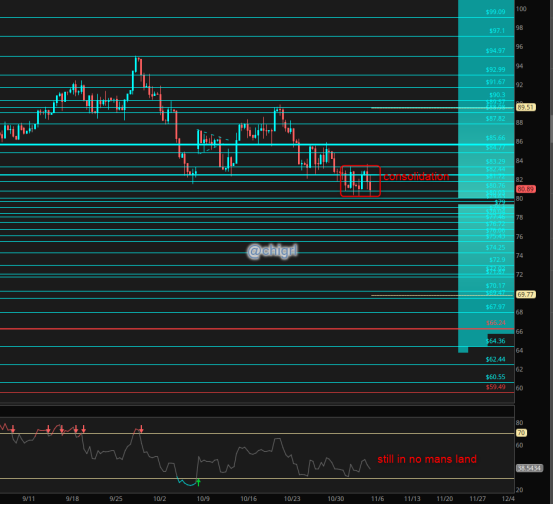

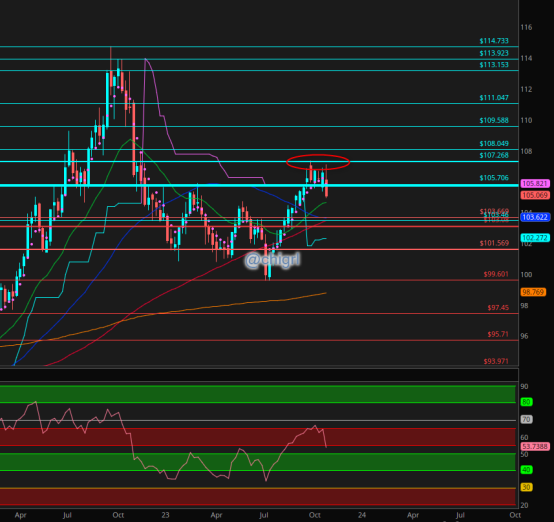

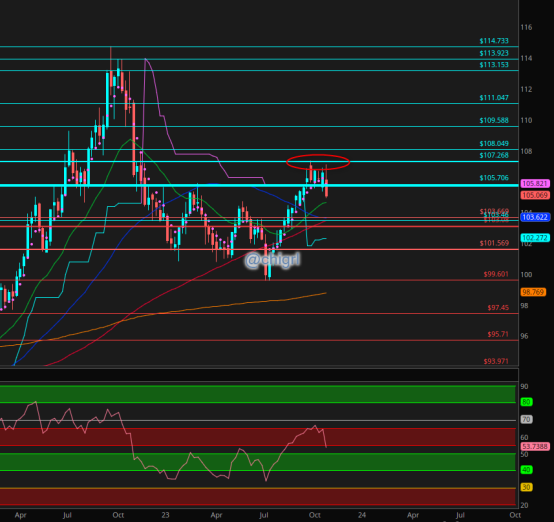

Crude oil

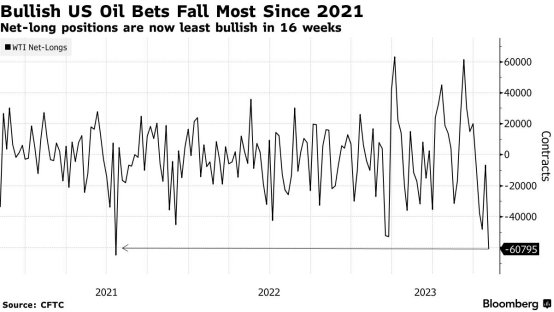

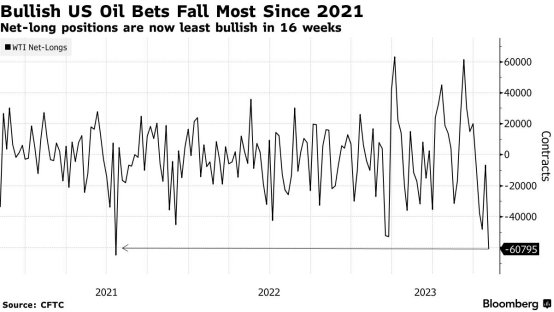

The most interesting aspect of this market is that via COT: Oil bullish bests have fallen the most since 2021

COMMENTS: A lot of length has been taken out of WTI contract…this actually a sign of opportunity in the market. Holding over $80 with this kind of exodus is a testament this market remains fundamentally strong. I am looking for long opportunities.

Nat Gas

My view has not changed

Last week I noted: This market is out of consolidation.

On August 20th I noted: If you are a long term investor, might not be a bad time to start a position here as I think that this winter will be much different than last for Europe due to El Nino. (I still like this play)

Looking at Feb/March call options (NG or UNG)

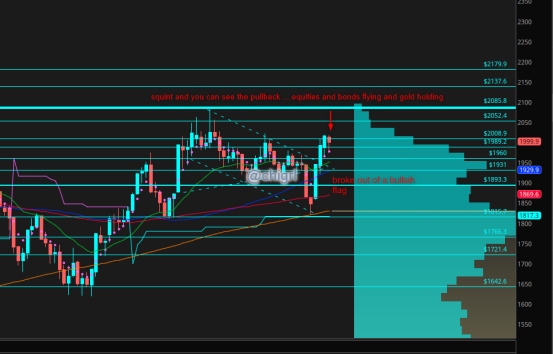

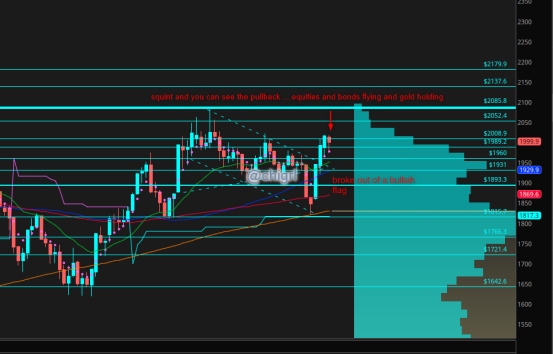

Gold

Last week I noted: Hard to believe it was only two weeks ago when I noted that gold hit a technical support area just as geopolitical risk was taking off. Since then we have rallied over $100

This week we did hit that ~ $2000 psychological level that everyone is watching. That said we are still far from overbought, though we could see a pullback.

Again this market is also hyper sensitive to geopolitical risk right now, I would not be surprised at another attempt at that multi-year triple top

We did get a slight pullback as anticipated, but nothing close to calling this a reversal

If you missed this Wednesday spaces, I spoke with Lawrence Lepard about the gold market…be sure to catch it…it is up on www.placeyourtrades.com

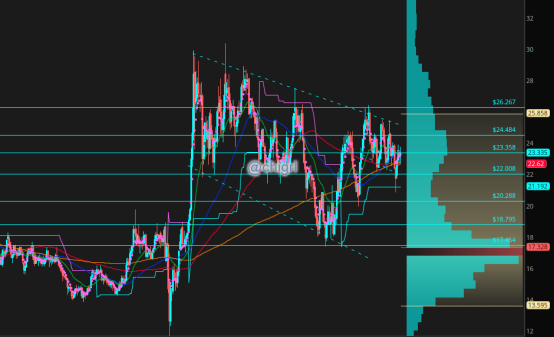

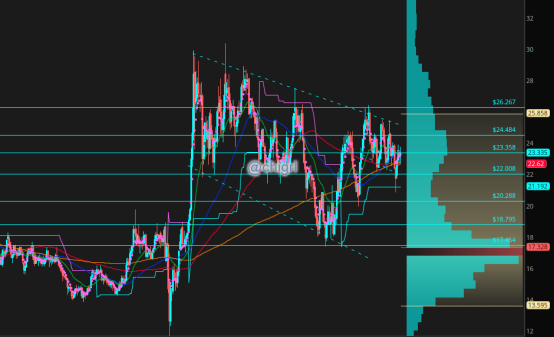

Silver

Silver also held weekly support and is still trading in a a bullish flag withing an even larger bullish pattern.

The fundamentals as well remain strong.

I will say this is a much harder trade than other metals.

Pretty much flat on the week

Copper

Boom

Last week I noted: Technically speaking watch that 3.5 weekly support area. We are getting oversold as well.

Nice bounce this week, that said, not out of the woods yest. I remain bullish long term but CAUTION short term

USD $DXY

Global markets getting some relief from this pullback in USD

We could definitely see more of a pullback this week …as always keep an eye on USD

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.